Market Roadmap: Following 2007 to a "B"

Regarding our current stock market, something's been gnawing at my mind for a while now...

Call it a trader's Deja Vu.

I just couldn't put my finger on it. The trading action of the past number of months felt very familiar (and not in a good way), but I couldn't place where that feeling came from.

I mean, Wall Street keeps saying "Come on in, the water's fine!"

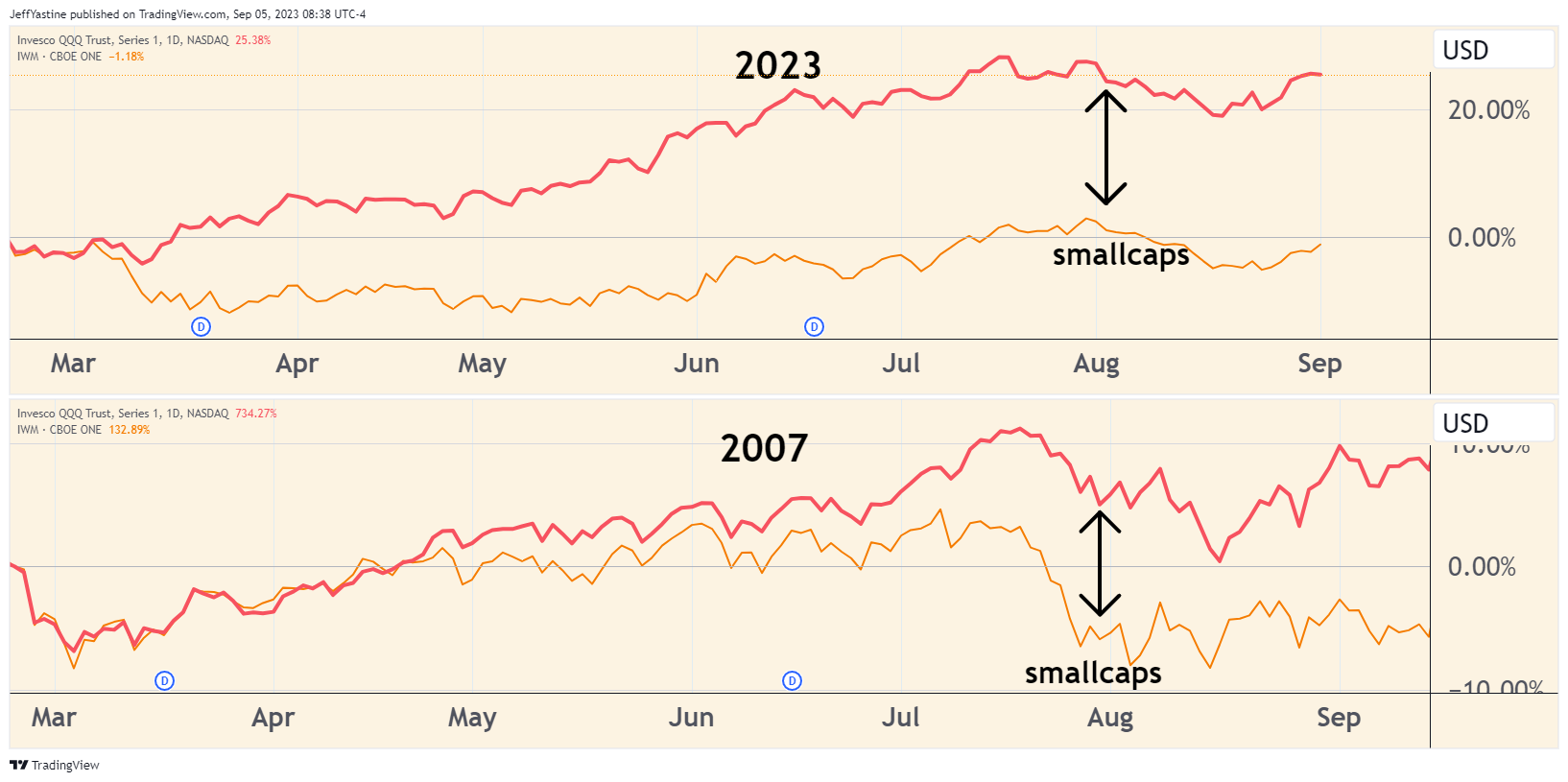

Yet key sectors continue to severely underperform, like...

- Banking

- Smallcap stocks

- Retail

- Travel

Anyway, I finally found the answer to my nagging Deja Vu over the long Labor Day weekend.

2007 Redux?

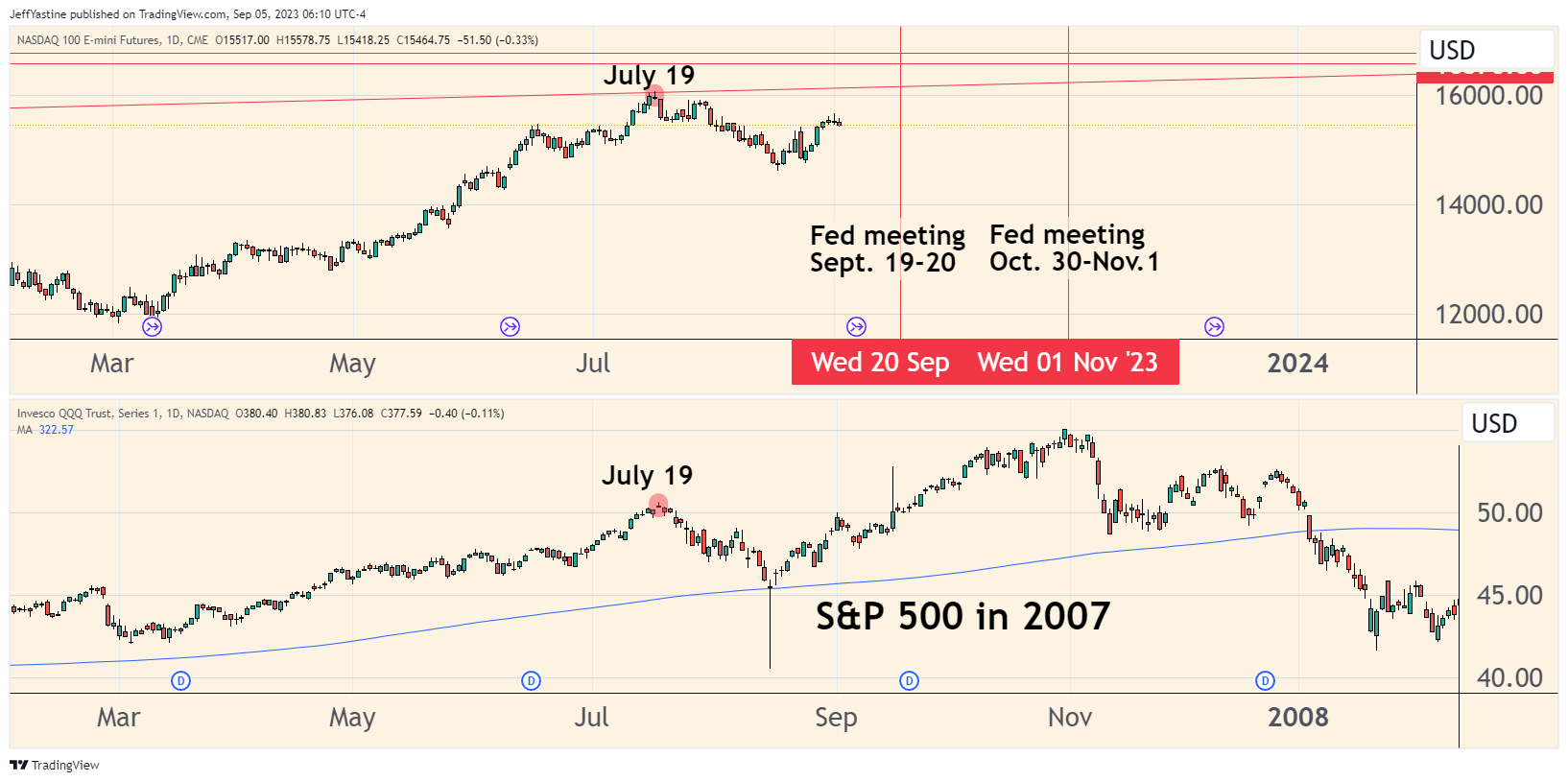

We may be on a collision course with the infamous market year of 2007 all over again. Certainly, the charts below - our current market above, and 2007 in the bottom half - match up almost exactly:

In 2007, the major indexes fell 10% in two weeks - basically November 1 through November 12th, marking the first tremors of the 2007-2009 bear market.

So if our stock market follows the 2007 model, then we're looking at another 7 or 8 weeks of upward activity, and likely an equalling of the Nasdaq's all-time highs from 2021.

But afterwards comes the onset of renewed bearish activity.

Other similarities of our 2023 market to 2007 aren't easily dismissed, in my opinion.

For example, 2007 was a year where smallcap stocks (as represented by the Russell 2000 (IWM) ETF) increasingly lagged the performance of the Nasdaq and S&P 500 - just like it's doing here in 2023:

So that's where my personal Deja Vu is coming from.

For me, 2007 was a very tough year. I felt strongly that something was wrong with the economy. So I was bearish. But I wasn't disciplined. I wasn't patient. I didn't respect risk the way I do now.

It was clear in early 2007 that the nation's banks were having loan problems and that the housing and construction boom couldn't last forever. But despite those headlines, the 2007 stock market - like our market here in 2023 - just kept moving relentlessly higher and higher for the first 10 months of the year.

So when the market finally peaked at the end of October 2007, I had already lost too much confidence (and too much money) trying to fight its rise in earlier months.

Of course, whenever someone like me mentions "2007," the next unspoken question is whether we'll also see a "2008" afterward.

That part, I do not know.

But in 2007-2008, the biggest S&P 500 stocks were dangerously concentrated in financial stocks before the worst of the bear market set in.

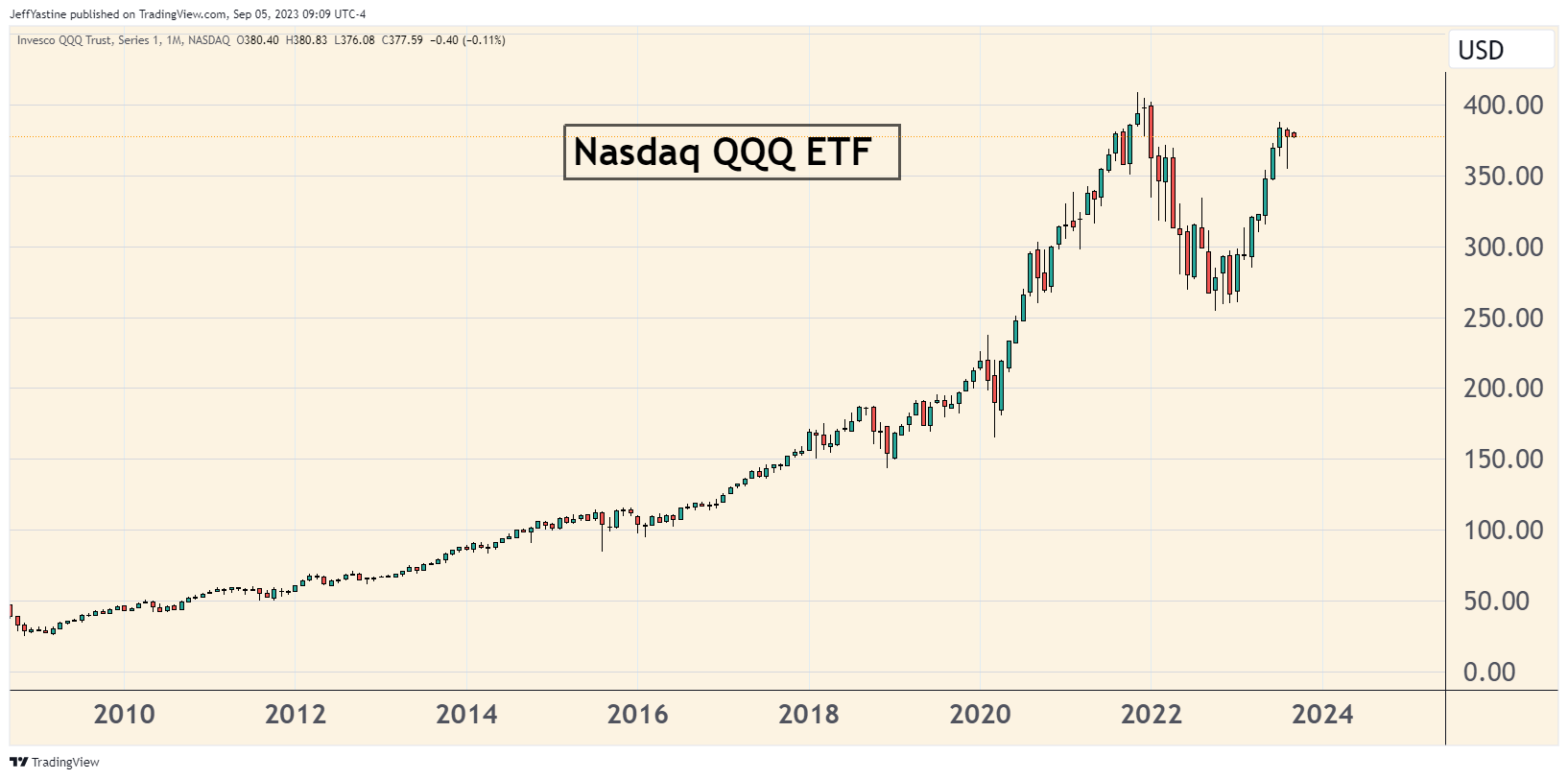

These days, as we watch the Nasdaq climb towards its 2021 highs (and a potential "double-top" on its chart) all the money is concentrated in a handful of megacap tech stocks:

Beyond that, I'll let you draw your own conclusions.

Best of goodBUYs,

Jeff Yastine

Member discussion