New Buys! Bristol-Myers Squibb (BMY) and Stereotaxis (STXS)

One important aspect of stock picking is recognizing (and respecting) the power of trends and fads...

For that reason, I'm adding Bristol-Myers Squibb (BMY) and Stereotaxis (STXS) to the portfolio for important technical and fundamental reasons.

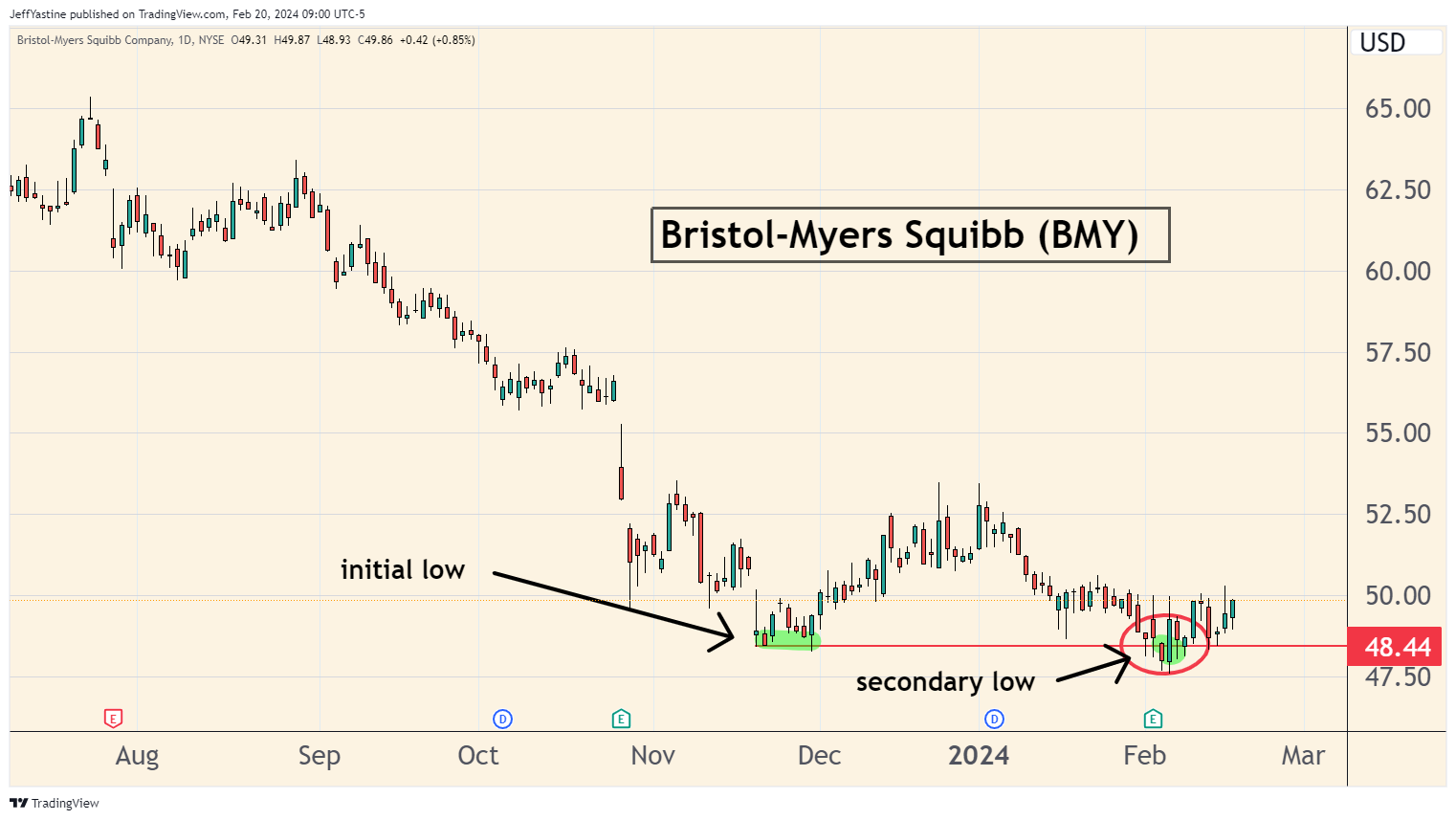

Regarding Bristol-Myers Squibb, let's look at the technical side of things first...

I think the stock has likely made a nice double bottom on its chart. Or what I sometimes call an "undercut low" where the stock briefly penetrates a prior low point and then ricochets higher from that point:

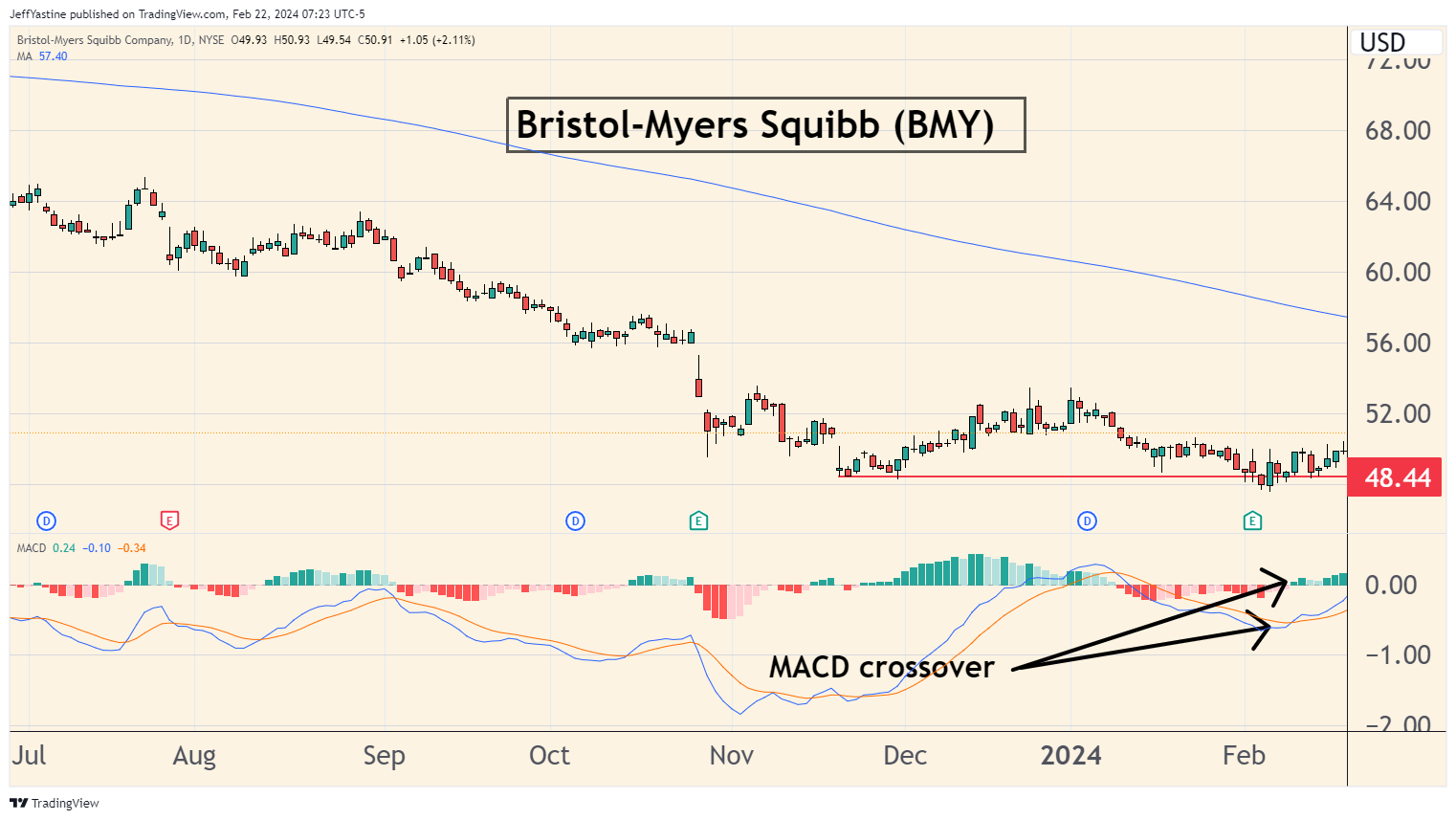

We can use another simple trend indicator, like a MACD (moving average convergence divergence) oscillator, to see that a new uptrend may be emerging in the stock.

Of course, we never know - except in the rear-view mirror - if a "double bottom" or new uptrend is really taking shape. Sometimes it works, sometimes it doesn't. That's why investing in stocks is always a risk-based proposition. Our crystal balls are never particularly clear.

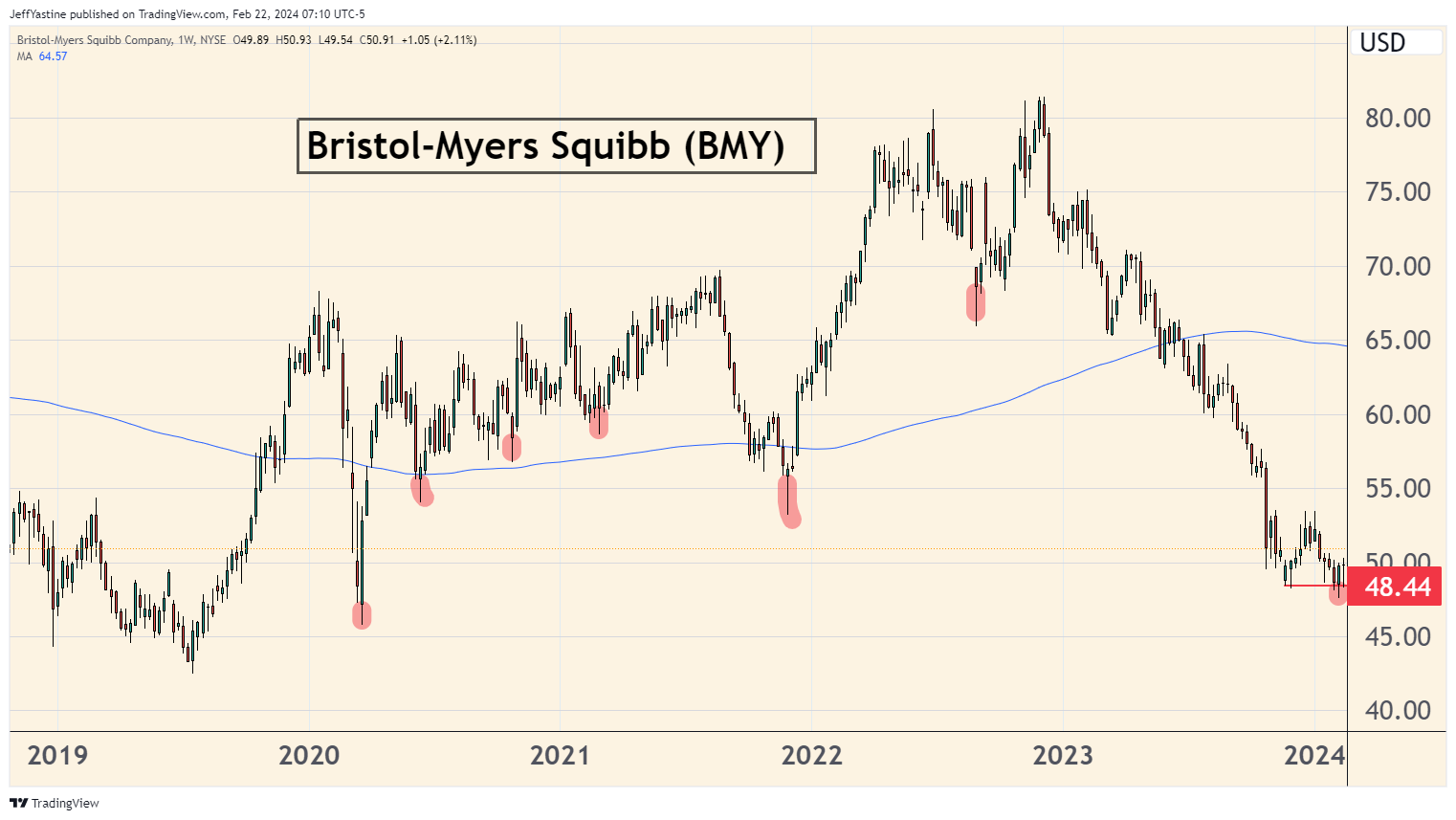

But if we look at the highlighted weekly chart of the stock - where every bar is one week's worth of pricing data - we can see that these "undercut lows" are fairly common for this particular stock, prior to minor and major rallies:

Of course, it only takes one look at the chart above to also see that BMY - which is profitable, with revenue growth and pays out a sustainable quarterly dividend - is down more than 40% from its all-time highs in late 2022.

That's a good thing if we're looking for alternatives to tech stocks. In that situation, we would want to look for stocks that fell out of favor as market participants fell in love with the "magnificent 7" tech stocks, and stand ready to be re-discovered.

I think Bristol-Myers Squibb could be one of those stocks.

And this is where the "trends and fads" element enters the picture. They ruPart of the stock's decline can be balmed on the fact that BMY (unlike a competitor such as Novo-Nordisk) does not have a "new era weight-loss" drug like Ozempic or Zepbound in its development pipeline.

If you're a drug company like BMY, without a me-too Ozempic in your portfolio, traders will sell first and not even bother to ask questions later. But as an investment story, the Ozempic-type drugs are starting to be "old news" at this point.

So we have to look ahead and think - where is the "new" news, and why would investors be attracted to BMY's stock in a big way over the next year or two?

BMY's catalyst: Radiopharmaceuticals

I think the catalyst might be in an emerging class of cancer-fighting drugs called radiopharmaceuticals.

To take a brief step back, you may already be a little familiar with gene-based CAR-T cancer-fighting drugs.

CAR-T therapies basically take your own white blood cells, re-engineer those cells with cancer-fighting properties in a lab, and then re-inject those cells back into your body to fight the cancer. There's a growing number of effective CAR-T therapies out there with FDA approvals.

But CAR-T therapies aren't as effective on what are called "solid tumor" cancers. So we're talking about our bones, breasts, brains, muscles, and kidneys for starters.

Basically, there's too much bone or fibrous material for the CAR-T drugs to penetrate and do a 100% effective job on their own.

So that's where radiopharmaceuticals enter the fight.

In a nutshell, radiopharmaceuticals combine the "precision" abilities of CAR-T cancer fighting drugs, with a nano-scale amount of cancer-killing nuclear isotope.

In essence, the CAR-T drugs do the precise targeting of the cancer cells inside the body. And whatever the CAR-T drug can't kill on its own (because of the bone or fibrous material in the way), the nuclear-isotope kills off with tiny amounts of radiation.

I'm entering Bristol-Myers' stock in the portfolio at current market prices. As always, I'm keeping in mind the possibility that the stock has not bottomed. If it makes new lows, I'll need to re-assess.

Stereotaxis (STXS)

For long-time subscribers, you'll recognize the name of this $2 stock. I've been watching it, off and on, over the past few years as it declined from a pre-bear market high of $10.

Stereotaxis is a developer of hospital-based robotic surgery systems.

I became a close watcher of the stock after a large Florida hospital system bought a unit in 2021, and began accepting patients for it in 2023. The company has about 150 such systems installed at hospitals in the US, Europe, and in Asia.

What makes Stereotaxis' robotic operating system unique is that it uses super magnets to gently slide a catheter through a patient's arteries in order to conduct ablation therapy on the interior muscles of the heart. So there's no cutting.

To give you some idea of the market opportunity, medical researchers estimate that 5% of the US population (15 million people, give or take) has some form of arrhythmia - an unhealthy heart beat rhythm - that needs to be fixed

But we also need to face an important trading fact. Most stocks that trade at $2 or $3 a share...rarely make it beyond that price range again. There's either no revenue growth, no profit growth (or no business at all) behind the stock. So I don't spend too much time looking at stocks at this price level.

But every so often, a small biotech or tech idea pops up above the clutter. And I'm as interested as anyone else in latching on to a $2 stock that could potentially head to $20 - which is why Stereotaxis (STXS) looks mighty interesting these days.

When we look at a chart like the one above, that's a positive. There's clearly trend higher. But...can it continue in a significant, powerful way?

The chart below helps answer that question:

Notice how the stock sliced through a series of prior price-resistance levels?

That's a very good sign, as far as these things go. It means someone is buying Stereotaxis' stock, and buying it with enough conviction to blow past the typical chart-based markers where traders would typically sell out of a stock (especially one that trades in the single digits).

The final step is to look at the big picture. In other words, we've seen the "tree" - but what does the chart "forest" look like?

If we take a step back, and look at STXS on a weekly chart below (where each bar represents one week of pricing activity), it's not hard to see that the stock may be attempting to break out of the stupor imposed by the 2022-2023 bear market on smallcap stocks like this one:

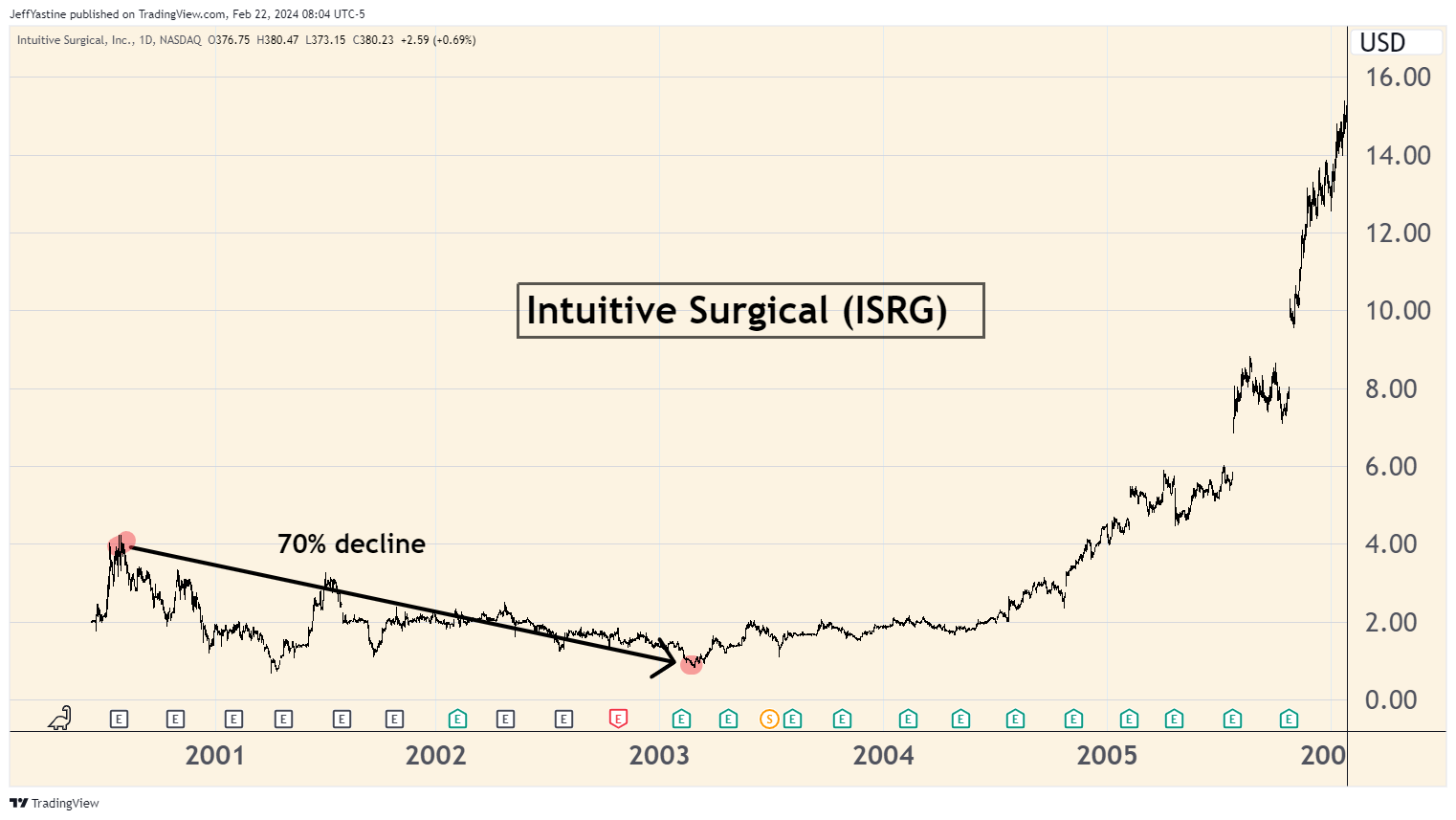

Yes, it's still "early days" so we'll need to be very patient. But if it's any consolation, another huge winner in this same space - robotic surgical technology - started off in very much the same manner.

Perhaps you're familiar with Intuitive Surgical (ISRG)? At a current $380 a share, it's been a huge winner for the past 20 years, with 2 separate 3-for-1 stock splits. Just in the past 5 years alone, the shares are up 470%.

But like STXS, ISRG had humble beginnings. From its IPO in 2000 to 2003, the stock fell 70%. In fact, in 2003 Intuitive Surgical had to do a reverse 1-for-2 stock split because its stock price was so low it would have been delisted from the Nasdaq.

Yet as you can see from the chart - as hospitals began buying the company's revolutionary "DaVinci" surgical robots - the stock was gradually discovered by investors:

My point is... Steretaxis could be another Intuitive Surgical. We'll know whether that's really the case or not in the fullness of time.

Best of goodBUYs,

Jeff Yastine

Member discussion