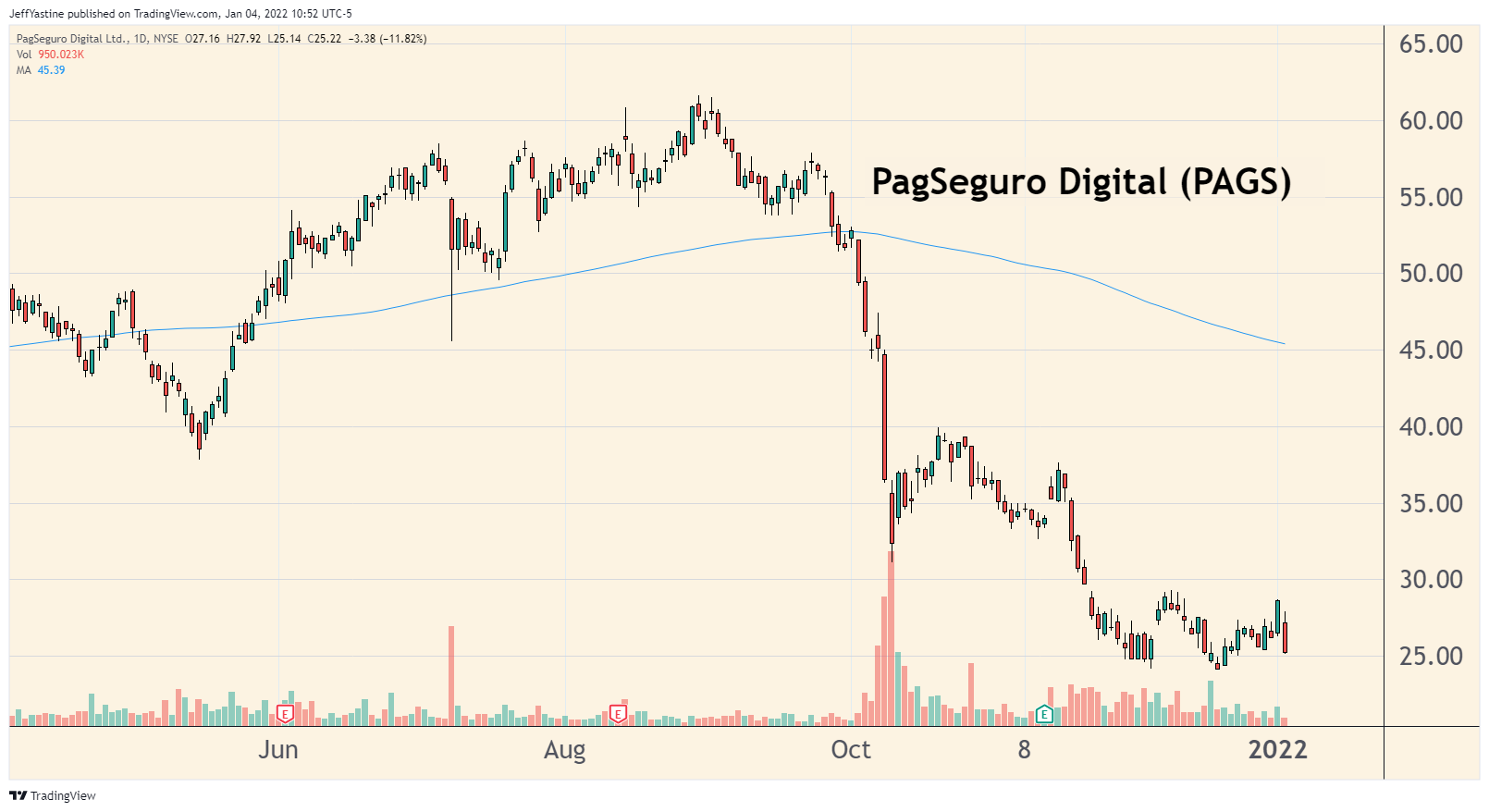

Chart of the Week: PagSeguro (PAGS) & How to Deal with Market Volatility

When it comes to the stock market, there's only one kind of "volatility" that I like - the kind that carries a stock up, instead of down.

So when it comes to stocks that aren't behaving as expected, I'd rather sell some shares, and reduce risk first - and ask questions later.

That's my thought with a recent special report I sent out that included a stock called PagSeguro Digital (PAGS), which is down 11% today for reasons I'll get into below.

As I note to my premium subscribers all the time, cutting losses early - and keeping them from snowballing into more serious problems for a portfolio - is as important (perhaps more important) to our investing success as the gains that come our way.

With that in mind, I'm going to take the loss on PAGS (about -7%) and move it to my watchlist for a better future entry point in coming months, when the external selling pressures may not be so great.

What sort of "external selling pressures" could there be?

Well, if I were writing a headline about PagSeguro Digital being down today, it's because an analyst at UBS downgraded the shares to neutral, while lowering his price target from $50 to $30.

Considering that the stock has already fallen from $60 to $25 in the last 5 months, I'd say most of the analyst's worries are already priced into the current price of the stock, which is one reason why I thought - looking out to the rest of 2022 - that the stock was a goodBUY at these prices.

Ordinarily, I'd shrug off this kind of decline and expect a rebound in coming days.

But extra risks arise when a stock is also owned by lots of momentum-oriented exchanged-traded funds (or ETFs).

In the case of PAGS, it's heavily owned by many tech funds like Cathie Wood's ARK Innovation ETF (ARKK), which is skirting along the cliff edge of a bigger decline itself.

The point is, ETFs and mutual funds don't have lots of cash sitting around.

So when lots of account holders redeem their shares (forcing the price of the ETF lower) it means the fund manager has to sell something to meet the share redemptions. And the manager isn't going to sell just one stock in an ETF's portfolio, but lots of them across the board.

So selling begets more selling, and the process goes on and on until those selling pressures are finally satisfied.

That's why stocks can often fall much further than we ever think possible, and why it's important to cut losses early, such as with PagSeguro, before they become a bigger problem to our portfolios and our confidence levels.

It's never fun to deal with. It's even less fun to talk about or write about. But it's part of the difficult but necessary work of learning how to survive difficult investing environments - and thrive in the good ones - amid the uncertainty and randomness of the stock market.

Best of goodBUYs,

Jeff Yastine

Member discussion