My Biggest Trading Regret of 2022

(NOTE: This will be my last post of the year. But look for my usual market update on Sunday, January 1st for some predictions on where we're headed for 2023).

When I look back at 2022 and the (ongoing) bear market, I think we did things right almost through the entire year...

In a bear market environment, "doing things right" means losing as little as possible compared to a passive benchmark index.

But I do have a couple of regrets - trading mistakes - that I think we can all learn from as we look out at 2023. More on that below.

Key to Surviving a Bear Market

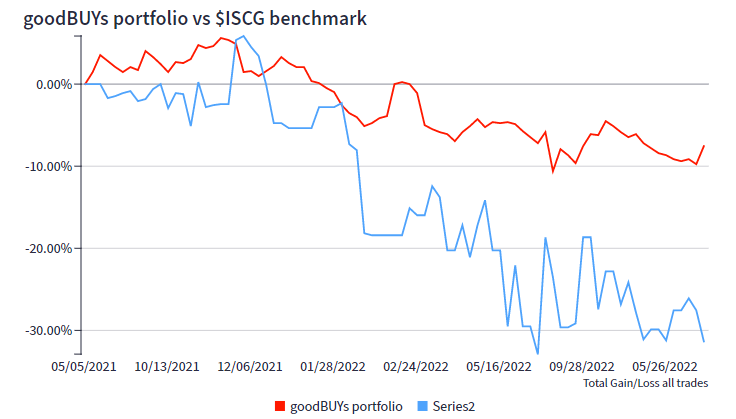

In the case of the goodBUYs portfolio, we'll likely finish the year with a loss of -10%, while our comparison benchmark (the iShares Morningstar Small Cap Growth ETF/ISCG) will close out the year down -30%.

Since starting the goodBUYs portfolio in March 2021, it marks the second year in a row I've beaten the index. In 2021, I managed a gain of +3.3% while our benchmark was down -4.7%

Since inception, here's what my portfolio's equity chart looks like from a starting point of $10,000:

But let's face it, "beating" the market with a loss of -10% might hardly seem like something to crow about.

However, investing and trading losses are like digging a hole. The deeper we make it, the harder it is (and longer it takes) to climb out. Here's how the mathematics of investing and trading losses work...

- With a loss of 10%, I only need a subsequent 11% gain to get back to breakeven.

- With a loss of 20%, I'll need a gain of 25% to get back to breakeven.

- With a loss of 30%, I need a gain of 43% to get back to breakeven.

- With a loss of 40%, I need a gain of 66% to get back to breakeven.

So I outpaced the market by carrying sizable amounts of cash, and methodically putting it to work when the market appeared to mount an occasional bear market rally, while most importantly, cutting losses quickly whenever a stock began "heading south."

That's the challenge we all face as investors in a bear market - when to sell a stock for a loss, and when (as in a bull market) to hold on tight.

No one tells us when a bear market is going to hit, or how long it will last. No one tells us when a bull market is going to start, or its duration, either.

We can have our suspicions. For example in September 2021, I began telling subscribers that it was a good time to "start raising cash" (i.e. sell stocks) as the Federal Reserve telegraphed its intent to raise interest rates. In December 2021, I pointed out how weak the stock market would be if we took away the performance of just 5 megacap stocks.

But did I know for sure when and where a bear market would strike? No.

I mean, it might seem obvious now - the bear market began January 3rd, 2022 - the first trading day of the year, and also the day the S&P 500 hit its all-time high before beginning its decline.

But it's just human nature - when someone predicts really bad news, few of us take it seriously until we see it start to happen ourselves. And by then it's often too late to do much about it.

My Biggest Regret of 2022

So what was my biggest regret this year?

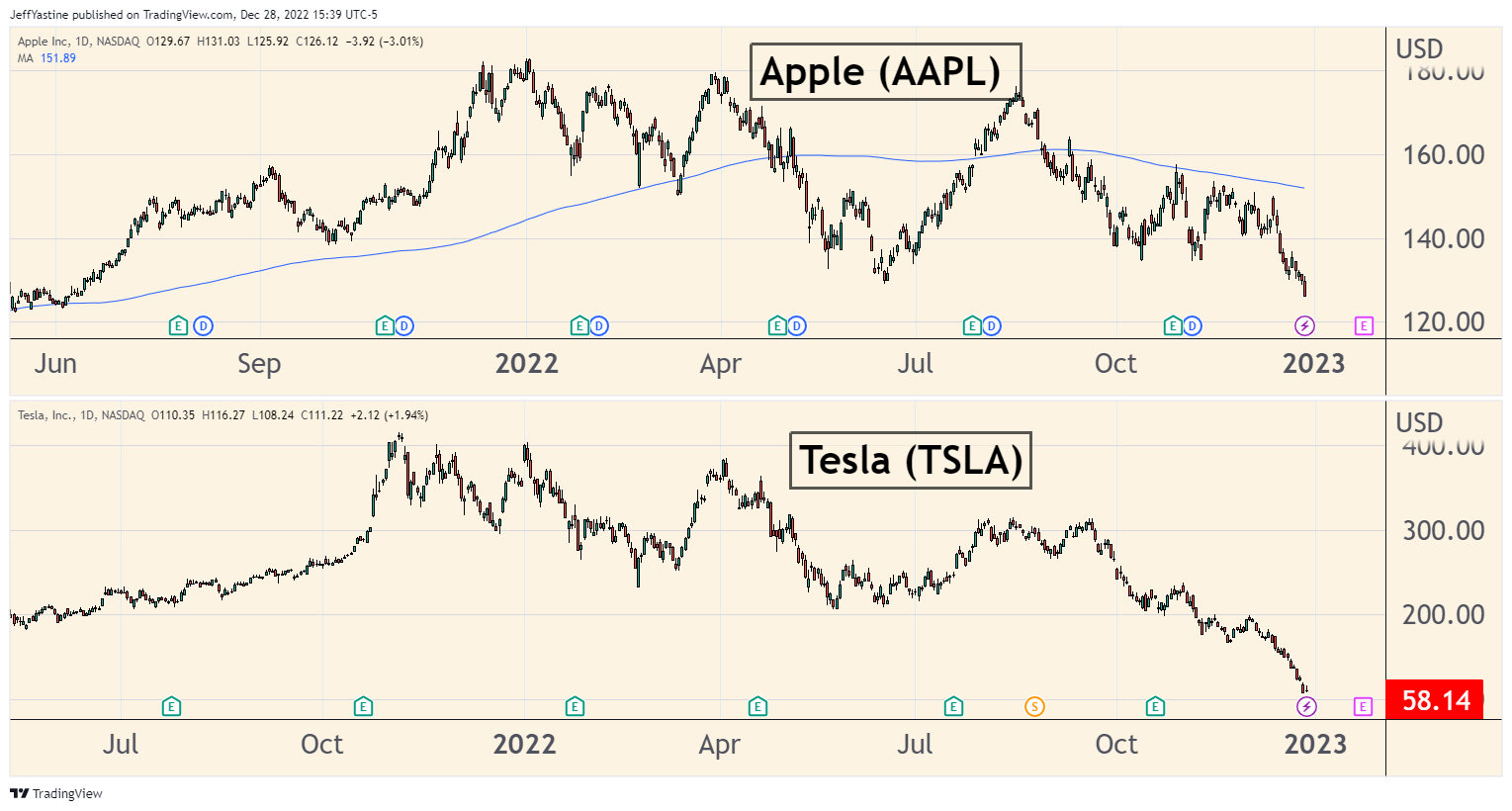

In late August, I began shorting shares of Apple (AAPL) and Tesla (TSLA), anticipating that both stocks were about to move lower in a big way. From a broader perspective, I couldn't have been more right.

The persistent weakness in both stocks is why the S&P 500 and Nasdaq are having such a terrible time here at the end of the year.

My mistake was in not being patient with either trade though. I cashed in both stocks far too early. I wound up with a decent gain from the Apple short sale (offset by a small loss in the Tesla short).

The lesson we can all learn from this is summed up in an old Wall Street saying...

For successful trading, it's not the buying that counts. It's the sitting.

In other words...sitting on one's hands, doing nothing. I try to practice that philosophy with my stock purchases. Clearly it works with short selling too. But in this particular case, I didn't practice what I preach.

To give you some idea why the "sitting" is so important... Had I "sat" on both AAPL and TSLA shorts through this week, the goodBUYs portfolio would be up around 2% for the year just on the success of those 2 trades.

And yes, I could have put on even my short sales on additional stocks and likely done even better. But I know myself well enough to know where I'm most comfortable - investing and trading from the "long" end of things, aiming to buy low and sell high.

I try to stick to what I know best, even if it means foregoing opportunities to make money as stocks fall further in the bear market. The current grind with lower and lower prices won't last forever.

I'm up to my gills in cash. When the stock market finally turns higher (likely from prices a fair degree lower than we are right now), I'll be right there putting that money to work, in order to fulfill my goal of once again beating the market in 2023.

Have a great (and safe) New Year!

Jeff Yastine

..

Member discussion