How to Navigate the Market's "Summer Drift"

[NOTE: To premium subscribers, I'm traveling this weekend so there will be no Sunday update. There's a new trading action related to the goodBUYs portfolio below].

My trader's mindset has me wishfully asking "Can we just fast-forward past July and August, and cue up September, please?"

I mean, the dogdays of summer are upon us. Drifting on a "lazy river" innertube, or on a float at the beach...that's relaxing.

But when the markets decide to drift?

The good outcome is an unexpected, countertrend rally (my unfulfilled expectation in recent weeks) that takes us up through the highs of late June, between now and Labor Day. Such rallies - however long-lasting or not - keep bearish-leaning traders from getting too confident.

Conditions are ripe for one to happen, amid general public bearishness and slow, late summer trading conditions.

But we have to respect the potential "bad" outcome, too.

At these levels - with the S&P 500 down 21% and Nasdaq off nearly 30% - a market adrift is like being on an innertube off Amityville Beach (you know, the fictional town in Jaws) waiting for "Bruce" (Steven Spielberg's mechanical shark) to swim in for a bite.

In short, the more the markets drift without a significant counter-trend rally , the more the odds grow that a bigger decline is awaiting us.

To put it clearly, I'm still hopeful for that counter-trend late-summer rally.

But I also know, from experience, feeling the same way in other late-summer drifting periods, such as 2000-2002, and especially 2008. And then watching something like this happen:

My point is not to scare anyone. In the markets, usually the worst things we can think of...don't happen.

But we're talking probabilities here. I live near the ocean. A hurricane hasn't scored a direct hit on my little corner of the Florida coast in many decades. But there's always that chance, and it would be foolish of me to dismiss it from happening.

Follow the Bellwethers

For now, I continue to watch certain groups of stocks for clues.

For example, banks like Citigroup (C) and Wells Fargo (WFC) are starting to report their latest quarterly results. The numbers themselves don't mean much - but the reaction (or lack of it) from investors is the valuable part of this exercise.

Financial stocks, as noted in this SPDR Banking Sector ETF (XLF) chart, have pasted a series of "lower highs" since the beginning of this year - a bearish omen. If this ETF were to make a new near-term high (the green dotted line on the chart below)...that would be a good thing, and perhaps an indication that demand for loans - and by proxy the economy and the market itself - is starting to round the corner:

Last weekend, I also noted that retail stocks like Amazon (AMZN) and Target (TGT) are also worth keeping an eye on.

With their stores and warehouses swollen with excess inventories, the stocks look primed to fall sharply. But, if they could manage a decent-sized rally to new near-term highs...again, that would be something positive:

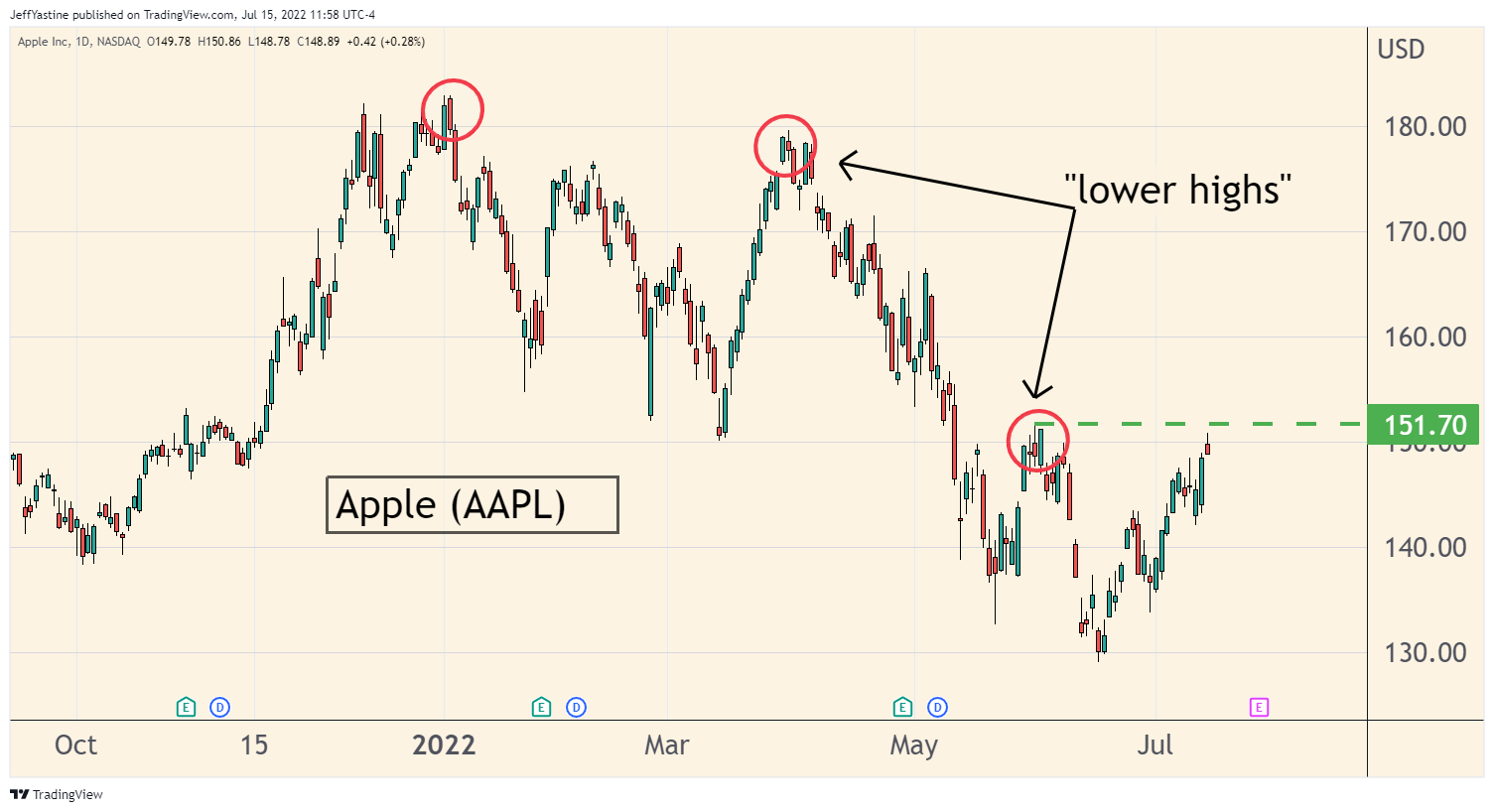

And then there's the granddaddy bellwether stock of them all - Apple (AAPL). As many fans as Apple has, on and off Wall Street...its shares have also had a hard time making a "higher high" in the last 6 months.

If it manages to do so in coming days, it would be sending a message that perhaps things aren't quite as bad in the economy, or the markets, as many might imagine.

The main point here is that this is by no means a decided contest. I've seen too many markets where the CNBC and Wall Street pundits were hugely bearish - and the market went up on a multi-week or multi-month rally - and vice-versa.

It's just the way the markets work.