The Beginning of the End for the Bear Market?

Let me tell you a little story that happened to me years ago...

Hopefully, it explains something of my "about-face" late last week, where I covered several short-sales in Apple (AAPL) and Tesla (TSLA) while adding a few more "longs" to the goodBUYs portfolio (which is still roughly 80% in cash)...

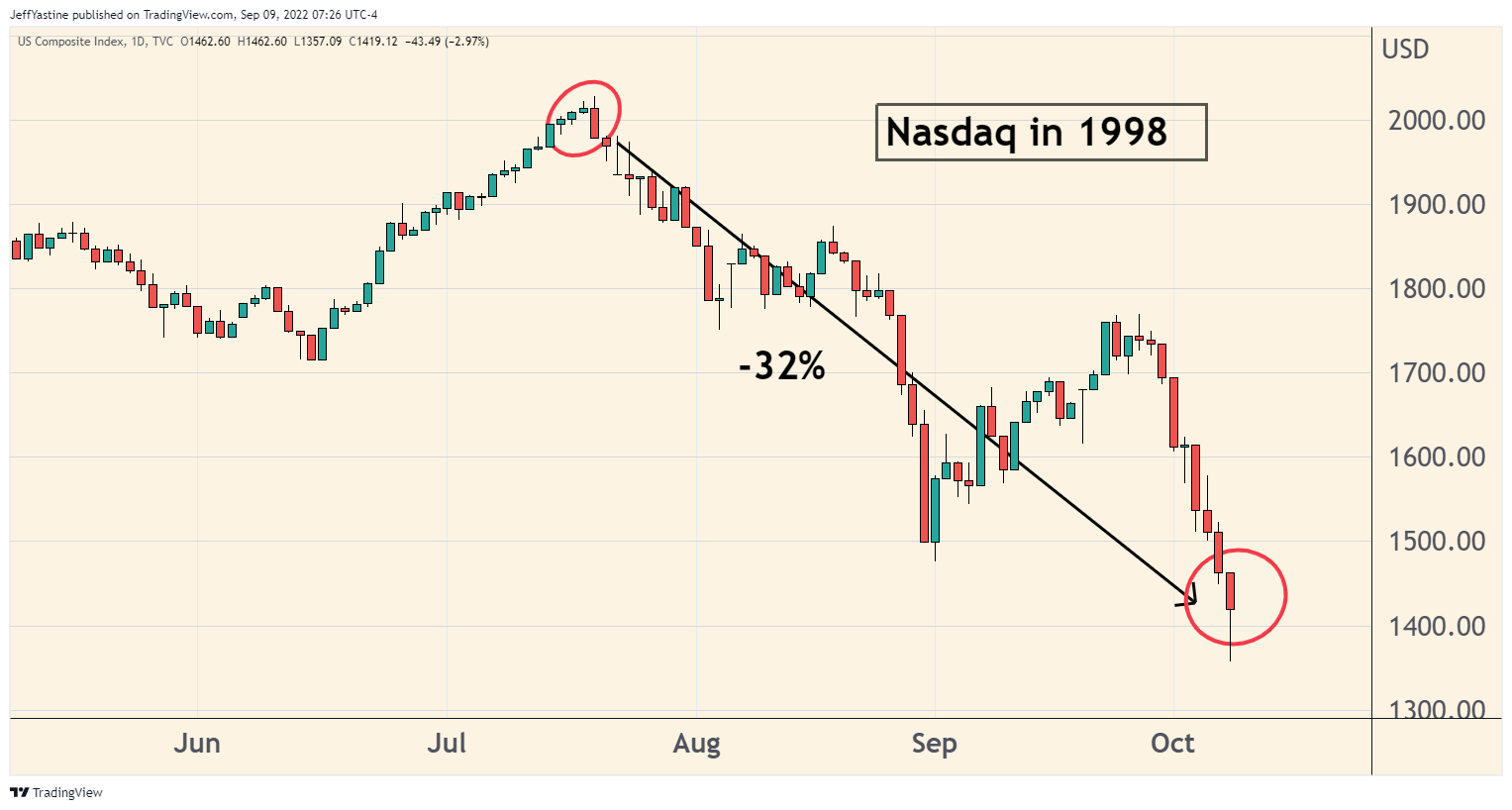

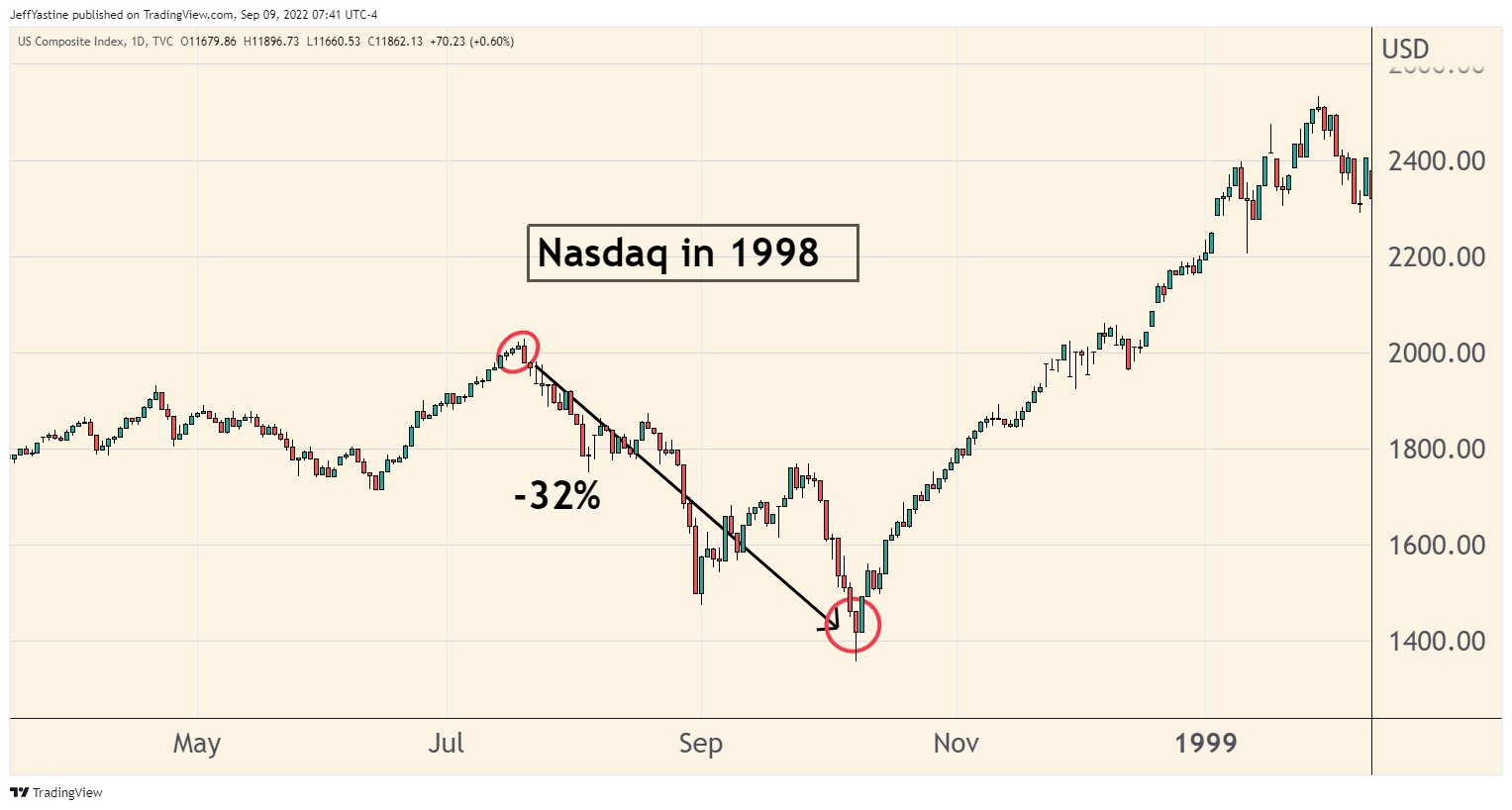

It was October 1998. In the prior 3 months, the S&P 500 had fallen 22% and the Nasdaq dropped 32%.

The bad news was relentless.

- There was a dire currency crisis and severe recession that started in Asia in the prior year, spreading to Latin America.

- Russia plunged into its first "ruble crisis" since the breakup of the Soviet Union only a few years earlier.

- And while no one knew it at the time, a successful but secretive hedge fund called Long Term Capital Management had made a series of highly leveraged, bad bets in the bond market. With $5 billion in equity, but a trading account leveraged to $125 billion, the fund's massive losses threatened to drag down the entire US banking system.

The Federal Reserve was worried enough about these global crises to start cutting interest rates earlier that summer.

As a stock market newbie, I was bearish. I saw an opportunity to make a lot of money.

So when the Nasdaq sank to new lows on October 7-8 that year, I was convinced the market was headed for an even bigger decline. I became even more bearish and loaded up on put options...

Then a funny thing happened. The market rallied for a few days. "Dead cat bounce" I thought to myself - and bought even more puts.

On October 16, the Fed even held a rare emergency meeting and cut interest rates yet again.

I held tight to my puts. What better evidence of a global economy headed for disaster than an emergency Fed rate cut?

Instead, the stock market rocketed even higher, leaving me and my soon-to-be worthless put options in the dust...

I never forgot that lesson. There is such a thing as getting too bearish, or even worse - getting too bearish, too late in the process.

I was reading the headlines and ignoring the fact that the market was going up despite the bad news. The stock market was looking beyond those headlines, betting on a brighter outcome "over the horizon."

In other words, I was playing checkers, when I should have been playing Grand Master-level chess.

There comes a quiet turning point in every downturn where a great deal of bad news has already been "priced in."

The good news may not even be in the headlines yet. But the stock market can smell it, the way we sniff a fresh-bread bakery or barbecue joint from blocks away in a wispy breeze.

Is That "It" for the Bear Market?

This is one of those times where folks might say, "Well, Jeff is all-in on a new bull market."

I'm not. For all I know, we could still see the market take out the June lows.

But...in my opinion, there are enough signals out there to suggest that getting increasingly bearish - as I was in recent weeks - may no longer be the right move.

Reasons for my abrupt change of attitude...

1. Strong Friday trading session.

For months now, Fridays have tended to be weak days. In a bear market, no one wants to be long over the weekend and find themselves trapped with big losses if more bad news emerges before Monday morning.

So when I switched on my computer Friday morning and saw the index futures 1.7% higher on basically no news, I wondered if it was bait for another "pull-the-rug" selloff when the opening bell rang.

Yet when the market opened, every little dip during the session got "bought." Not just that, but lots of quality down-and-out stocks started getting bids and stayed that way through the rest of the session.

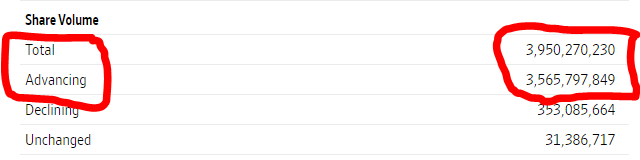

2. "90% upside volume" days.

Friday's session was important for another reason. It was a "90% upside volume" day. In other words, 90% or more of the overall NYSE volume was in stocks moving higher. Here's a screen grab from the WSJ:

"90% upside volume" days don't happen very often. When we see a cluster of them after a significant market decline, it hints at major institutions becoming buyers instead of sellers.

Is it a guarantee of a market bottom? No. No indicator, whether based on fundamental or technical analysis, is ever 100% accurate.

If you want to read more about the data and analysis behind market bottoms, market tops, and "90% upside days" (as well as their bookend opposites, "90% downside days")...click here to read this PDF document written by the indicator's originator, Paul Desmond of Lowry's Research Reports.

(Paul is retired these days, but I used to interview him from time to time and receive his research years ago in my days as a financial journalist.)

3. Russian defeat in Ukraine?

The war in Ukraine is not over yet, of course. But Ukrainian forces have been routing Russian units in recent days at strategic points on the map. Even pro-Putin bloggers are complaining openly about battlefield setbacks.

No doubt we'll read about a Russian counter-attack soon. But the war's momentum has been shifting towards Ukraine for a while now.

Setting aside the geopolitical implications, the bear market - though it started at the very beginning of the year - was fully cast when Russia invaded Ukraine in February.

A full-fledged Russian withdrawal from the region is still a long way off. But I can't help but think that some of the stock market's rise is in anticipation of just that event.

4. Inflation Peak?

We've been down this road before on the whole "inflation-has-or-has-not-peaked" story. But we'll get another bit of data on this on Tuesday with the release of the August CPI report.

The thing I'll be looking for isn't so much the report itself, but the market's reaction. The best thing that could happen would be to see a knee-jerk market selloff, attributed to the CPI report for one reason or another - then look for an eventual recovery.

That would give us yet more evidence that a bottom is being formed and the market is no longer being hurt in a permanent way by negative news.

5. Midterm elections getting closer.

As I've noted many times, the stock market hates uncertainty. The US midterm elections always represent a big question mark, the biggest uncertainty of all with legislative and taxation priorities.

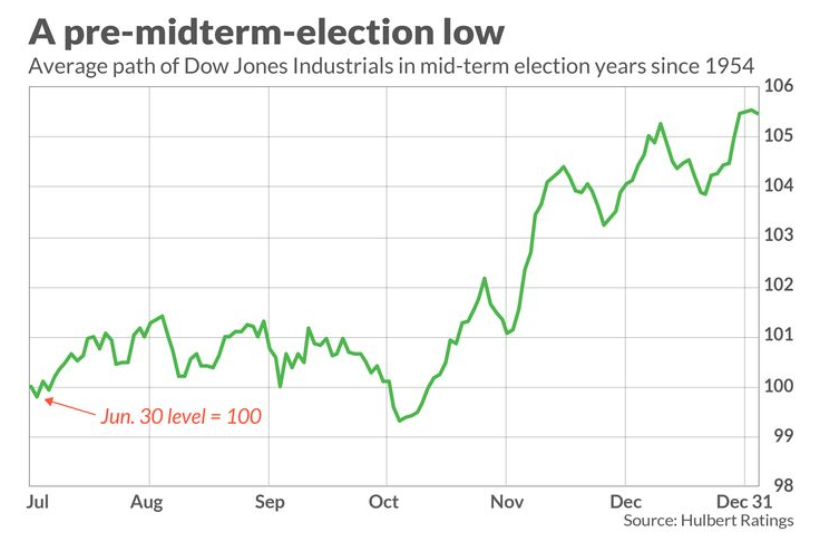

So I thought a recent article by one of my favorite data analysts, Marketwatch's Mark Hulbert, was interesting. If you average all the market data for midterm election years since 1954, you get a stock chart that looks something like this:

I have no idea if the market will conform to the pattern above - actually bottoming in early October. Remember, the chart represents an averaging of the DJIA over the last 18 midterm election years through the bull and bear markets over the last 68 years.

But the bigger point is that the market has a tendency to rally in advance of the November midterms.

If we keep that in mind, then it's like there's a ticking clock alongside the current bear market. The odds of a sustainable rally grow with every passing week, even if such a possibility seems like a crazy notion right now.

How to Play It?

The way I intend to play it is not to rush in, but instead to slowly add new positions here and there - ideally when the market gives us bouts of weakness.

I'm going to slowly wade into various beaten-down sectors of the market and stake positions there.

If my hunch is correct, we should see more stocks - like the travel stocks I recommended last week - that show potential signs of having bottomed.

And if I'm wrong, I'll take my losses and move on. Having kept a close eye on losses all year and still outperformed our benchmark index by a wide margin, we have room to take some bets and see what happens.

Jeff

Member discussion