Critical "Charting Moment" Ahead for Tesla

In every stock market cycle, there are "bellwether" stocks...

Bellwethers are usually just a handful of stocks, but they're important because they're big, have had lots of growth, and an upward trending stock for years, and therefore a big fan base among investors on Wall Street and on Main Street.

So when the bellwether stocks do well, everyone tends to do well. When that's not the case, well, look out below.

In the 1990s it was Microsoft, America Online, Yahoo, Intel, and Cisco Systems.

In the mid-2000s it was the big banks and lenders of that era like Citigroup and GE.

In our current raging bull market, I'd say our bellwethers are Bitcoin (obviously not a stock), Nvidia (NVDA), Microsoft (MSFT), the FAANG stocks (Facebook (FB), Apple (AAPL), Amazon (AMZN), Netflix (NFLX), Google (GOOG)) and...

Tesla (TSLA). Definitely Tesla.

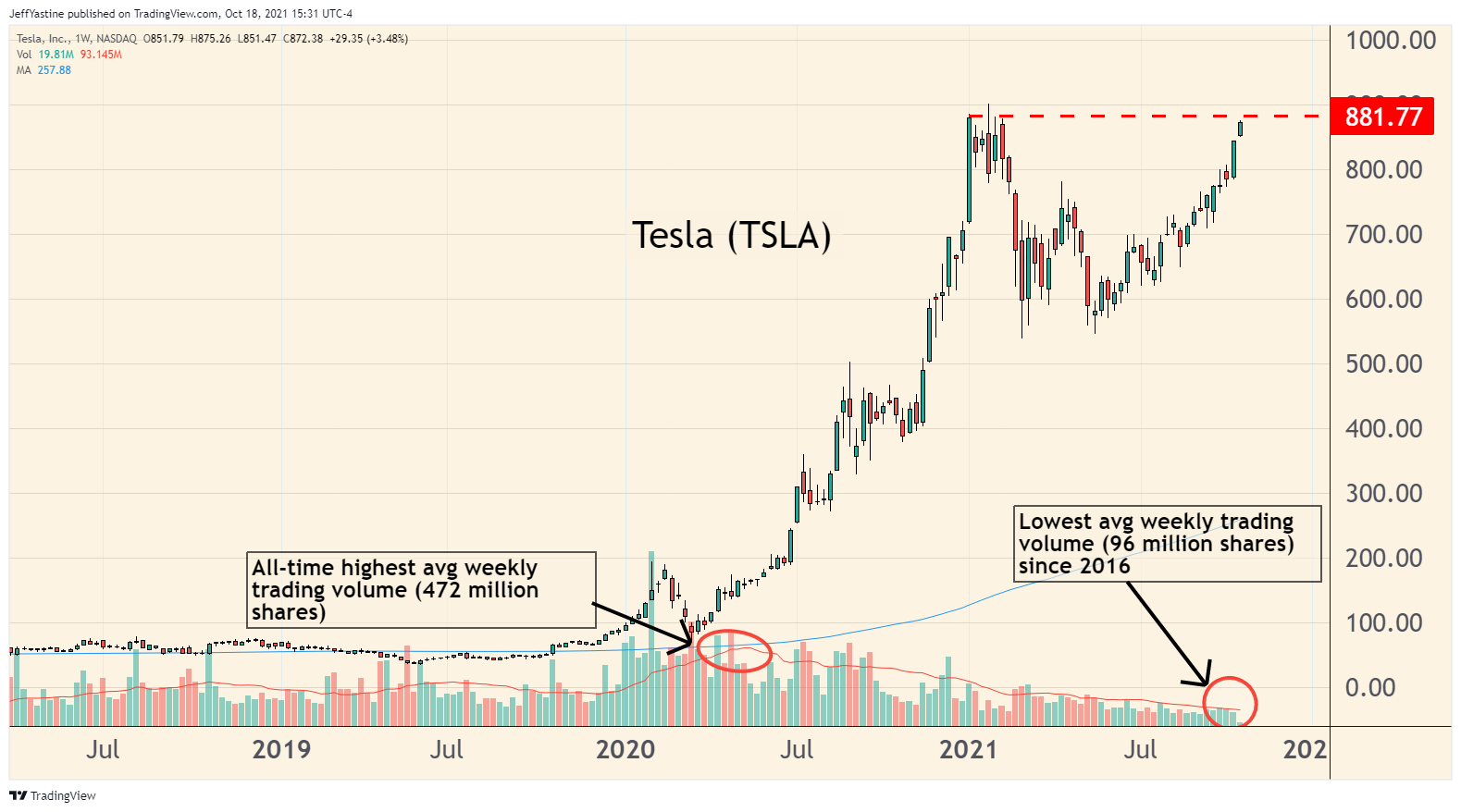

Tesla's may soon reach an important milestone on its stock chart. It's at $870 today, and within shouting distance of making a new all-time closing high (meaning its price at the end of the day) for the first time since January:

Why does that matter?

When a stock exceeds those old all-time highs and continues to make new all-time highs...that's a hugely bullish sign.

For Tesla, the key number is $880. That was the all-time end-of-session high price for the stock on January 8 this year, and was equaled again on January 25 before the stock lost its mojo a bit, dropping 38% in the subsequent 4-5 months.

So if Tesla, as a bellwether stock, can power above that $880 level in the next 2-3 weeks, that could be hugely bullish not just for the company but for the market as a whole.

But every potential reward also carries potential risks.

If it turns out Tesla's shares cannot keep powering higher, then it could be setting up a "double top" for the stock.

The implication would be that the stock's shareholders might be in for another bout of pain in the months ahead, as the shares move lower - until the stock gets cheap enough for investors to become enthusiastic about buying more shares again.

For example, for most stocks, their 200 day moving average tends to act as "support" - a spot where investors will come in and buy a stock after its experienced a selloff from higher altitudes.

But in Tesla's case, the stock has accelerated far into the charting stratosphere. TSLA's 200 day moving average is at $257 - implying a potential 70% drop from the stock's current price level if the worst came to pass.

So when it comes to TSLA's stock chart, I'm watching the average weekly trading volume very carefully.

Ideally, we want to see steady or rising volume as investors step up their buying, afraid that a stock is going to breach its old highs, and keep going without them.

That's what we saw early last year - TSLA was one of the first names to recover from the shock of the pandemic and push higher, racking up its highest average weekly trading volumes in its history.

But as the chart shows, the weekly average trading volume is down by 80% since then.

That could change, and quickly, of course. In fact, the last time the stock's average weekly trading volume was this low was in 2016. It turned out to be a great buying opportunity as the stock rose 150% over the next 18 months.

The difference is that before the big 2016 rebound got underway, the stock had fallen 30% as trading interest languished over the prior 9 months.

This time around, it's just the opposite.

The stock is up 50% since May. But the enthusiasm for the stock (at least as its expressed in people happily buying and selling the stock) is sharply lower.

We'll know soon enough - likely following the Federal Reserve's upcoming meeting on November 3-4 - which way Tesla and the rest of the market is likely to bend.

Best of goodBUYs!

Jeff

Member discussion