Bonus Buy: The "Rarest of Rare"...an Undervalued 3D Printing Stock

Sometimes you wait, and wait...and wait...for a favorite un-owned stock to finally look "buyable."

I've been watching Proto Labs (PRLB) literally for years, looking for a "best spot" to get in.

That time is now, in my opinion. I'm adding it to the goodBUYs portfolio at the current price of $53 and change.

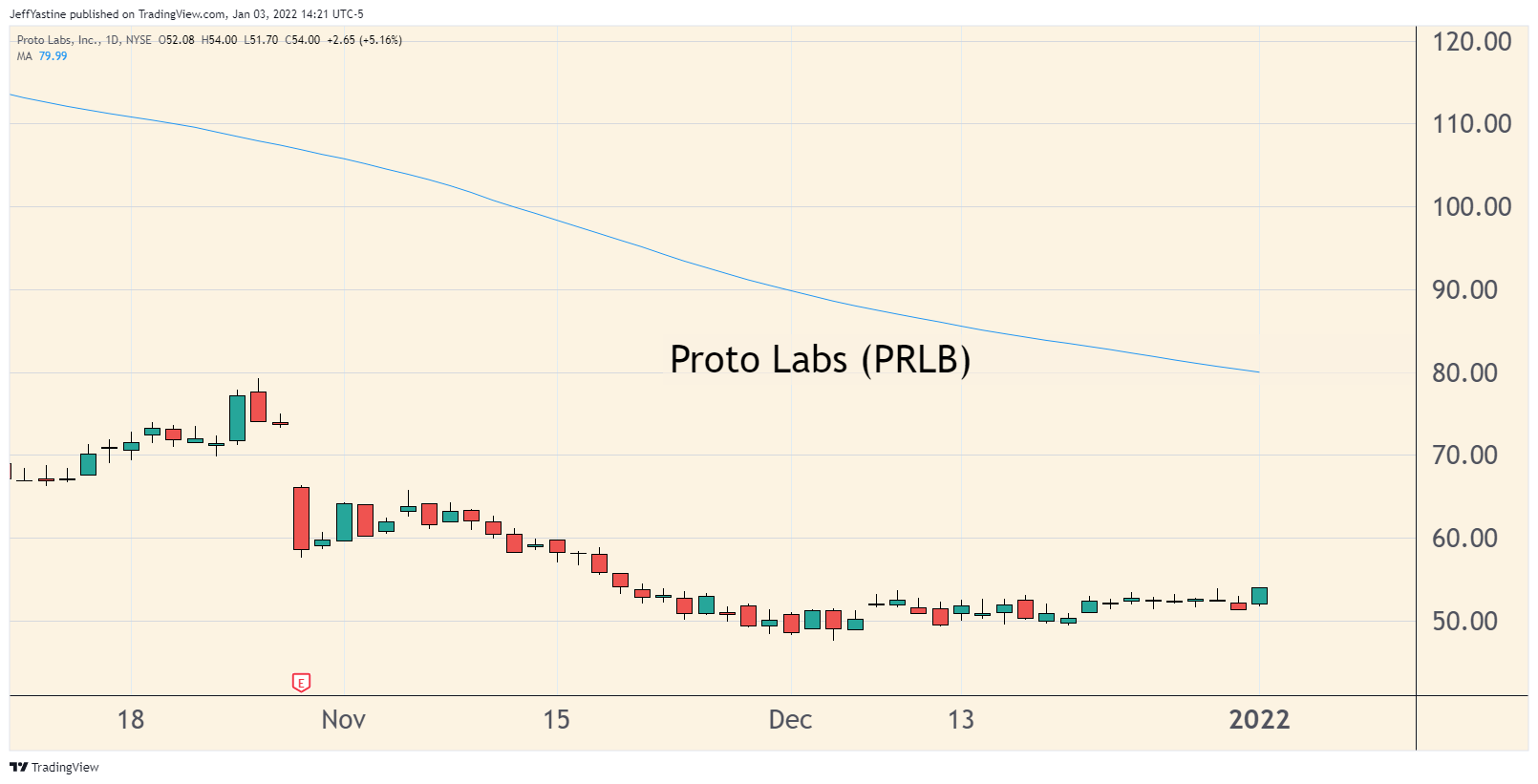

A year ago, when the stock was cresting above $200 - compared to $53 now - I thought I'd never get the chance to buy at a decent price But I also know that, when crowds of investors turn from hot to cold on a group of stocks...they often throw out the good with the bad.

And that's what happened over the past 12 months with 3D printing stocks. The whole group was riding high last January and February; investors have been selling them left and right ever since - Proto Labs among them.

Am I succumbing to the lure of "picking a bottom"? Yes.

I try not to make a habit of it. But with certain kinds of companies - the risk is worth the potential reward.

With Proto Labs, we're buying the world's leading maker of on-demand custom-manufactured prototypes and on-demand production parts.

To do that, the company uses a wide array 3D printing technology (though pros in this sector prefer the term "additive manufacturing") - including stereolithography, laser sintering, multi-jet fusion technology, and carbon DLS (or digital light synthesis).

But with Proto Labs, there's a very important "rest of the story."

With a corporate history dating back to 1999, the company wrote the book on digital manufacturing techniques.

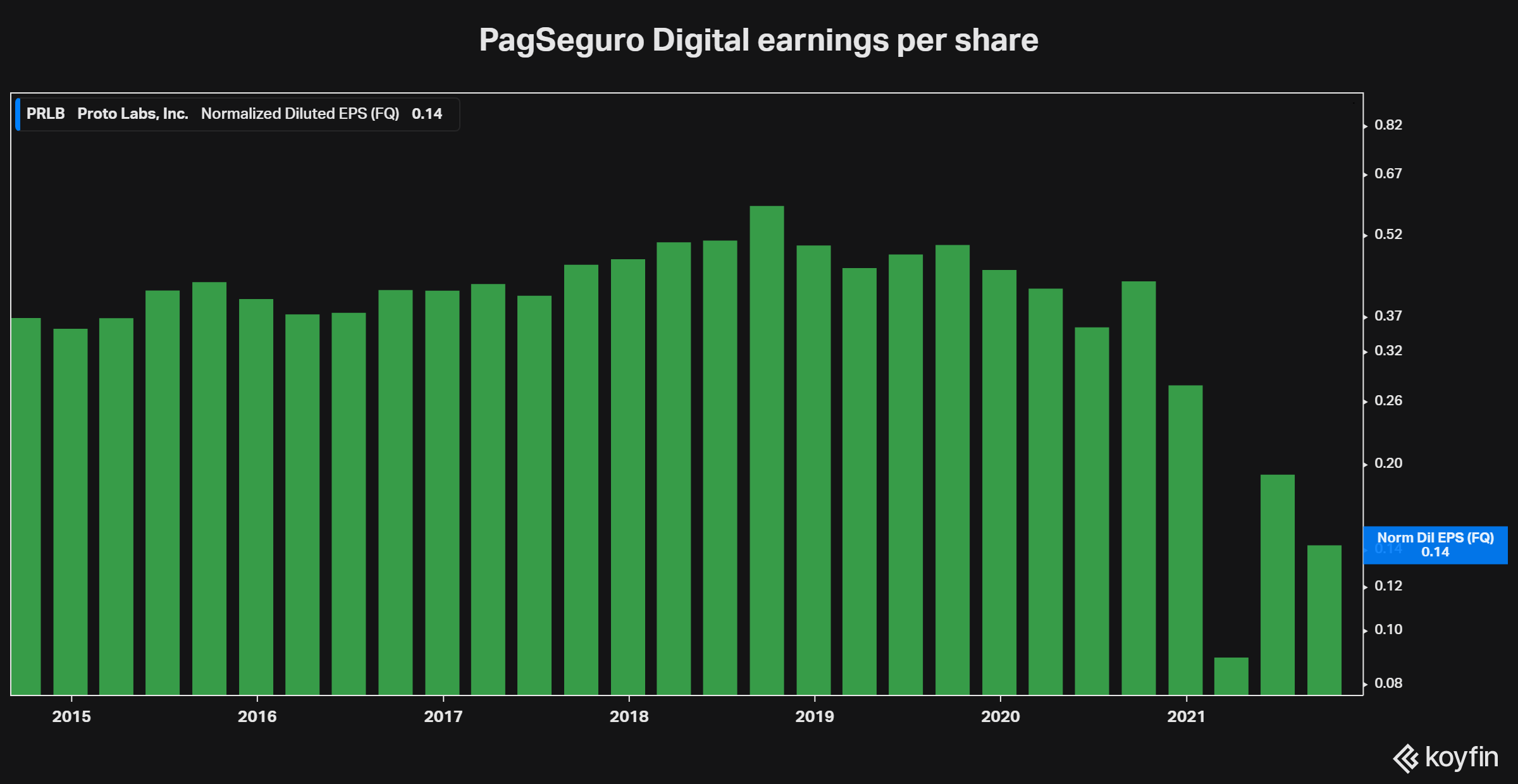

Nor is Proto Labs a money-losing startup or SPAC. Proto Labs has been a consistently profitable company, averaging annual earnings growth of 15%, since the day of its IPO back in 2013.

So if the company's so great, why did the stock fall so much last year?

Partly it was that "3D printing" stocks - a huge buzzword that draws investors like flies to honey - experienced an unsustainable parabolic top last year.

Almost every company, from 3D Systems (DDD), to Materialise (MTLS) and others in between, saw its stock pumped up to gigantically overvalued proportions in 2020, peak in January 2021, and then collapse in slow-motion the rest of the year.

Proto Labs experienced the same thing. Its share price fell from $250 to $50.

Momentum traders ignored the fact that Proto Labs' profits peaked 2 years earlier, to $2.84 a share. Earnings fell to $2.37 a share in 2019 and still further in 2020 to $1.90.

In fact, when PRLB reports its Q4 and 2021 results next month, the company will likely report an annual profit of $1.13 a share - its lowest in 8 years.

That sounds ominous, but it's not.

Partly, it's the ongoing drag of the pandemic on Proto Labs' operations and its manufacturing clients.

The company has also been busy integrating its $280 million acquisition of 3D Hubs, completed early last year.

"Hubs," as it's called now, is an online manufacturing platform that offers businesses on-demand access to a global network of manufacturing partners.

In other words, Proto Labs has now positioned itself as the "Amazon" of 3D manufacturing technology.

More importantly, Proto Labs has been steering substantial amounts of its cash flow towards new forms of technology, like laser sintering - which was barely a prototypical technology itself a handful of years ago.

Looking ahead to the rest of 2022, analysts think PRLB can earn $1.64 a share. But the big payoff would come in 2023, when the company's profits should rise more than 70% to $2.86 a share.

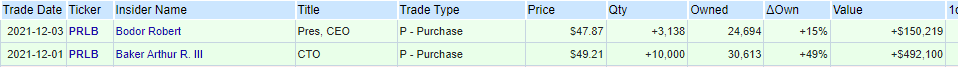

One other reason why I like Proto Labs at this juncture...early in December, the stock got so cheap that the CEO and CTO (chief technology officer) each made substantial "insider" stock buys, the first for any senior executive at the company in years.

I think these executives recognized just how cheap their stock was (and is).

At the current price of the stock, and presuming PRLB can meet analysts' profit estimates for this year, the shares are trading at a price-earnings ratio of 33. That's cheap for a stock that has typically traded at a p/e of 40 or better for most of the past decade.

My bet is that the stock is undervalued, and that Wall Street will learn to like this stock again this year and on into 2023.

If we use the historical p/e of 40...and multiply by this year's projected profits, it gets us a potential stock price of $65 by year-end. If the company can hit its 2023 profit projections, traders could bid it as high as $114 or better over the next 12-18 months.

Best of goodBUYs,

Jeff Yastine

Member discussion