Market Update: "Groundhog Day"

Does anyone else feel like we're stuck in some kind of financial "Groundhog Day" movie?

In the 1993 Bill Murray comedy, he keeps reliving the same day in time (which is coming up for us on February 2nd, the "real" Groundhog Day).

And as investors and traders, we're likewise stuck in the same time-warp.

I mean, here we are in January 2024, and what's leading the stock market higher, day after day?

You guessed it - the same "Magnificent 7" stocks that lead the way higher a year ago, as we moved beyond the 2022-2023 bear market.

In fact, Google searches for the term hit a peak at this point nearly a year ago, only to be surpassed in the past month as the Nasdaq QQQ ETF surged past its old all-time highs:

I'm not really complaining.

But depending on your perspective, it's either interesting or alarming, that we're still depending on a handful of tech stocks to power the market to higher and higher price levels.

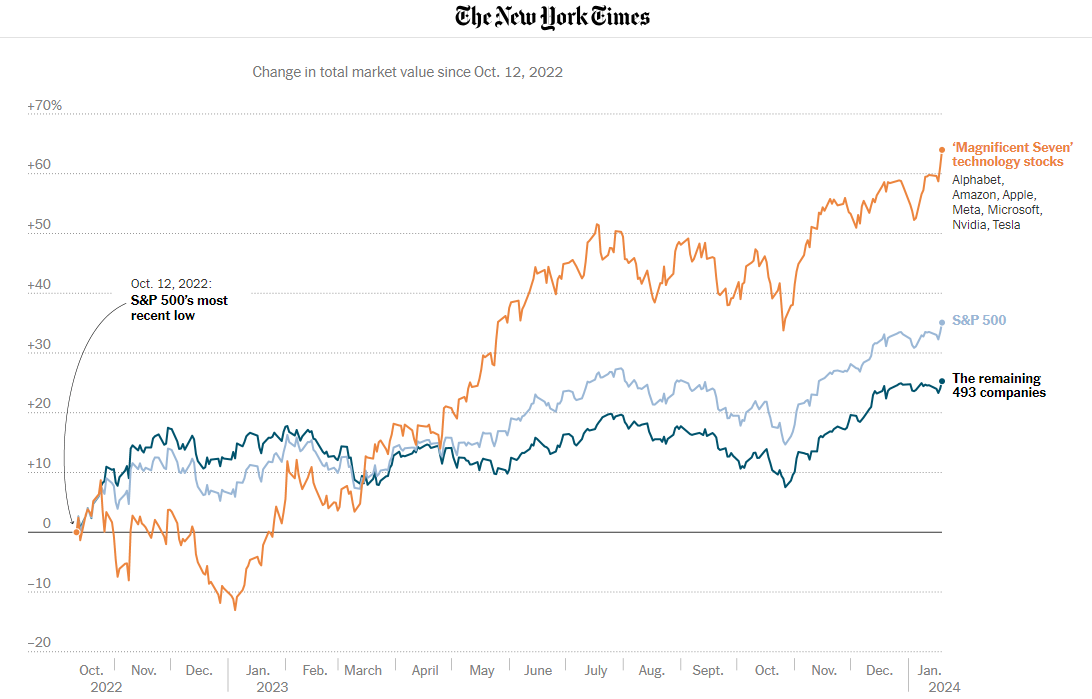

Even the New York Times took note of this long-running trend the other day as a front-page story:

We can argue that other groups of stocks are rising too, kinda sorta.

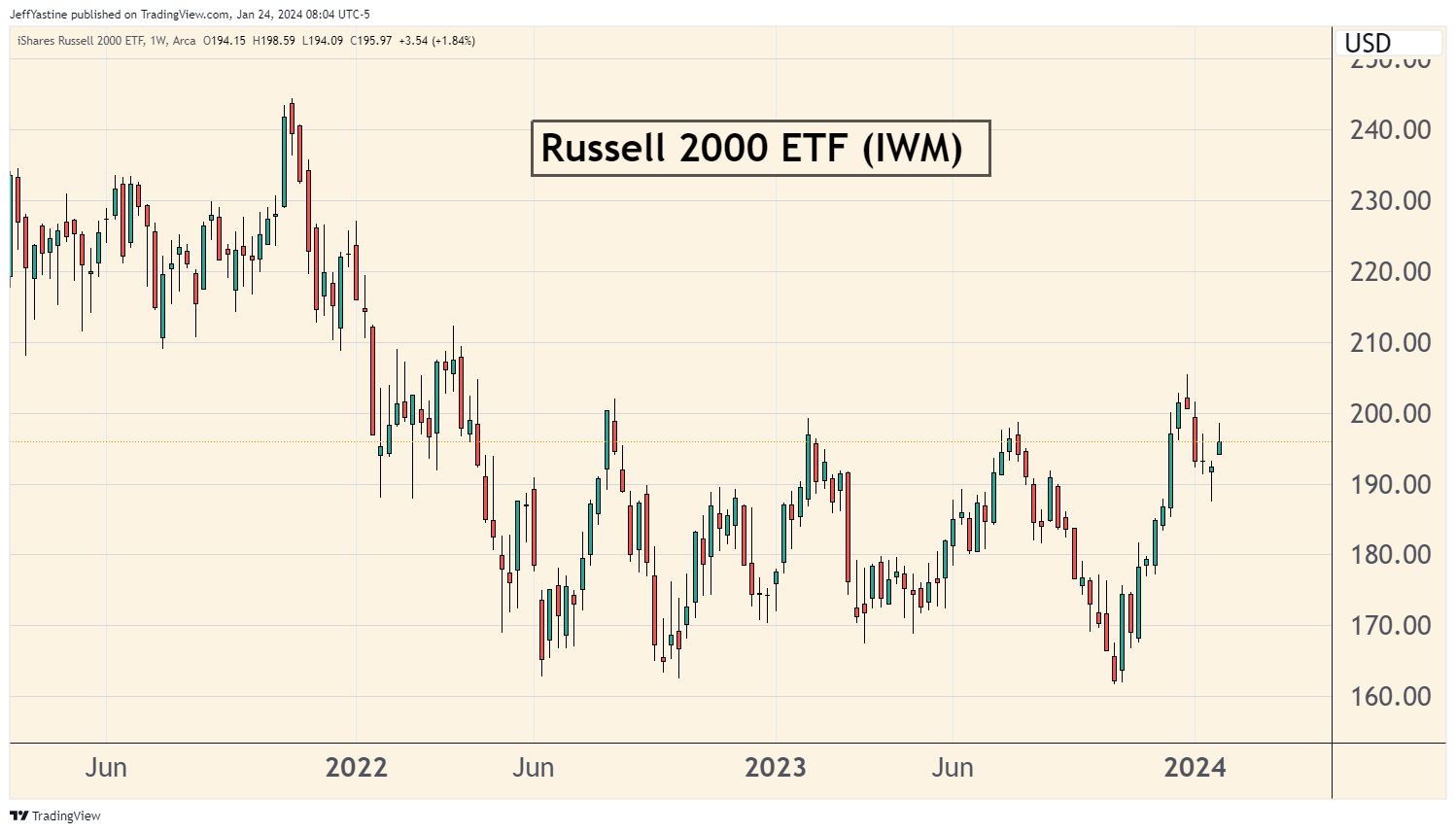

From a technical standpoint, the only real laggard is the Russell 2000 (IWM) small stocks index. It's up 30% or so from its lows of late last year, but still stumbling around in the bottom half of its bear-market trading range of the last few years:

But at this point, does anyone really care? No, not really.

And yes, there might be bearish implications somewhere down the road. When I look at the Nasdaq (and S&P 500) these days, it's tempting to speak the dreaded 5-letter word "bubble."

But try as we might, we don't really know these outcomes ahead of time. As one such example, most of my own warnings from the past 12-18 months were either wrong, or too short-lived to be of much use.

And this being a presidential election year, well, the historical outcomes are typically bullish roughly 70% of the time - with a handful of bearish exceptions like the year 2000, and 2008.

That's the problem with using past history to predict the market's future performance, up or down. It works some of the time. And it doesn't work some of the time. In other words, there's a heck of a lot of "randomness" to confound and confuse us.

And even in the year 2000 - the last real true bubble period - the indexes went straight up until March of that year before rolling over.

So, for now, I'd rather just tell myself to lean back, take in whatever positive impact the rally is having on my portfolio, and enjoy the ride.

Best of goodBUYs,

Jeff Yastine

Member discussion