Market Stinks; But We're Up +70% on This Stock

Well, thinking about my weekend post, all I can say to myself (and you) is...

So much for the 'power of seasonality.'

Wrong, wrong, wrong. The market couldn't even keep itself together at a higher altitude in anticipation of next week when we'll hear about...

- Inflation trends (via the November CPI report, due on Tuesday, December 13th)

- Interest rates (via the Federal Reserve's next meeting, December 13-14).

So let's assume (once again) that the market is sending us a warning message.

I've been whipsawed before on these things. But the right move all through this bear market has been - in the absence of any other information - to trim up positions to avoid the potential of larger losses.

I've trimmed up some of my own personal portfolios with that in mind. However unlikely it might seem, there's always the chance that the last 2 days is just the opening salvo in a more extended market decline over coming days, weeks or months.

We have to respect that possibility.

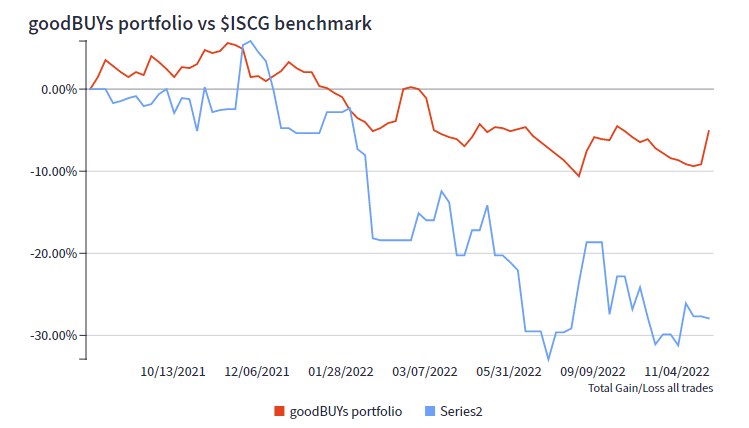

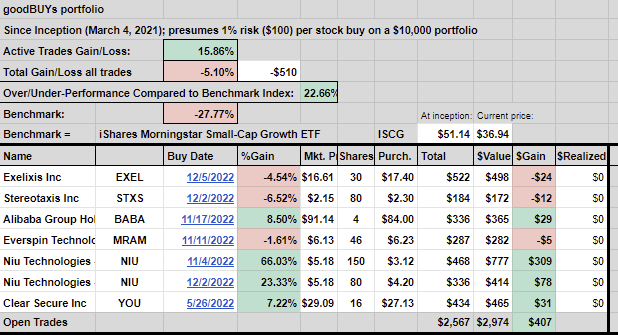

That said, the goodBUYs portfolio is doing pretty well. Most of that is thanks to a massive run in the China-based scooter manufacturer Niu Technologies (NIU), where we're up roughly 70%. Alibaba (BABA) shares have also been resilient; that stock is up around 9% for us:

While the temptation is strong to take profits on NIU - especially if US stocks keep heading south in coming days, I think the better play is to stand aside.

Let's give the shares some room to run. If the stock rolls over and heads south in a hurry, the portfolio would only suffer a small loss. But in the possibility that NIU shares keep making their way higher in coming days or weeks, well...the gains could be much larger still. The rewards vs the risks are good.

The rest of the portfolio is a mixed bag. The position in Clear Secure (YOU) now has just a 7% gain after taking it on the chin yesterday and today, dropping about 12% from last week's highs.

But it tends to be a volatile stock anyway, and it's shown nice strength in that it hasn't actually touched a new low since June. So I'm willing to give it room to get bumped around by the broader market.

Another interesting aspect of Clear Secure...the company is generating enough cash that it actually paid out a special $0.25 a share dividend to shareholders. That's always a nice sign to see.

The new positions added last Friday (Stereotaxis (STXS)) and Monday (Exelixis (EXEL)) have been weakening. Obviously, if those continue to head south in coming days, I'll have to move them out of the portfolio to avoid the potential for deeper losses.

I guess my main message is that the market is like navigating a set of whitewater rapids right now. We have to keep our eyes out in front, looking for the big rocks.

But as always, if we can avoid 'tipping the canoe' (i.e. big portfolio losses) we'll continue to be in a very favorable position. I think the goodBUYs portfolio is a real-life example of that strategy.

Just like putting a position into NIU Technologies over the past month appears to be yielding some very favorable results, we'll likewise be in a great position to take other risks where the potential rewards are well worth it.

Jeff

Member discussion