This Morning's CPI: Beginning of the Bear Market's End - Part 2

A long time ago, I used to sit on the edge of my seat as an important economic indicator came out...

Eventually, I learned not to care so much about the actual data. It's the stock market's reaction to the data that's important.

I have to tell you....as perverse as it might seem, today's big selloff is exactly what we want to see.

If you believe as I do that the stock market is in the process of bottoming - which is something I've begun to indicate to subscribers lately - then days like today are good.

It's healthy. It's what ought to be happening.

You could rightly ask, what's so healthy about it?

Mainly it comes down to something that's been sorely lacking for much of the past 9 months - fear. Market bottoms are built on fear.

The August CPI indicated that the pace of annual inflation is slowing. It fell to 8.3% (compared to 8.5% in July, and +9% in June).

The trend is what's important. That's what the Fed wants to see.

So why are investors selling so much today? Because certain components of the monthly CPI report came in a little stronger than expected. As if that's really a big surprise at this stage of the game.

Ask yourself this: How many times since the start of the year has the market shown no fear?

We've had rip-roaring market rallies before and after each and every Federal Reserve meeting. Each time, hope reigned supreme that "Maybe we'll only need another rate hike or two, and it'll be over."

Fast-forward to today. The end of the Fed's rate hike cycle is just over the horizon - remember that it's the pace of annual inflation (which is now going down) that really counts - and investors are instead abandoning the ship.

My overall point is...unless I'm very wrong, the next 3-4 weeks are going to be an opportunity to buy at the lows of this market cycle:

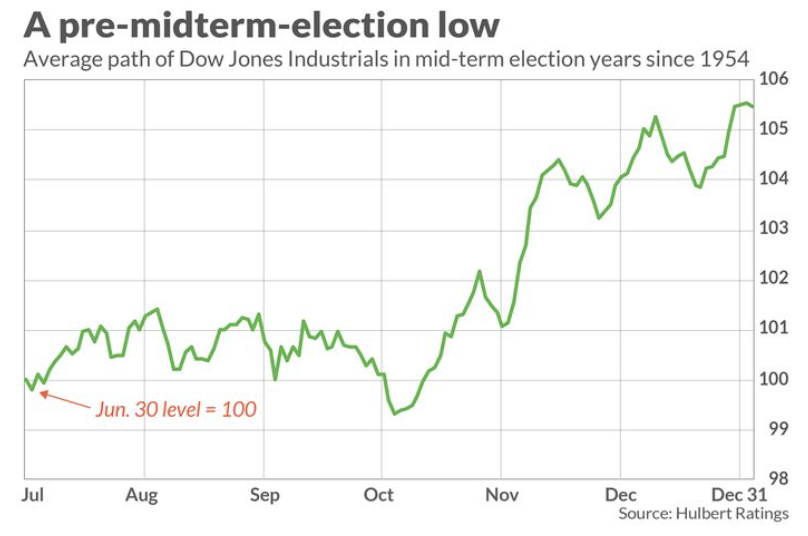

I'll also throw in a chart I showed you over the weekend - the average of what the stock market tends to do during the uncertainty of midterm election years:

There's no need to rush in. Some people like to wait until prices truly move higher. Others like to average-down and accumulate a position over time. As I always try to remind myself, I want to make new purchases with the potential risk in mind and make sure to limit the overall risk to a portfolio.

But the main thing is to not let yourself succumb to the inevitable panic that occurs at stock market bottoms. Sometimes that panic takes the form of a sharp stab downward - like today's big plunge. Other times, it's more like the death of a thousand cuts.

But I'm more convinced than ever that, as noted a few days ago, we're seeing the beginning of the end of the bear market.

Jeff Yastine

Member discussion