Market Update & Sell Alert

I know the selloff is getting bad because...it hurts to write these sell alerts.

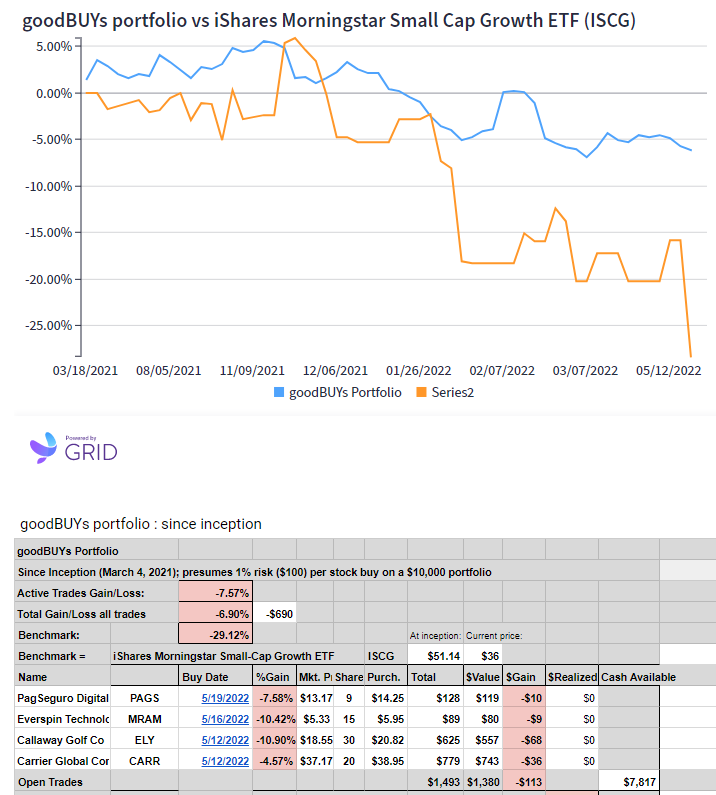

Emotionally and from a "keeping score" perspective, the loss is minimal to the goodBUYs portfolio. And logically, I know this selloff will end and stocks will climb again. We just have to be patient (an update on that below, as well).

But it still stinks to write "sell this stock."

Callaway Golf (ELY) is on the verge of making new lows with today's widespread weakness. Believe me, the urge remains to buy and hold.

But I've learned my lesson by hard-won experience. Too often in situations like now (where the broader market continues to weaken) "buy-and-hold" often turns into "buy and hope."

That's not a strategy.

So as much as I like the stock, we'll exit ELY with an 11% loss (but only dent the portfolio's value by a fraction by using careful portfolio risk management).

The rest of the portfolio isn't responding well either, though far better than the major stock averages or benchmarks. But if it keeps heading south, I'll move Carrier Global (CARR) out of the way as well.

As noted in last week's other buys, I'll look to average down on the other 2 positions - Everspin Technologies (MRAM) and PagSeguro (PAGS) at lower prices.

Where's the Bottom?

Before getting into a market update, one thing I thought was interesting and tweeted about this morning...

Could be very important signal from Fed...concerns about overdoing rate hikes.

— Jeff Yastine (@JeffYastine) May 24, 2022

Market is ignoring now. But here's the reason stocks could rally hard in second half of summer. https://t.co/gM0BTPkXcb

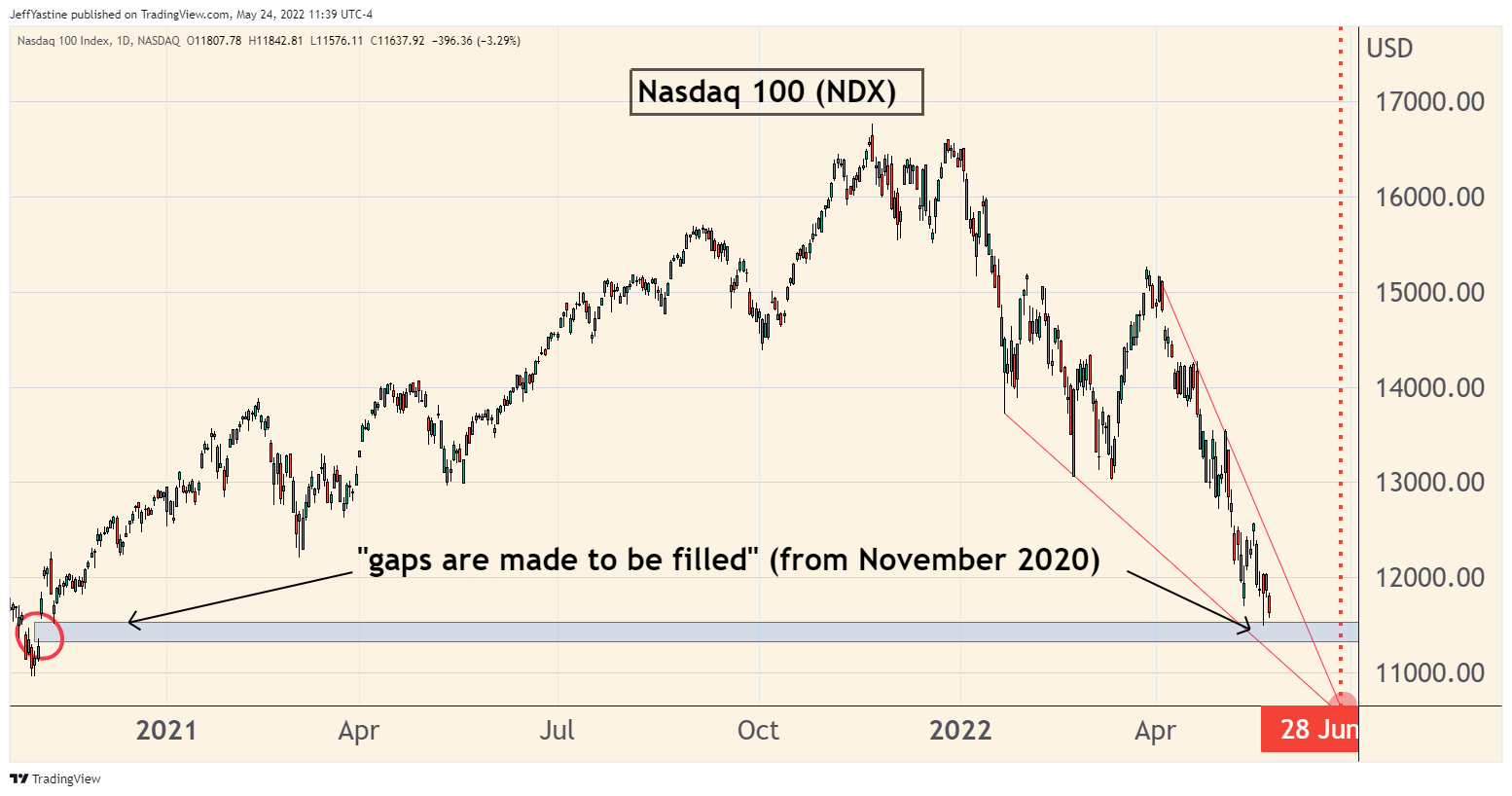

But until then, the markets still appear to have unfinished business to the downside. So far, the "declining wedge" I've been showing you continues to point the way lower through the end of June.

In the Sunday update, I noted the existence of a few chart-related price gaps from 2020 (for the DJIA, S&P 500 and Russell 2000). But somehow I missed the existence of a similar one in the Nasdaq-100 and Nasdaq Composite Index (as noted above). It could well act as a "magnet" that pulls the index lower for the time being.

Jeff

Member discussion