Why is the Market Rising?

I'll tell you a quick little story...

I waved to one of my neighbors on July 4 as our cars approached on the street. We both rolled down our windows to say a quick hello - and knowing my interest in the stock market - he half-jokingly yelled "Sell it all!" as his Range Rover went by.

I won't claim to base a contrarian bullish thesis on a singly neighborly anecdote - but it is the kind of thing you typically see when the market is primed for a rally of some kind.

Is it "the" market bottom? Probably not.

But are we experiencing "a" bottom that gives us a tradeable rally of 8-10% for a handful of weeks? Say, through Labor Day weekend (September 5th)?

At the risk of embarrassing myself, I'll lean way out on my toothpick-diameter tree limb and say "yes."

Hold that thought while I note what's going on with the market lately, and why last week's rally could go a bit further and longer than many think.

So Bad It's Good

I certainly had my doubts as last week started, and was almost hoping the indices would go down as we began the third quarter in earnest - to get more of the bad stuff out of the way sooner rather than later.

Yet, as I pointed out in a midweek update to premium subscribers, the market did the opposite - and we should sit up and pay attention when that happens.

But exactly why would the market move higher last week (+10% since mid-June)?

Try to follow the logic - which makes sense in the weird anticipatory way things tend to work when it comes to stocks...

- Key commodity prices fell sharply, reflecting concerns about a looming downturn. Since early June, oil fell 20%; copper prices dropped 25%.

- Everyone but the Fed (meaning everyone on Wall Street and CNBC) seems to think that a US economic recession is now almost a certainty.

- Historically speaking, the US stock market tends to anticipate (i.e. move lower) recessions by an average of 6 to 7 months.

- When monthly economic data confirm a recession (or nearly so), the Federal Reserve will have no choice but to abandon its inflation-oriented "rising rates" policy and start cutting rates, perhaps in 2023.

- If the Fed starts cutting rates in 2023, buy the best stocks now while they are still cheap because the market itself may not get much cheaper.

Yes, with all that in mind, there are many reasons why the stock market still may have some pain ahead of it and could move to new lows.

Analysts' earnings estimates for many S&P 500 and Nasdaq companies are probably still too optimistic. If analysts are going to lower those quarterly profit estimates, then the share prices of many consumer-oriented firms are probably too high and need to move lower as well, in order to reflect a more dour economic landscape.

But going to the idea of a late summer rally, let's keep in mind that according to market historians, the S&P 500 had its worst 6-month start since 1970.

So perhaps expecting more of the same - a steady predictable path lower - for another 3 months might be pushing our luck.

The "Labor Day Effect"

So why else - besides the possibility of a recession next year and eventual Fed rate cuts - send stocks higher?

I call it "the Labor Day Effect."

It doesn't happen every year, by any means. But the market seems to have a propensity for floating higher - when we least expect - in the summer dog days of June, July and August, often right up to Labor Day weekend.

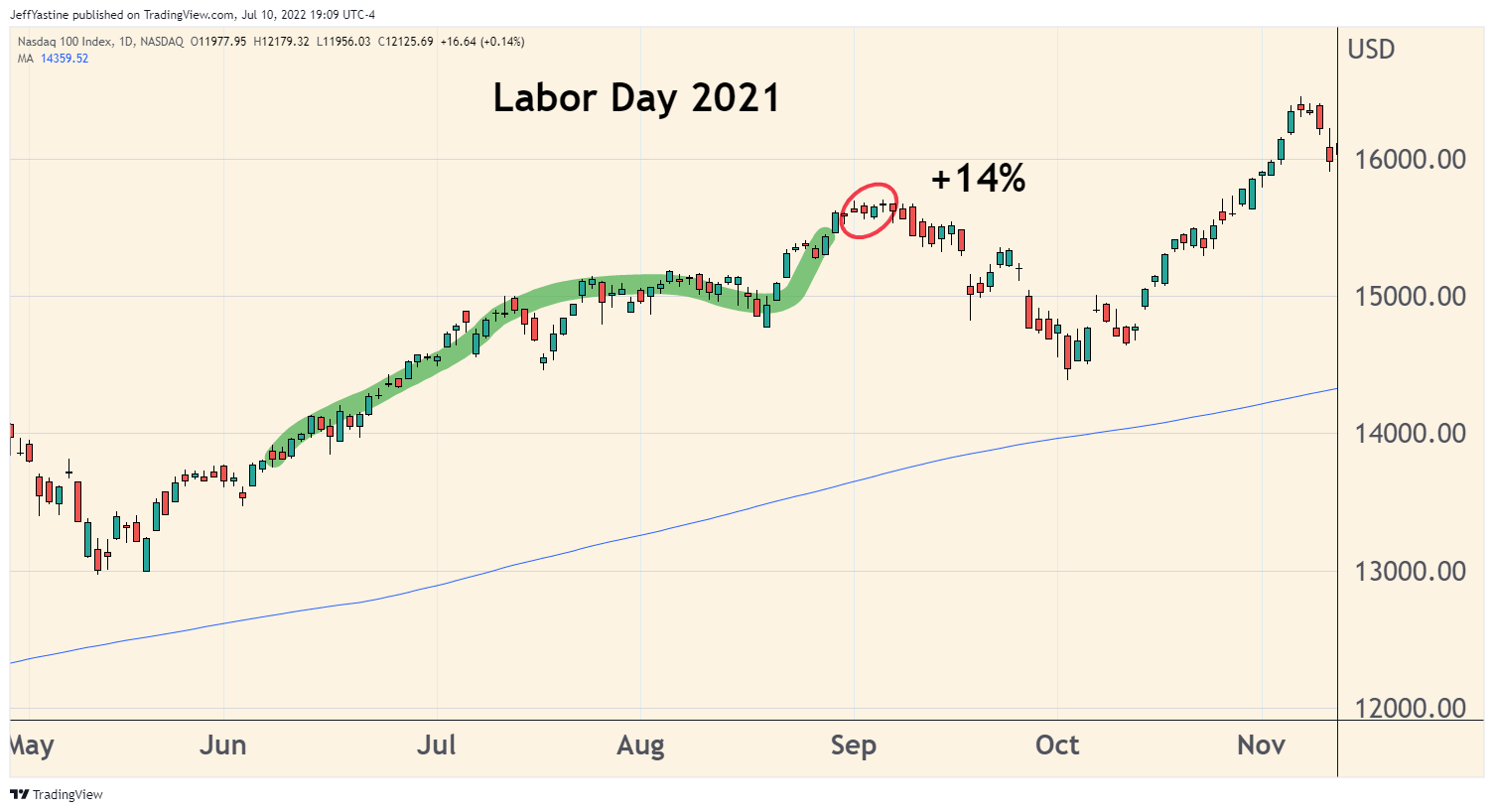

For example, in 2020 and 2021 the Nasdaq 100 (QQQ) index rose by double-digit percentage amounts into the Labor Day period:

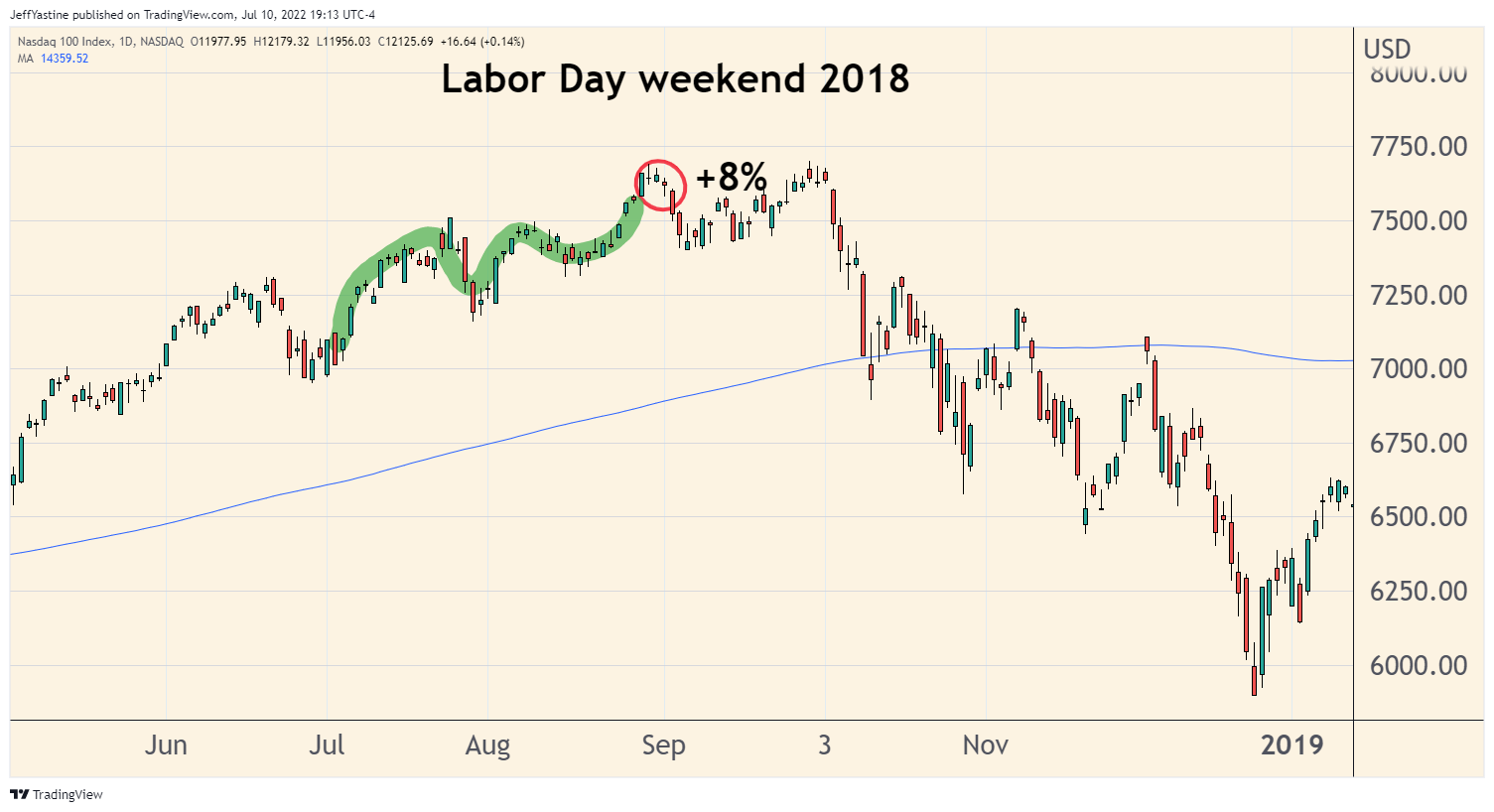

It happened in the same period in 2018, despite growing evidence of an economic slowdown - which is why after Labor Day that year, the major indexes fell 23% into the December holiday period.

Or perhaps an even more chilling example is in 2000, when the Nasdaq fell sharply between March and April - yet managed to grind its way higher into Labor Day weekend that year, before the real collapse began.

My point is - there's a potential rally ahead, and with it - an opportunity to make some money.

I don't know for sure that it's going to happen - the whole market could roll over next week, for all I know.

But my point is, if the market worms its way higher - in spite of all the strikes against it - don't be surprised, or too bearish.

It could be the Labor Day Effect playing itself out yet again, confounding bulls and bears alike, as stock markets tend to do anyway.

Jeff

Member discussion