Amazon "Then & Now": Lessons from the 2000 Bear Market Collapse

I hope you're having a great weekend!

Last week was a rough one for me. My stocks all did well enough as the market moved inched higher. That was nice to see. But I was up in Atlanta watching my son pitch in a national baseball tournament.

As a 15-year-old, he did pretty well pitching to mainly 16-year-old hitters. He started 2 games, going 4 innings in each and allowing only a handful of earned runs.

His team, however, had its own baseball "bear market" - they lost every single game. They went 0-and-7 in the tourney.

What's the old saying that "What doesn't kill us...makes us stronger"?

In that case, we should all have super-human strength as stock market investors.

Dotcom Collapse & Amazon

With that in mind, I thought the following email asked a great question - great, because it brings up a point that's overlooked by 99% of all investors.

Here's the email:

Dear Jeff,

I like reading your Sunday weekly market notes. But in a bear market, don't all stocks head lower?

So why bother having a premium portfolio, and continuing to look for "good" individual stocks to own since they're going to drop in value like everything else?

Bob J.

Bob, here's my motivation on why I joyfully continue to look for great stocks for premium subscribers - and will continue to make judicious bets on them (cutting them quickly if they decline, letting them run higher if they don't) - even in the midst of a bear market.

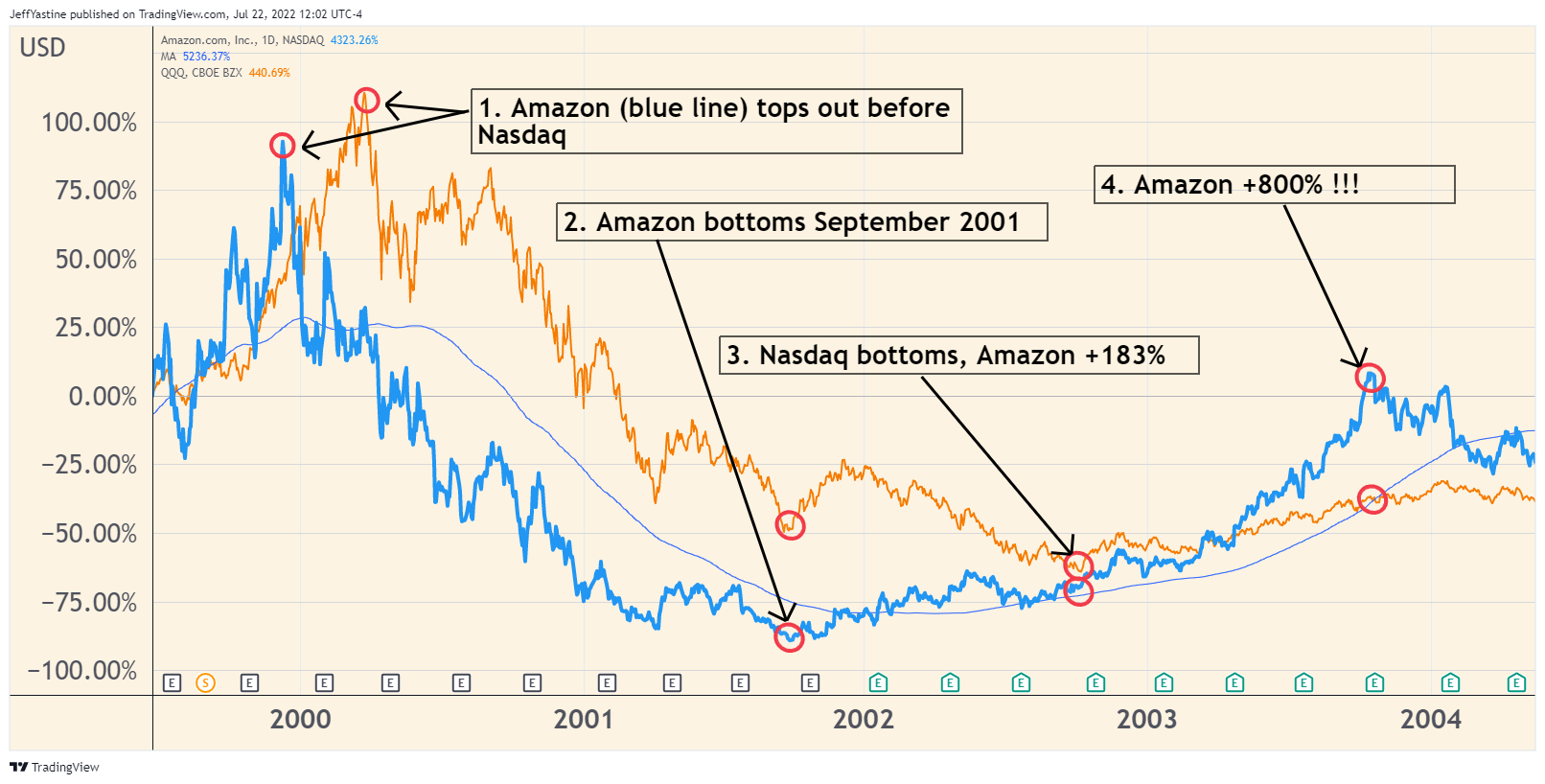

The chart below is from the 2000-2003 bear market, comparing when Amazon (AMZN) bottomed, versus the main Nasdaq-100 (QQQ) index:

The main point - if we look at #2 and #3 above - is that Amazon bottomed nearly a full year before the tech index.

Think about that for a moment. By the time the Nasdaq put in its final bear market low, Amazon's shares had nearly tripled in value (+183%)!

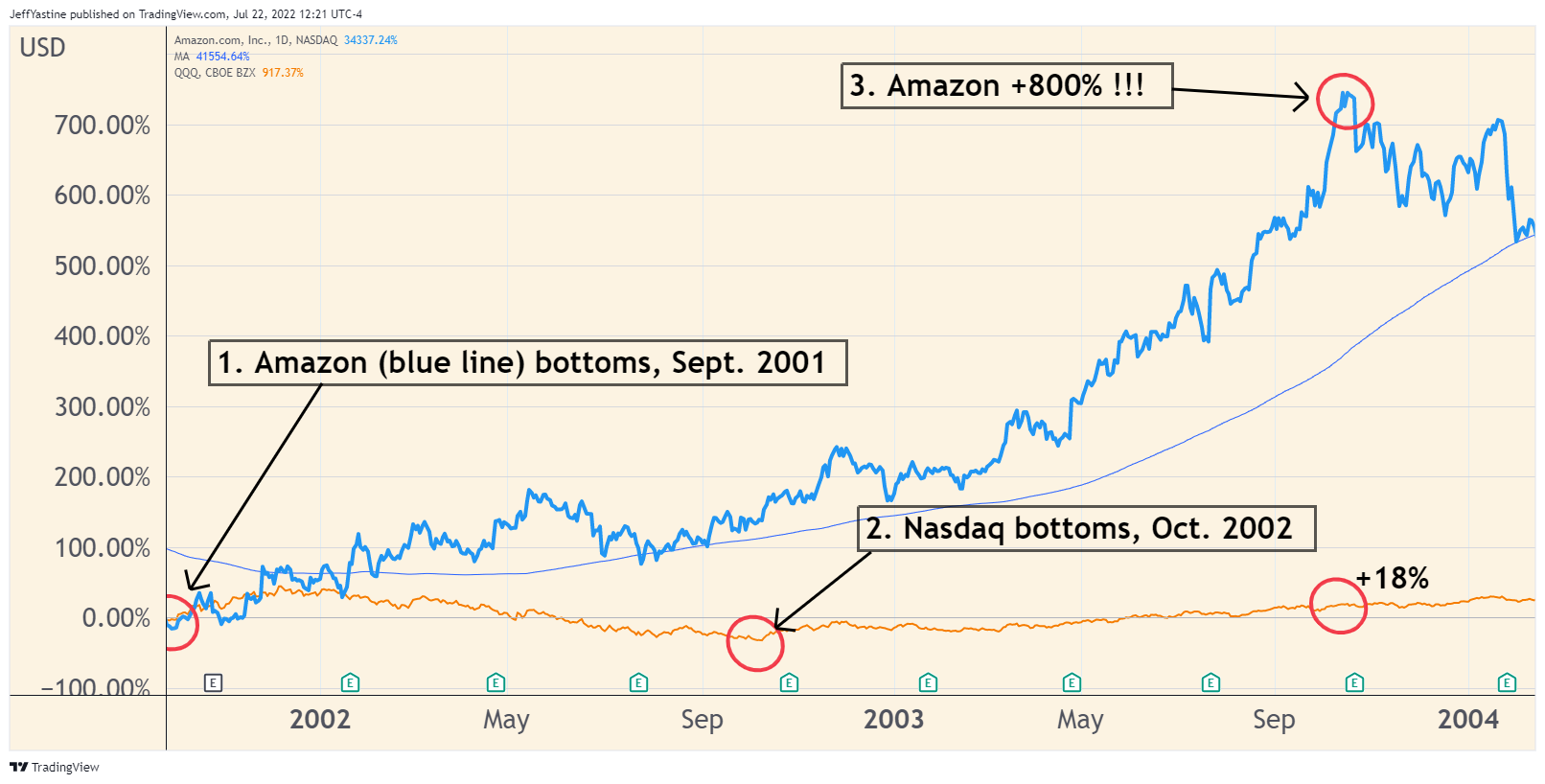

The next chart shows us the same thing, but starts the percentage comparison from the point when Amazon bottomed in 2001 through 2004, long after the Nasdaq bear market had clearly ended.

The point being...isn't the rewarding chance of an 800% potential gain, worth the equal chance of risking a 20% or 30% decline if the stock keeps falling in the midst of a bear market?

Remember that I said I want to make judicious bets on promising stock ideas. If we bet large chunks of our portfolio on any one single stock idea - it's a recipe for disaster. But if we're willing to risk small 1% portions (I show premium subscribers how to do the calculation in every recommendation), you can be wrong a bunch of times in a row - and still come out a winner.

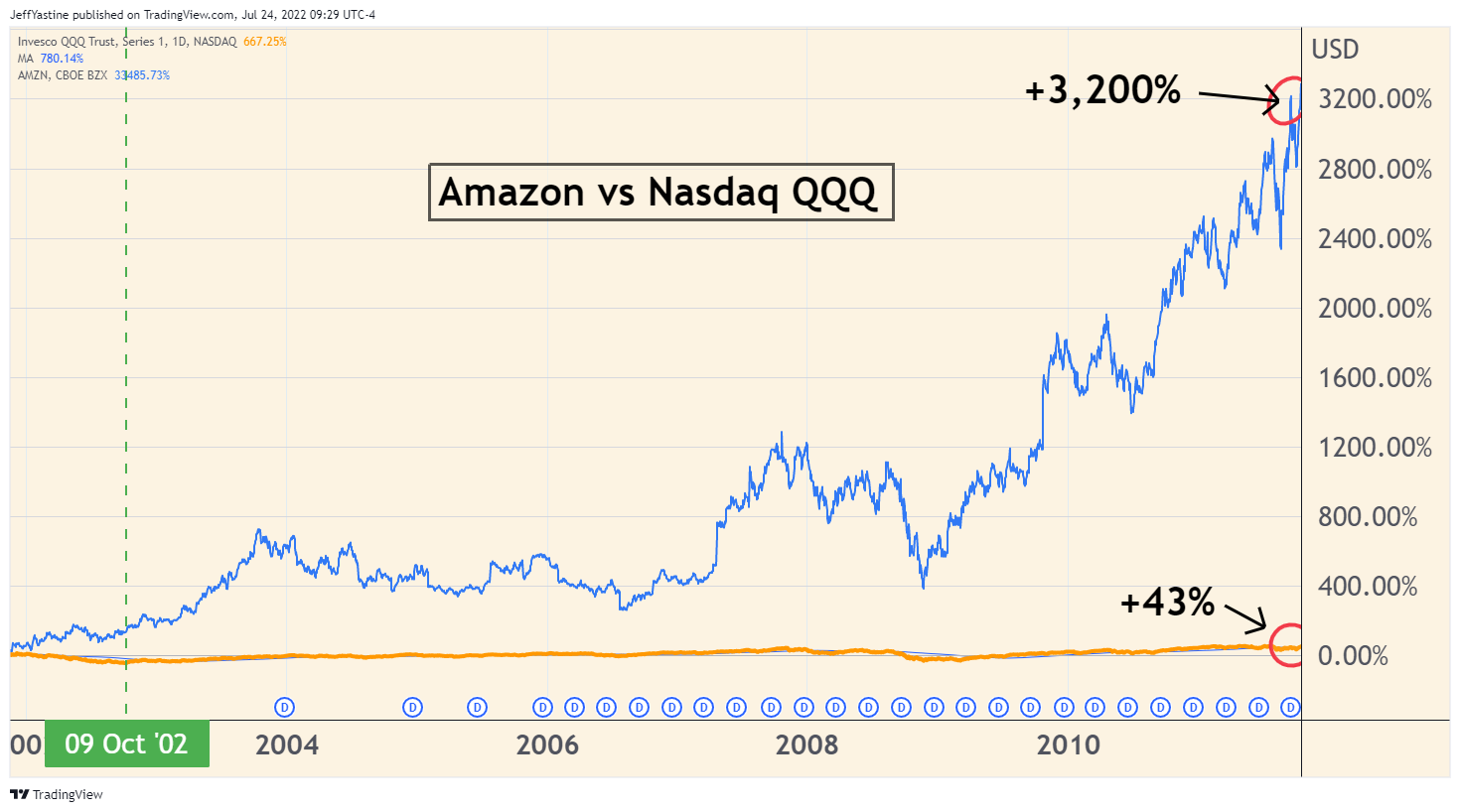

From an even longer time perspective, the payoff from taking a chance and buying Amazon amid the dot-com bear market was even bigger over the next decade:

Psychologically, it would have been tough buying a stock like Amazon in 2001 or 2002 (I can't say I was one of them - I was too inexperienced myself back then to know better).

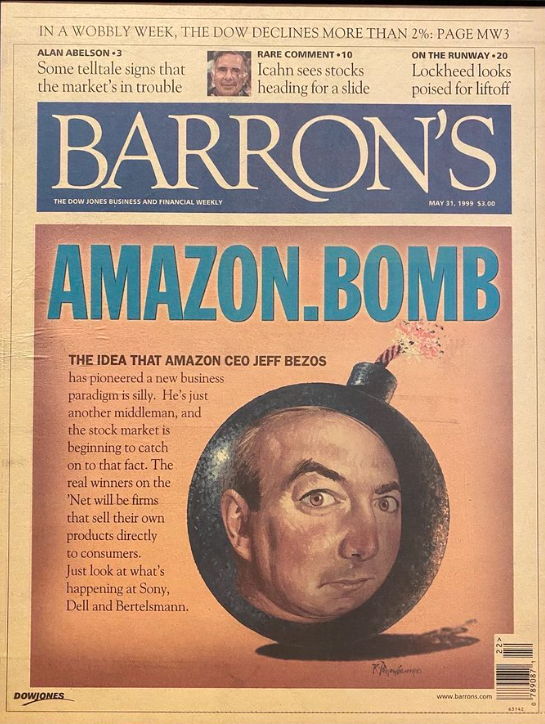

After all, Amazon had fallen more than 90% from its 1999 highs, amid high-profile negative cover stories like this famous one, from Barron's in May 1999:

Am I "cherry-picking" here?

Yes. Absolutely. Amid thousands of stocks that were around during the 2000-2003 era, I'm choosing likely the best-performing stock of them all to show "what if" - what if someone had bought then when everyone else was selling?

There was no way to know with absolute certainty that Amazon during that bear market era would go on to become the dominant Amazon we know today.

But there were clues that Amazon was turning the corner, and that "dot-bomb" skeptics were probably wrong.

For example...

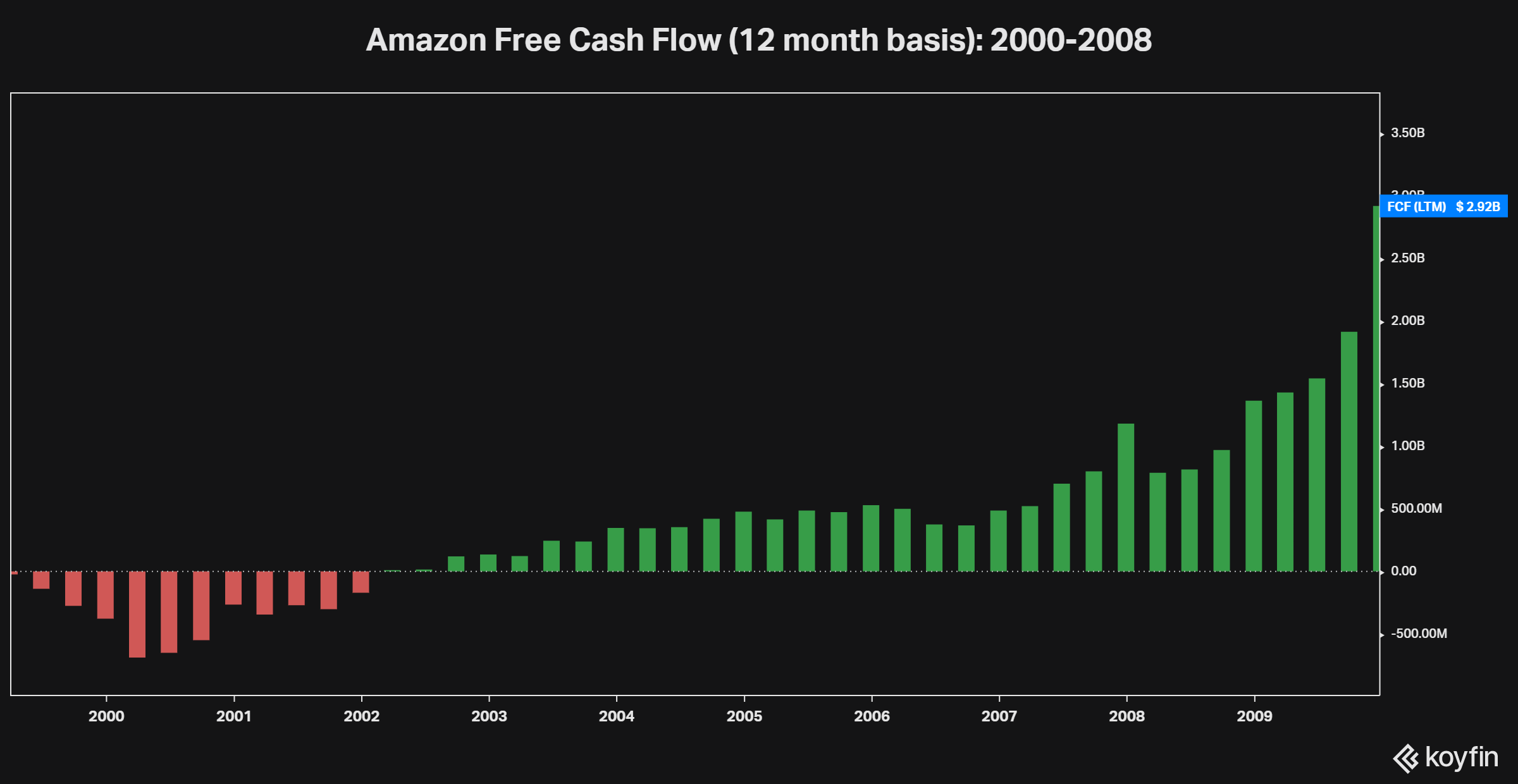

- Q4 2000: First-ever quarterly positive free cash flow (an important milestone for any company)

- Q4 2001: First quarterly profit

- Q2 2002: First-ever 12-month period of free cash flow

- 2003: First annual profit

In other words, Amazon was on what I like to call a "path to profitability."

That's what I look for in every stock that goes into the goodBUYs Premium Portfolio.

In my view, it doesn't really matter whether a stock is currently a money-earner or a money-loser. What matters is the trend.

What direction are its business operations heading? If they appear to be improving, the stock is worth at least a second look. Maybe we buy it next week, or it could be next month or next year. But those are the stocks we want to pay attention to.

Yes, in the midst of a bear market, good growth stocks tend to go down like everything else. But at some point, they get hammered so low that smart investors - looking ahead and following a company's path to profitability - realize that the potential rewards start to outweigh the risks.

And so they begin buying the stock.

They don't really know if the company is going to be "the next Amazon" that soars in the midst of a bear market - or sinks like a rock with the rest of the bear market.

But considering what Amazon did in the 2000-2003 bear market, I believe the risks (once again if judiciously taken) are well worth the potential rewards.

Jeff

Member discussion