Enjoy This Rally! But...

Ever since I wrote last week's post "Did the Market Just Bottom?" it's as if someone switched on a big neon bullish light.

"Jeff, how high could this go?" and "Jeff, is it too late for me to get in?" - seem to be the prevailing questions. Folks have clearly switched from hugely bearish to massively bullish in just a few days' time.

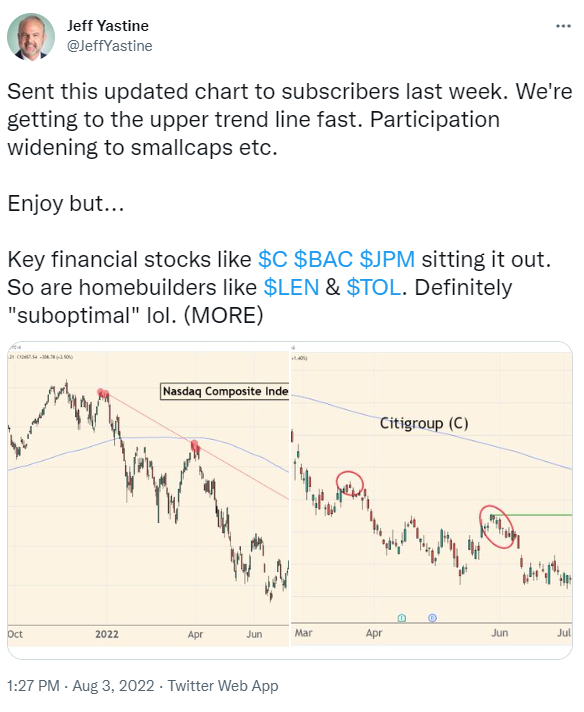

When I posted this chart a week ago, I noted we could get to the upper red trendline very quickly. And here we are...

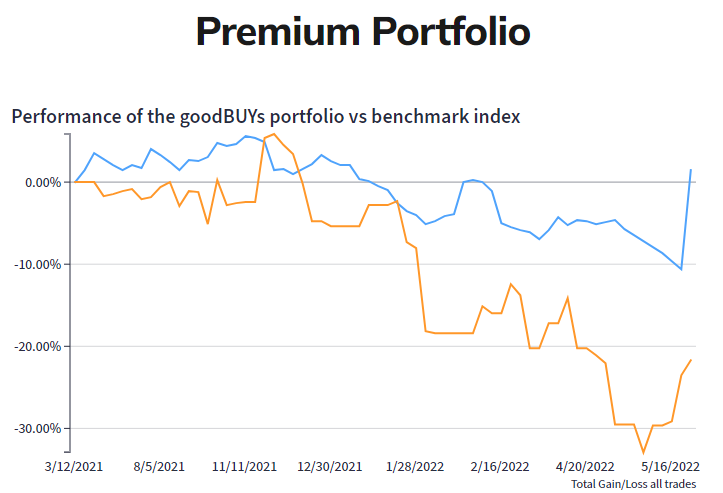

For example, this rally has pushed the goodBUYs portfolio (for premium subscribers) into the green for the first time this year. We've spent the last 7 months avoiding taking big losses, far outpacing our small-cap growth fund benchmark in the process:

It's further proof of what I constantly note to subscribers...take small losses and let your winners run.

So here's my advice... enjoy this rally. Put some money to work.

But as I noted last week, invest with a skeptical eye. If this rally has "legs" - meaning its a bull market advance that's going to rise, fall back, then rise again and slowly work its way higher - you'll have plenty of time to start investing your portfolio in a responsible way.

But...

The stock market is all about uncertainty. No one can guarantee that this is NOT a bear market rally, for a number of important reasons (more on those below).

But it wouldn't be the first time that a huge rally got investors all lathered up, then pulled the rug out. For example, in the midst of the 2000-2003 bear market, the S&P 500 index (down 28% from its all-time highs at the time), turned and soared 20% in 6 weeks - which only served as a setup for a more vicious decline:

So I'm not saying to be bearish - just skeptical.

In the past week, some downtrodden sectors of the market have started to wake up and move higher. Small-cap stocks, for example, are starting to do very well in the last few days. I'm hopeful we'll see others start to outperform in coming days.

But as I noted in a tweet a few days ago, a few important sectors - banks & homebuilders - still haven't moved up.

Maybe they will start doing better later this week or next. But unless or until they do, it could be signaling that this market rally has a lot of sparkly fireworks but not necessarily a lot of substance.

We won't know except in the fullness of time.

Jeff

Member discussion