Market Update: "Oh No, I Forgot to Get Rich"

The fear of missing out - FOMO, as we call it - is a powerful thing in the stock market...

When I was a financial reporter and anchor for PBS Nightly Business Report years ago, someone (in typical office humor) tacked up a large comic-book type illustration to the newsroom bulletin board.

It featured an anguished-looking man in a suit, smacking his forehead with his palm and saying:

"Oh no! I forgot to get rich!"

The illustration was up on that bulletin board near my desk for years. So I think of it whenever the market launches a huge, unexpected rally.

Last week may have you feeling just that way ("I missed the big move!") if you're holding a fair amount of cash, or like the goodBUYreport portfolio - concentrate on investing or trading positions over months and years, not days and hours.

It's perfectly natural to feel left behind.

To which I will tell you...shake it off.

Don't allow yourself to engage in Monday Morning quarterbacking, and suddenly plunge into the market in a panic as many fund managers appeared to do last week.

If last week's rally was "real" - meaning it has the legs to become a new bull market in the weeks and months to come - you'll have plenty of time to add new positions and make lots of money.

And if it proves itself to be yet another clever bear market fakeout rally....?

Well, you'll be glad you didn't get too excited.

Leaning Bullish or Bearish?

As I noted in a Thursday morning note last week, we have to respect a large market rally while realizing that late summer is "a time when it's easy for Wall Street traders to push stocks up or down for weeks at a time."

That's why I think the current rally could move at least as high as the red trend line with the "?" on the chart above (which could just as quickly happen by tomorrow morning if the market opens sharply higher across-the-board).

I also think there's a 60% chance we could even the Nasdaq move up near its 200-day moving average (the blue line on the chart above) by Labor Day weekend.

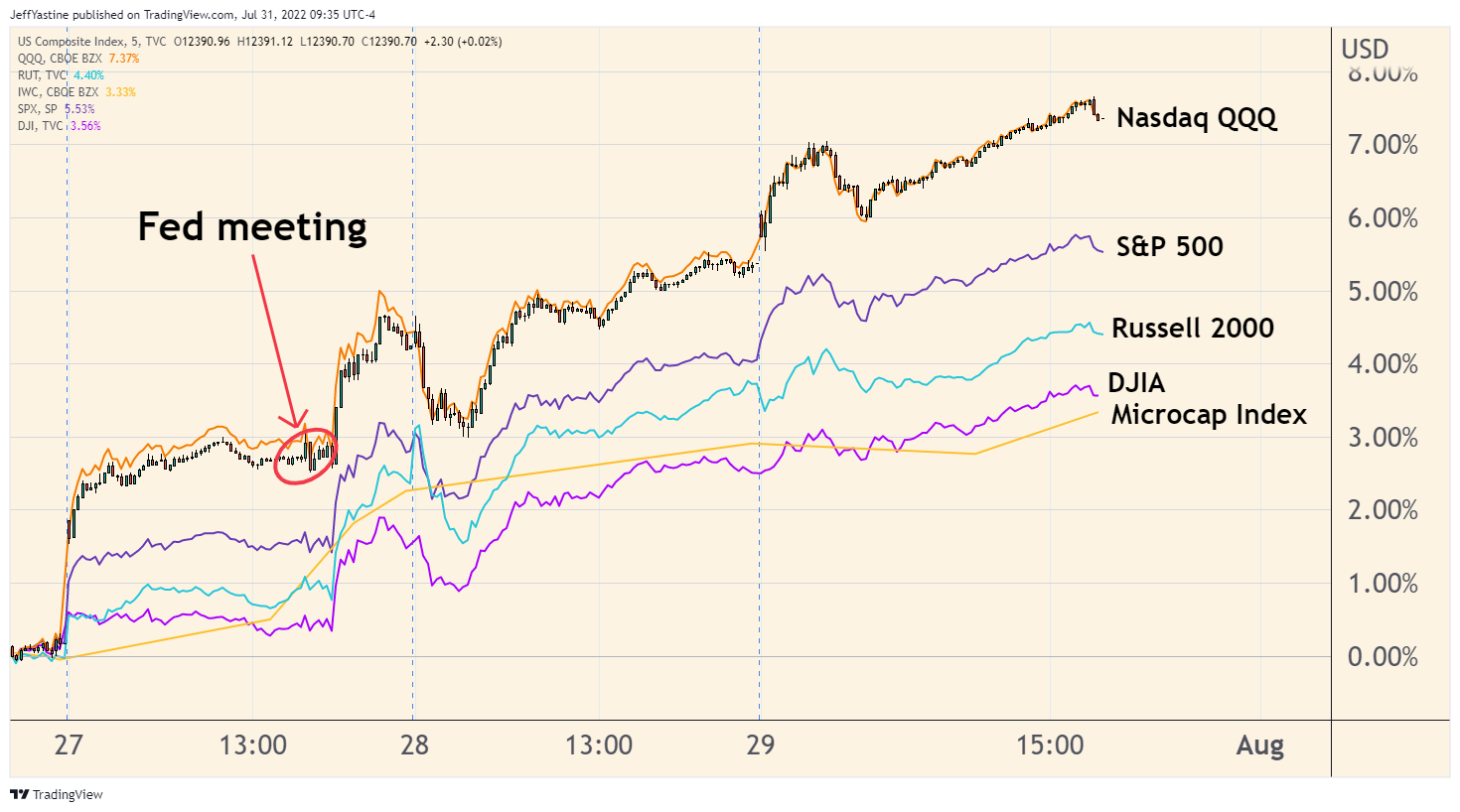

But I would suggest keeping a very close eye on the DJIA and small/micro-cap stocks.

Last week's rally was a lopsided affair. Large tech stocks ran sharply higher. Everything else, from industrial stocks to small- and micro-cap stocks, was left far behind in the dust:

My point is that for this rally to truly gain traction, it needs to quickly "broaden out" and include more classes of stocks.

Sometimes it takes a few weeks for investors to come out of their bear-market foxholes and buy small, higher-risk companies.

With that hope in mind, I'm going to start strategically adding a few more stocks to the goodBUYs portfolio for premium subscribers in the coming week. As I've noted many times before, we have to respect a big fast rise in the market (while always keeping in mind the risks - so we can limit losses if we're wrong).

Yet there many reasons to be highly skeptical that last week's advance was "the bottom" in my opinion.

For example, I couldn't help but notice a note from longtime Wall Street strategist Tom Lee (who's very much a member of the perma-bull community)...

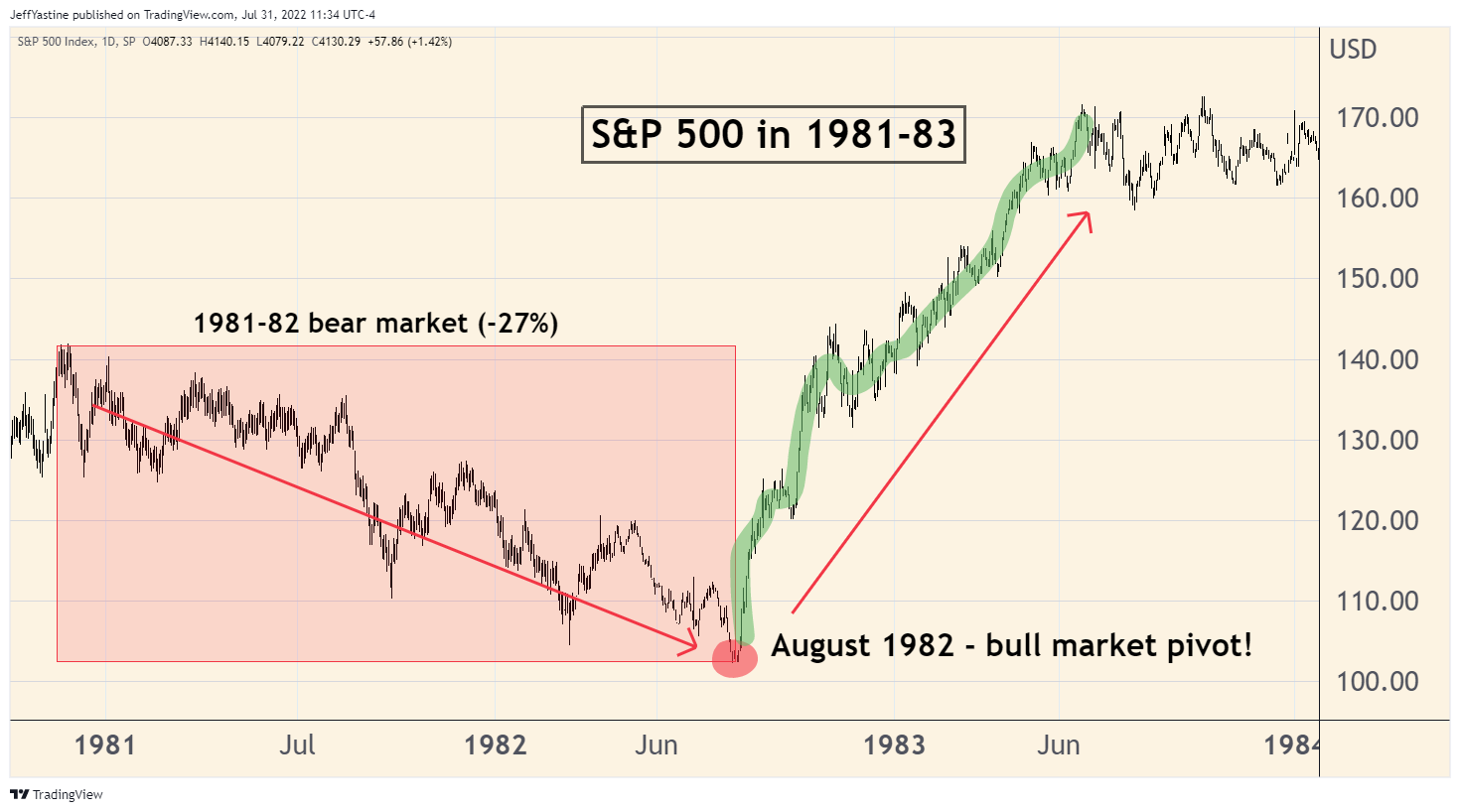

He makes the case that last week's rally is very similar to a famous "pivot" by the Federal Reserve back in 1982, which spurred the S&P 500 to quickly reverse its bear market losses in 4 months!

Here's the chart from back then:

Maybe it will really happen that way again, who knows.

But the difference I see is that in 1982 the Fed raised rates very, very high (the prime interest rate had been raised all the way up to 20%). Meanwhile, the stock market was very very cheap.

Back then, the S&P 500 had a price/earnings (P/E) ratio of 7 - one of the cheapest levels for the market since the early 1950s.

By comparison, today's S&P 500 has a p/e ratio of 20.

To put in perspective, corporate profits (the "e" in the p/e ratio) have to accelerate in a huge way over the next year or two - in order to support further advances by the market without it becoming exceedingly overvalued again.

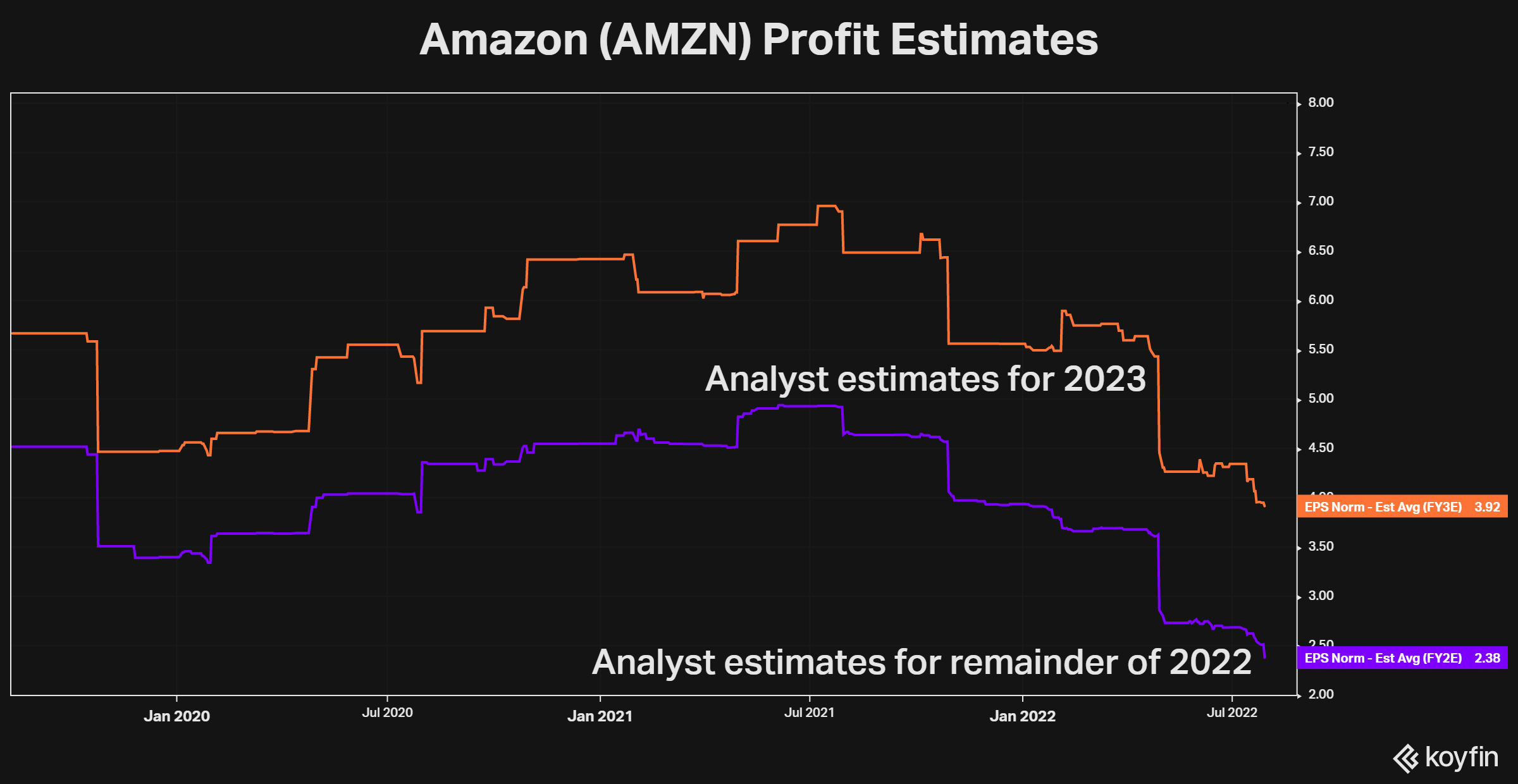

Under a 1982 "runaway bull market" scenario, a company like Amazon (AMZN) - which led last week's market rally when it reported better-than-expected results - needs to surprise investors with a sharp rebound in profits in coming quarters.

In other words, the lines on this chart - representing analysts' profit expectations for Amazon for this year and 2023 - need to be redrawn month by month, as Wall Street revises its profit predictions higher instead of lower:

Here's the last thing I'll point out...

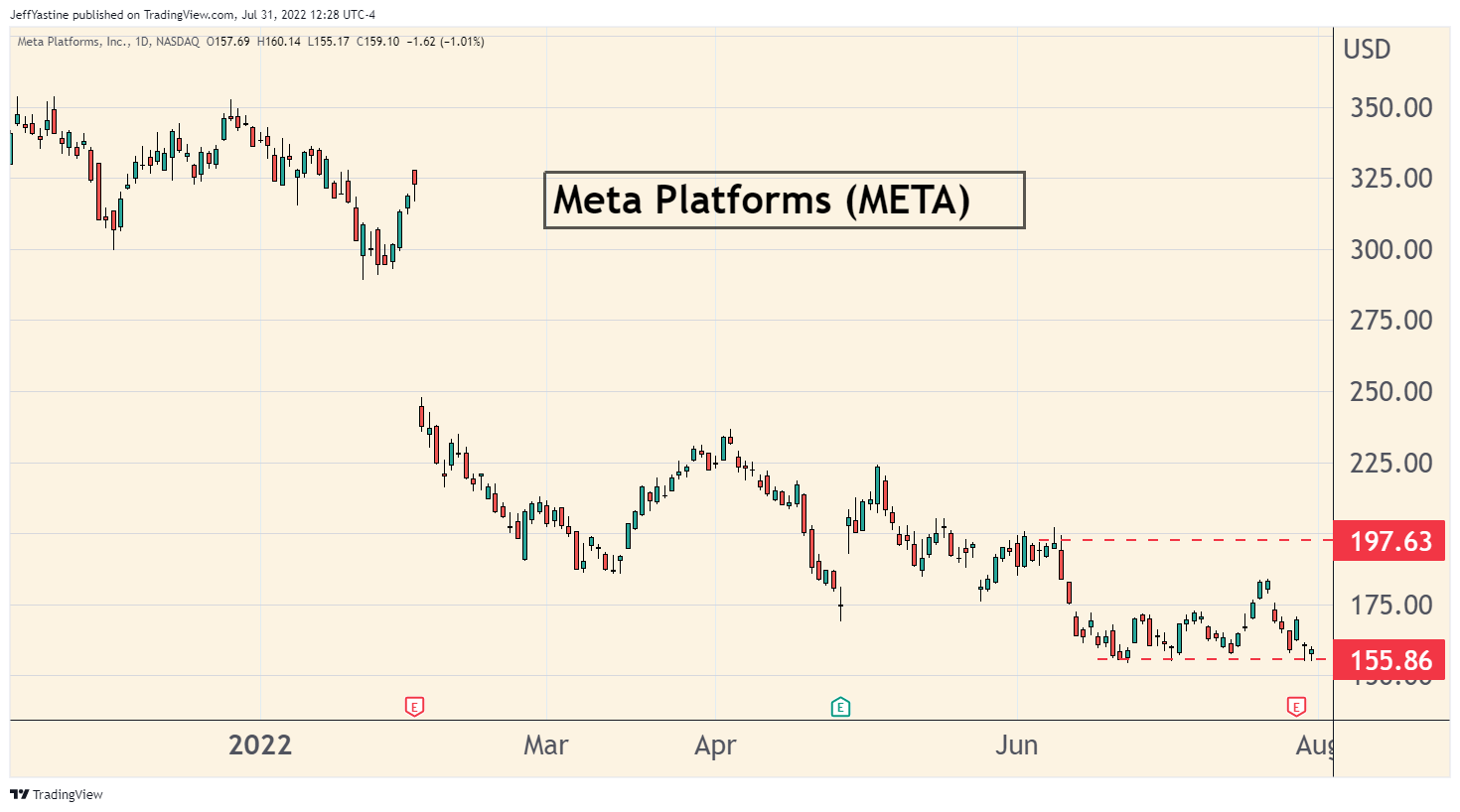

If the stock market is really entering a new bullish phase, we should soon see the biggest advertising-dependent stocks like Meta Platforms (META) start to rebound in a big way.

The rebound would presumably reflect the expectation that Americans will soon be back to spending big in coming quarters, with advertisers aiming to influence consumers' purchasing decisions.

Yet Meta's stock barely moved last week and - unless a rebound materializes in coming weeks - could move even lower:

So let's enjoy this rally for however far it goes, and however long it lasts.

But as I've noted many times in recent weeks, skepticism is a good thing when dealing with a tricky bull market.