Cutting Losses, Taking Profits

I think this is a good time to start cutting exposure to the stock market.

I doubt that the main indexes are going to roll over and plummet in any immediate sense. But this chart of the Nasdaq from the year 2000, and headlines from March 10th of that year...haunt me, plain and simple:

The challenge of navigating potentially bubblish markets is that the news is good, and things "feel" good - until they're not. We're like crabs in a pot. The water's nice when we go in. But when the water gets hot - it's too late.

So I'd rather be wrong and have to chase the market again - then watch the index begin to bleed in coming weeks, with much smaller profits and larger losses in my individual stocks before making my exit (more on this below).

With that in mind, I'm moving the following stocks out of the goodBUYs portfolio:

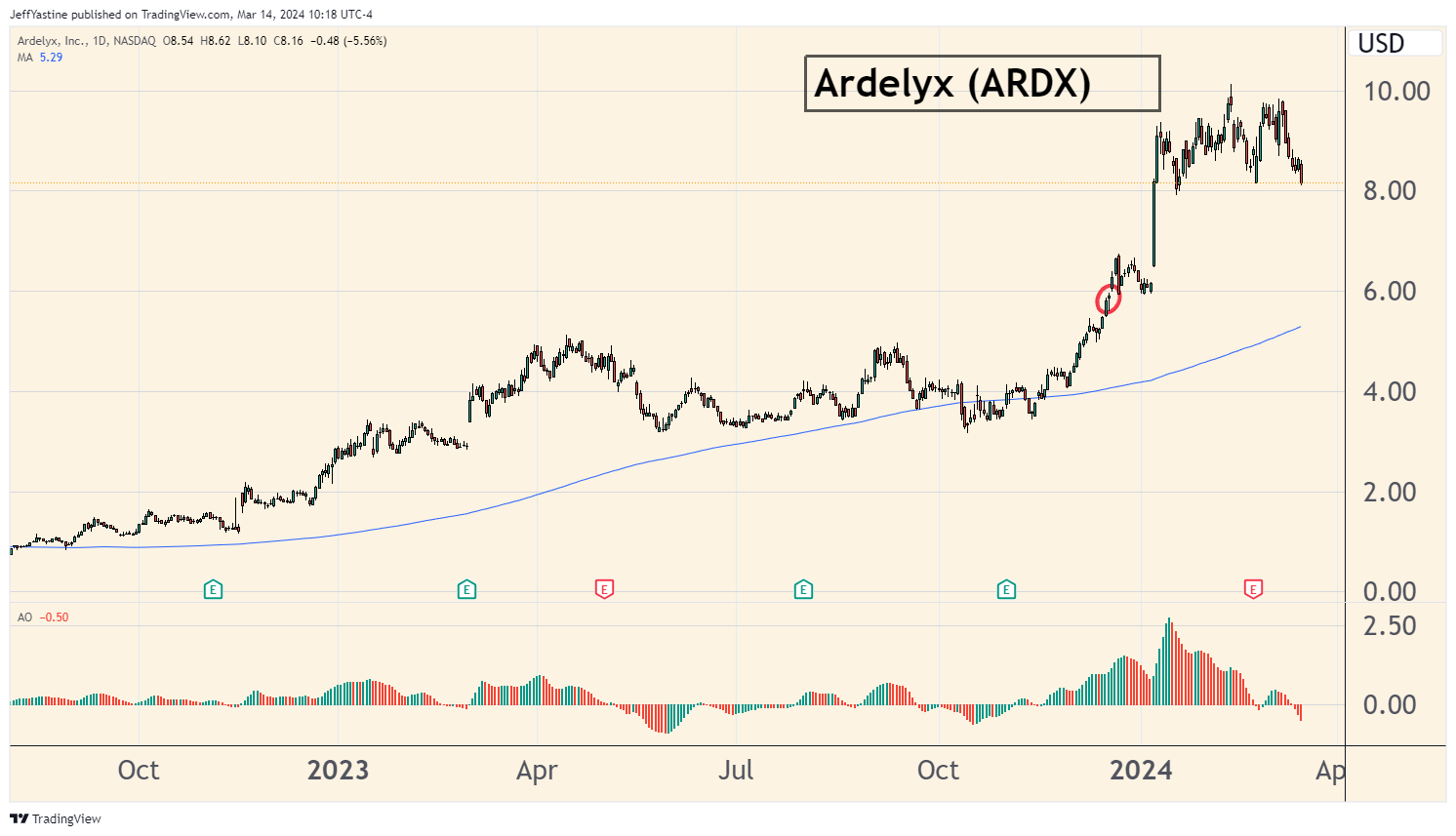

- Ardelyx (ARDX) has had a nice gain of +44% for us since being added last December.

But it could be about to make a sharp move lower. Given the sketchiness of the overall market, I'm reluctant to let that profit slip away at this point, given that the overall market may be starting to weaken (and it's being held up largely by a tiny handful of mega-powerful stocks):

Skywater Technologies (SKYT) is a new addition to the portfolio, and is down about 12% in the portfolio. I'm also going to push it over the side as well.

I'm also going to dump Bristol-Myers Squibb (BMY), for a fractional gain, and Stereotaxis (STXS) for a 15% loss.

It's a presidential election year (typically bullish). Lord knows there's plenty of bullish-sounding headlines out there. The economic measures aren't horribly bad. And broad measures of public participation of the stock market have never been higher.

I guess that's what worries me.

This was much the same case in early March of 2000. Lots of bullish prognostications- even on the day when the Nasdaq Composite put in its final top.

The Fed was even in the process of raising interest rates at the time, and yet it didn't seem to be hurting the US economy or the market. The bad news on that (basically US companies pulling back on their tech spending) didn't emerge until weeks and months later, when the Nasdaq was already far lower.

So don't get me wrong. In many ways, "sitting on your hands" is a great investing strategy. Most of us trade too much. I'm guilty of that as much as anyone.

But we really only have 2 cards to play as investors, and both of them are "finite."

We have our money. And we have our confidence.

It's important to preserve both in bull markets, bear markets, and weird markets (like this one), no matter what.

Jeff

Member discussion