Market Update: The Tesla-AI-Nvidia Conundrum

Before getting into the whole Tesla-AI-Nvidia thing, let me tell you a brief story about my 16-year-old son...

He was never interested in the stock market. But he's taking a macroeconomics course in high school, so he's become more curious about what makes stock prices go up and down.

So I gave him a Robinhood account with $500 and said "Here you go. I can talk at you all I want. But the only way to really learn is to do it."

Two months later, his account balance stands at $475. So he's down 5%.

I'm proud of him actually. We learn more from our failures than our successes. So he's learning at a young age about risk and the importance of "betting small." Half the battle is learning to survive tough periods and not "blowing yourself up" by losing large amounts of money.

He's also learning that the stock market isn't always easy.

The truth is there are times - lasting weeks or months - where it can be frustratingly hard.

This is one of those times.

The tech-oriented "magnificent 7" stocks continue to make gains. In fact, the comparison I pointed to last week - that the current setup matches the Nasdaq's movements in August-October 2007 just prior to the 2007-2009 bear market - remains very much intact, almost to the day.

I won't bore you by putting up the same chart as last week again. But if our market continues to "mirror" the one from late 2007, then we'll see a general upward bias to the market through the end of October.

The Tesla-AI-Nvidia Conundrum

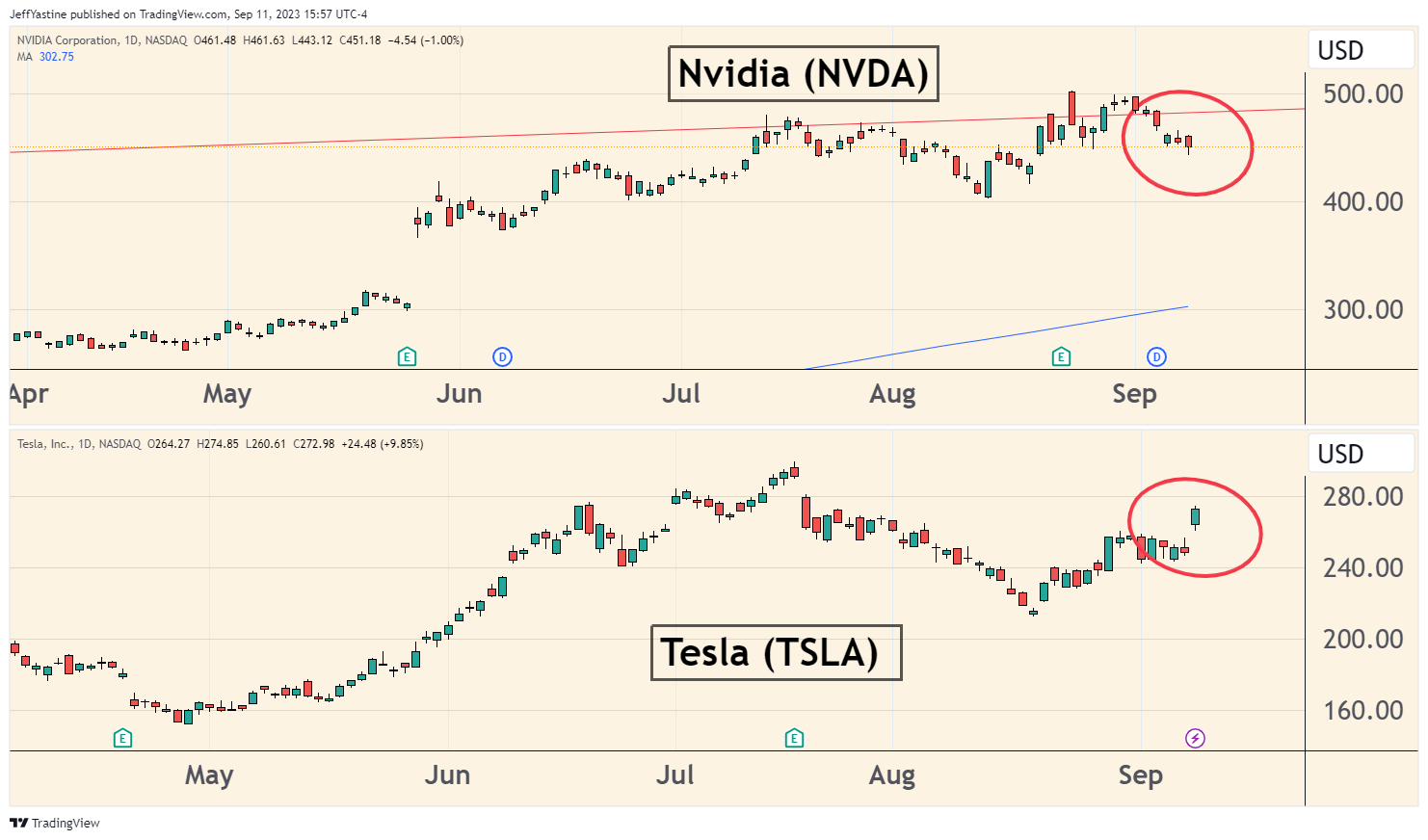

The action in Tesla (TSLA) vs Nvidia (NVDA) is a good example of the current period of market frustration.

Tesla's stock soared 10% Monday after executives gave a presentation on the company's foray into artificial intelligence (AI).

So what's good for Tesla ought to be great for Nvidia, since it's the go-to maker of AI chips, right?

Tesla executives even told Wall Street analysts they were buying as many Nvidia GPUs as they could get and "cannot physically secure the amount of chips necessary."

That sounds pretty bullish for Nvidia on the face of things.

And yet, Nvidia shares are down 1% today.

Bifurcation All Around

We're seeing similar perplexing activity in other sectors.

For example, Walmart (WMT) is hitting new all-time highs in recent sessions:

Yet the share prices of most other retailers, even Walmart's peers like Target (TGT), match more closely to the disappointing performance of the S&P Retail ETF (XRT)...

My point is...we could be in for a sizable stretch of time where it's becoming increasingly dangerous, and deceptively easy to lose lots of money.

It's easy to lose because we're receiving mixed signals.

While "the market" heads higher (dragged upward by the usual megacap suspects) - far too many stocks are either already heading lower, or drifting sideways without direction.

Just in today's session, the Nasdaq finished out today's session up more than 1%. And yet the small-cap Russell 2000 index barely closed in the green.

So it's easy to be lulled into a false sense of confidence.

It's sort of reaching for a bare electric wire on the ground, or tip-toeing further and further out on the branch of a tall tree. By the time you sense the danger, it's too late to do anything.

So be careful out there. Like I said earlier, the market will likely drift higher for another 4 to 6 weeks, so there's still opportunity to make money from buying stocks.

But as the stock market's leadership narrows, that money-making window gets smaller and smaller.

Best of goodBUYs,

Jeff Yastine

Member discussion