Old Guy "still" ♥♥♥ Robinhood IPO!

Well, it's always nice when a plan comes together!

Today Robinhood's shares are up 20%!

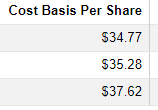

And I'm up a quick 23% based on last week's posted entries with an average price of $35.50.

But here's the question on my mind...

I'm wondering what took everyone until this week to realize about the Robinhood IPO....that wasn't already immediately apparent last week when they went public and I wrote my article (and video)?

Well, I suppose it was partly having the imprimatur of someone like CNBC's Jim Cramer.

Yesterday, he made the same point to viewers that I told everyone here about last week (my article reprinted below), not to mention via Twitter and Facebook?

In other words, Robinhood's IPO opens the door to a host of nicely profitable financial services.

In a few years' time, we won't speak of the company as solely a "free" stock and crypto trading service.

Robinhood will use its competitive edge in system design and frictionless consumer "touchpoints" to disrupt the retirement services industry just like it disrupted the discount brokerage industry over the last 7 years.

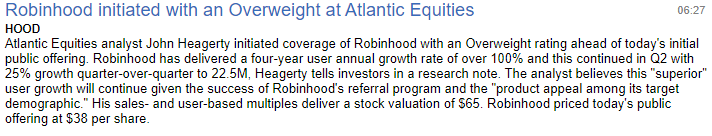

An analyst at Atlantic Equities pegged a target price to HOOD's stock at$65 - almost double the IPO price of last week:

I think Robinhood's stock is going to hit that $68 level fairly quickly, and likely move even higher - if I'm willing to be patient in owning the stock.

If you missed my original post last week, keep reading below or watch the video!

Best of goodBUYs!

Jeff

Old Guy ♥♥♥ Loves Robinhood IPO

I did something yesterday that I haven't done, ever.

I bought shares in an IPO - Robinhood (HOOD).

I typically avoid IPOs. I prefer to let new issues trade for awhile before even considering a purchase.

But given how negative the sentiment on this stock has been all of a sudden, I was curious whether the share price would drop like a stone when it began trading.

If it did, I wanted to buy it as a personal investment at something less than the $38 opening price.

I wound up buying most of my shares yesterday at an average price of $35.50.

It's not a "bet the house" sort of thing. If we hit a market correction, I'll buy more in the $20s or $teens.

Here's the thing. I've had a Robinhood account since 2017. I don't use it very often. But I was amazed then and continue to be amazed now by how easy they make the process. I think it's a good thing.

I only wish that my bank, and my other trading and investing accounts at other institutions would make their systems as intuitive and yes - fun - to use.

Compared to Robinhood, trying to open an account anywhere else is like pulling teeth.

Regulators and politicians may not like it. But I think that's part of Robinhood's competitive edge - in how they design their systems and processes - and a key reason I want to own the stock.

The other reason? Robinhood is just getting started in the financial services industry.

What financial brand do millennials trust with their money as they move up their career ladders?

It's not Bank of America, Merrill Lynch or Wells Fargo, that's for sure.

So if I were those banks, I'd be very worried by Robinhood's next move.

According to published reports, the company may soon launch a US retirement service - that means offering 401(k)s and IRA accounts.

If you have a business employing lots of young people, do you want your retirement account provider to be a stodgy old bank, or Fidelity, or Vanguard?

Or are you going to offer 401k options where your employees expect and want to put their money already - at Robinhood?

I think the answer is obvious.

With the retirement accounts, it's all about AUM - assets under management. Retirement accounts are huge fee generators for the likes of Fidelity and banks.

Once the money's there, it tends to stay there - with the bank taking its half-percent cut and never really having to work for it.

Half the time, when someone leaves a company they forget they even have a retirement account back at their old job.

I'm on my 4th 401(k) account in the past 11 years. Transferring each one to an IRA somewhere else is always an onerous chore.

So all that presents a gigantic opportunity for Robinhood. It's a chance to create a very stable base of revenue, and generate consistent profits - to offset the ups and downs in its stock- and crypto-trading operations.

With that in place, Robinhood has a good shot at being the Amazon of financial services.

Over the next 20 years, I think we can expect to see a range of products, from Venmo-type money transfers, to credit cards, loans, mortgages and other banking products.

Robinhood will use its edge in system design, technology, and a deep knowledge of blockchain and cryptocurrencies - to disrupt the financial services industry, the same way Amazon has disrupted the retail industry over the last 20 years.

That's how I view Robinhood. The stock may fall further from here. That's OK. When the dust settles, I think it will have a real competitive longterm advantage.

Best of goodBUYs!

Jeff

Member discussion