Market Update: Here We Go Again?

Just a brief note as we close out the week...

Here we are again on a Friday afternoon with the major indexes drip, drip, dripping lower.

Keep in mind, there's a 3-day holiday weekend ahead of us with MLK Day.

So the default mode for traders is to go ahead and sell, just in case something crazy happens while the markets are closed.

Post-holiday, if things keep going in this direction, my guess is that the major indexes are all likely aiming for a break below their 200 day moving averages - about 3-5% below current prices - before (in my opinion) we have enough fear and worry to have another shot at a tradeable bottom and decent rebound.

I say all that so you know where the potential "maximum pain point" is and choose to prepare accordingly. For me, it means raising cash by taking profits on some short-term positions and closing out others for small losses.

It always sounds weird to state this, but those 2 emotions - fear and greed, in large enough quantities among investors - are what create market bottoms.

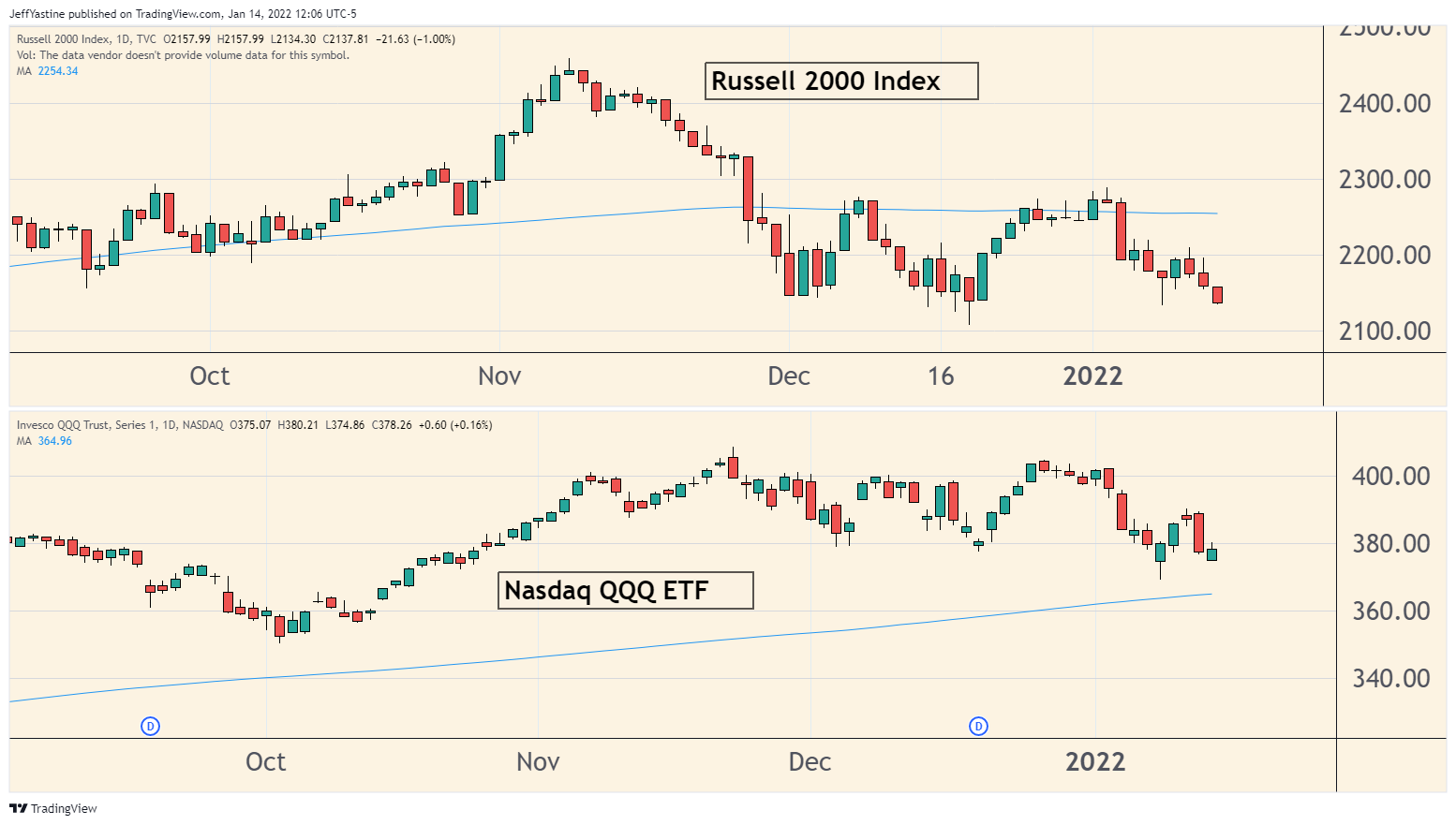

For example, the Russell 2000 small cap index has been trading below its 200 dma for the better part of 2 weeks already. But the Nasdaq 100, representing the biggest, best-performing tech stocks, is still about 4% above the same indicator:

So this is just my way of saying, "be careful out there."

We'll see better market environments ahead. But the important part, as I keep saying, is to survive the harsh ones with your portfolio and confidence intact.

Have a great MLK holiday!

Jeff Yastine

.

Member discussion