The Truth about Market Tops

I learned my lesson years ago... "tops" in the stock market have a way of sneaking up on us. That's what I want to remind you about today, with four points. Here's the first three:

- No one wants the good times to end.

- No one wants to look potentially foolish.

- We all like to "go with the flow."

Try going to a party and say "I think the stock market might be in trouble" to someone - you'll find yourself drinking alone real fast.

Wall Street is no help either. You know all those highly-paid "market strategists" you see on Bloomberg and CNBC? My same 3 points listed above apply to them as well.

I remember when I was a business news reporter for PBS Nightly Business Report. It was the year 2000, and the great dot-com bubble had burst. We had a market strategist (who shall remain nameless) on the program who insisted that the Nasdaq's sharp decline was a mere blip, a pullback.

"Really, folks," he told our audience, "there's nothing to worry about."

Just like now, there were a lot of market strategists spouting that kind of nonsense back then:

Wall Street is always bullish at true market tops. For regular investors, that's bad - because it robs us from receiving much-needed negative feedback to challenge our bullish outlooks. And then there's the last of my four points...

- Bear market signals don't flash "red" until it's too late.

In other words, if we wait until the news headlines are shouting the equivalent of "Holy cow! It's a bear market!!"...the damage is already done to the market and your portfolio.

Weakness Continues

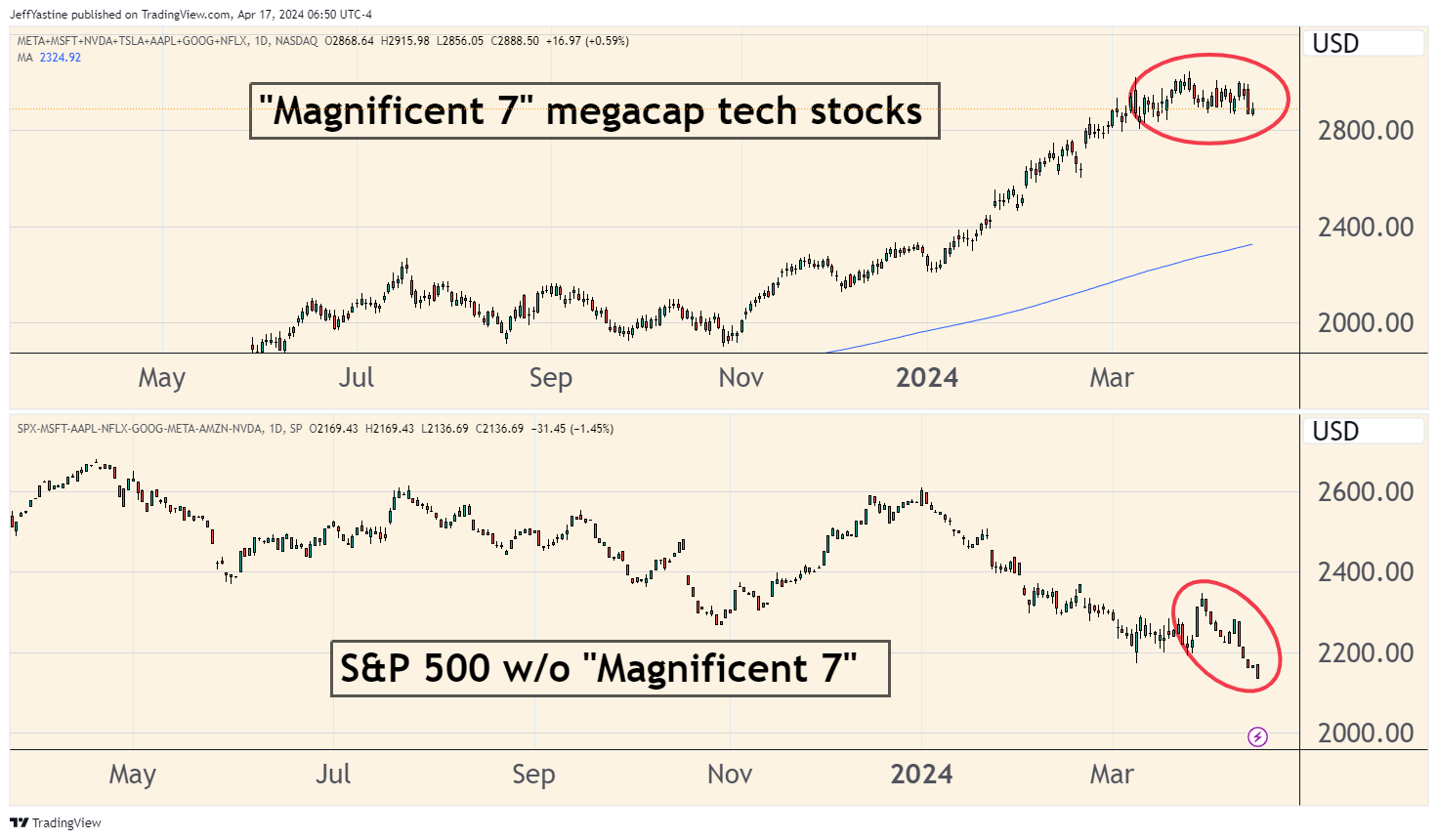

For example, we've all read about the earnings growth of the "Magnificent 7" tech stocks in the S&P 500. The big line from bullish investors is that AI stocks are the new big thing, and the bull market is only just beginning.

Those big companies' shares are starting to look rather iffy lately. But if we remove those 7 stocks from the S&P 500 - the index's chart looks much worse, with no improvement in past weeks:

My point here is...don't buy the talk that this is just a "pullback." If it were, the stocks on the bottom-half of the chart above would not be continuing their steady months-long decline.

The charts, in other words, are hinting that there are serious problems with the market (and while not evident yet, likely the economy as well). But the strength of certain stocks, driven by the AI bubble, is masking that weakness.

Don't believe me? Here's one more chart to rock your world.

Small-cap Weakness

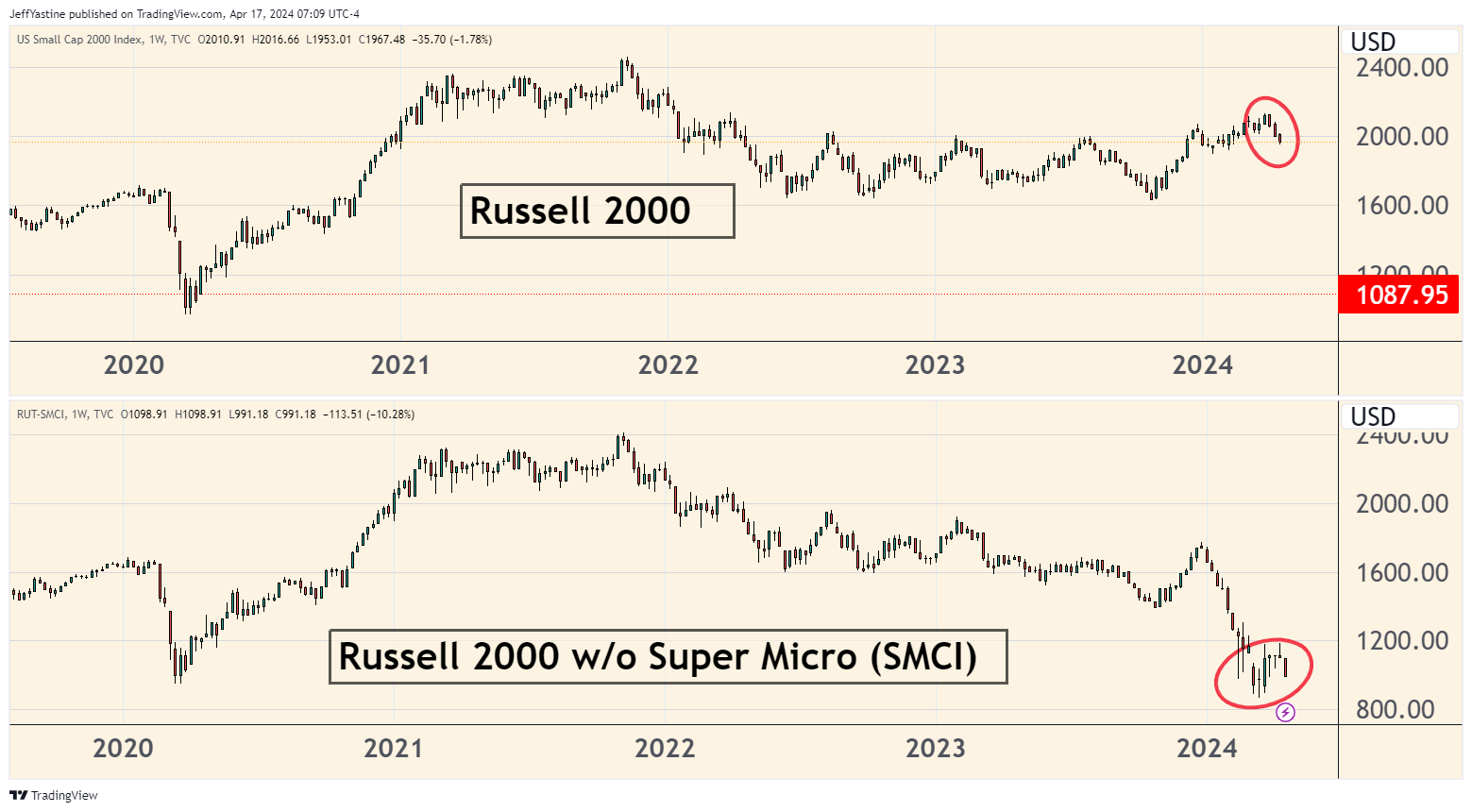

Unlike the S&P 500 and Nasdaq indexes, small-cap stocks are already in heaps of trouble. The Russell 2000 small-cap index participated somewhat in the rally of recent months - but it's still far below its all-time highs.

And if we remove the strength of just one stock - an AI-related computer seller called Super Micro (SMCI) - the Russell 2000 index looks not just bad, but plain ol' horrible:

In other words, instead of the Russell 2000 being down around 2% for the year right now...it would be down nearly 50%.

Again, the point is...there's lots of weakness out there, masked by the strength of a handful of stocks amid the craze for AI stocks. If the economy is as resilient and strong as many claim...why aren't more stocks doing well, or at least holding their own?

That's not a recipe for a good stock market.

Jeff Yastine

Member discussion