Market Update: Last Phase of a Downturn is Always the Hardest

The last part of a downturn really is the hardest.

By now, everyone's had losses, sometimes big ones. Plenty of disappointments.

Somehow it seems unrealistic to think that a stock trading at $5 today, could be trading at $15 or $20 a year from now - even though that's precisely what happens when a bull market kicks in.

So it gets easier and easier to give up, or buy completely into the narratives of the most-negative of Wall Street gurus, who say we're in for a "summer of pain."

No one really knows. Maybe we are.

But we always have to take these pronouncements with a grain of salt. As a former Wall Street journalist, I've seen these kinds of situations before.

I can guarantee that when enough damage has been done to the major stock market indexes (in the way of "bear market"-type declines)...they will stop falling and start rising, even when the financial news headlines are still very negative.

When market strategists turn uniformly bearish (as they're beginning to now) - you know a bottom - either a temporary "tradeable" one, or something more long-lasting - can't be that far away.

The key questions are "when" - and "how much lower"?

Market-wise, I believe it's whatever happens first in the chart below.

Either the market breaks decisively out of the "declining triangle" I've been notating for weeks now. Or barring that, the major indexes like the Nasdaq-100 (NDX) and S&P 500 (SPX) continue to drift mostly lower through the end of June into the bottom of that "wedge":

I don't want to sound too extreme or too negative. But there's also a small chance that the selloff picks up even more steam from here.

Instead of "drifting lower"...we get more of a "plunge lower." Allow me to explain...

Shifting "Pain Trade"

If we think about it, small-cap stocks experienced the most pain over the past year or so. Then the "pain trade" shifted to big cap tech stocks starting in February as megacap tech stocks like Facebook fell 50%.

Now it's the big-cap S&P 500 and DJIA companies taking the biggest blows as stocks like Walmart (WMT) and Target (TGT) dropped 20 to 30% last week.

The Dow index is most notable to me. It finished at new lows for the year on Friday. There's also "unfinished business" on the downside - a "gap" in the chart reaching back to 2020.

As longtime subscribers know, I often look for these gaps to be "filled" by later trading action. If I'm correct, then the DJIA could continue to move 7-8% lower until reaching the 28,000 to 29,000 range.

Does that mean the S&P 500 is in for a similar amount of pain?

There's that chance - there is a small "gap" in its chart (see below) down at the 3,400 level - a drop of 10 to 12% from here. But at this point, that seems extreme for an index with 500 stocks in it (versus just 30 in the DJIA).

We'll have to wait and see. For now, I'm expecting the S&P 500 to keep bouncing off the lower boundary of its "declining wedge" into late June, unless I'm proven wrong and we see a rally that sees the index break through the upper part of the "wedge".

And again, there's a small chance that this index could instead break decisively through the lower part of its "wedge" - and "fill the gap" far below :

I thought it equally interesting last week that the Russell 2000 index did NOT make a new low last week - which sounds like good news, right?

It could be - especially if we see all the indexes start to "wake up" and break out in the coming week (which is the lead-up to Memorial Day weekend, and a not-uncommon time for stocks to rally into a major holiday. Big rallies often happen when we least expect.

But while not evident on an index chart, the main iShares Russell 2000 ETF (IWM) has 2 big gaps on its chart just below the current price level:

Obviously, I'm trying to "thread the needle" not wanting to sound too bearish. My own strategy personally, and with the goodBUYreport portfolio, is to keep a toe dipped in the water with a handful of stocks that should do really well if and when the market improves.

And if not?

We'll average down on some and cut our losses on others as noted in prior buy alerts.

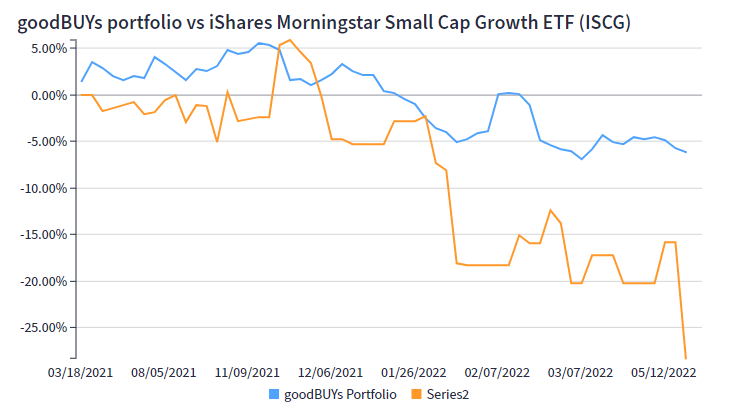

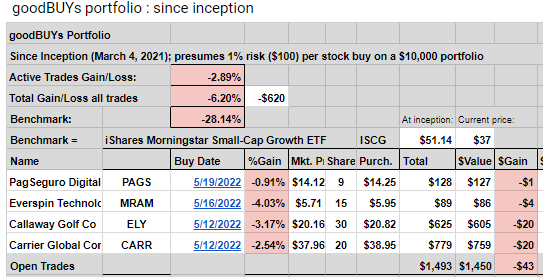

So far, it's been a good strategy. The goal in a correction or bear market is to lose the least. The goodBUYs portfolio is down about 6% while our benchmark, the iShares Morningstar Small Cap Growth ETF, is off about 28% over the same length of time:

I added 1 new stock to the portfolio last week - the Latin America-based fintech company PagSeguro Digital (PAGS). Our other positions in the air-conditioning manufacturer Carrier Global (CARR), the golf equipment and "Top Golf" chain owner Callaway Golf (ELY), and the nextgen chip maker Everspin Technologies (MRAM) have all been drifting lower.

As always, we'll keep our focus on keeping our losses small, and letting our winners (when we finally have some again) run.

Jeff

Member discussion