Market Update: The Power of Seasonality

Friday was a great example of the confounding (and resilient) power of stock market seasonality...-

The new US Employment Report for November showed that the economy added 263,000 jobs - far above expectations. Average hourly earnings rose by 0.6% on a month-over-month basis - roughly double economists' expectations.

On the face of things, that's bad news if you're the Federal Reserve - or an investor hoping for a halt to the Fed's policy this year of raising interest rates.

A few months ago, that news would have tanked the market.

But thanks to seasonality - in this case, the tendency for stocks to do up during the late October-November-December time frame - the major indexes on Friday morning suffered a large but temporary 2% selloff and slowly erased most of those losses to finish out the week.

If you'll notice in the first chart above, the S&P 500 index last week pulled itself perched above an important technical support level...the 200 day moving average. It's the first time in 7 months the index has attained that status.

Meanwhile, the Nasdaq Composite Index (and likewise, the Nasdaq 100 (QQQ)) is still below its 200 day moving average. My bet is that - once again thanks to seasonality tendencies - tech stocks will continue to work their way higher towards that level over the next 2 weeks, let's say to the point of the next Federal Reserve meeting on December 13-14.

At this point, I have low expectations of much beyond that point.

My belief is that whatever rally emerges from the Fed meeting...pro investors will use it as an opportunity to "sell into strength" (in other words, sell while lots of newly-emboldened regular investors are eagerly buying) and move to the sidelines until January.

Why is any of this important? What's the big picture?

Mainly it's to show you a potential roadmap, and an attempt to demystify why markets go up or down in ways designed to confuse the maximum number of people.

Lastly, I just want to point out that there are still plenty of stocks out there that are starting to perk up.

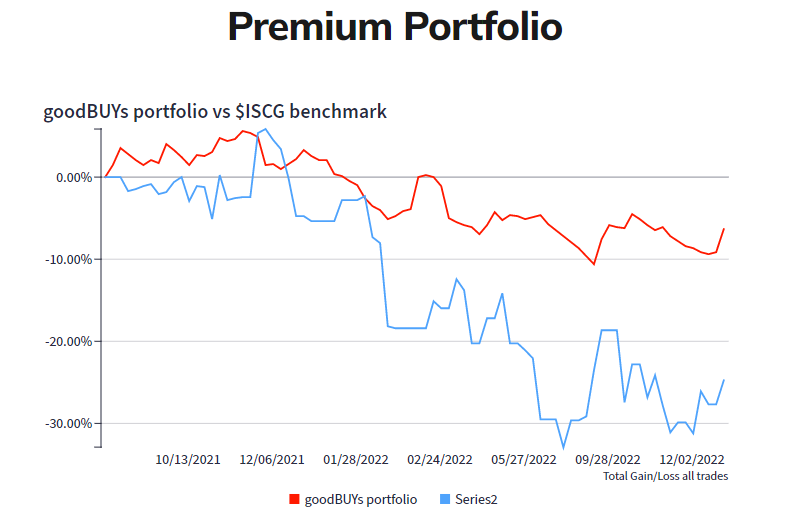

I've been methodically recommending new ideas in the goodBUYs portfolio:

The goal from the beginning has been to sidestep as much of the bear market as possible while positioning ourselves for renewed gains in forthcoming rallies. By cutting losses quickly, we've been able to keep losses to a minimum.

I'll continue to put new ideas into play for as long as we stocks line up, ready for takeoff. After that, I'll keep monitoring them as we see which wind up as small losses to cut quickly, while giving the rest plenty of room to run higher.

Jeff Yastine

Member discussion