Weekend Update

I hope you had a great holiday weekend.

I wish we could say the same about the stock market - the S&P and Nasdaq futures are down another 1.7% to 2.3% tonight, so the opening bell tomorrow may not be pretty.

Silver Lining in the Market Clouds?

If you notice the 2 charts above - both the S&P and Nasdaq futures indexes are now trading down to the half-way point (the blue dotted line) in a narrow downtrend channel since the start of the year.

From a technical standpoint, if we were going to see a reversal tomorrow morning (which in the case doesn't have to be a big rebound, just stocks trading sideways and not going down for a handful of days) this would be the place on the charts where the stock indexes might make a stand.

The stock market needed a good, vigorous correction since last year's frothiness - and we may have now gotten it.

The S&P 500 will likely open for trading tomorrow with news headlines talking about being down 10% for the year already, and the Nasdaq down 17% for the year.

Sounds bad, right?

So as crazy as this sounds, it wouldn't surprise me to see tomorrow morning potentially be the bottom for this correction.

I say that less as a prediction, and more of a warning to not to get too negative about the news headlines.

Ukraine-Russia, Oil Prices & the Federal Reserve

When I was a young investor, I would spend untold hours trying to anticipate the meaning and impact of these kinds of events on the stock market. But eventually I realized it was a fruitless task - one not worth a lot of time and effort.

Mainly, I realized that, as stocks go down for whatever reason(s), the worst of the news gets "discounted" into stock prices.

This is how most investors get "wrongfooted" and frustrated about the stock market.

At the very moment we consign ourselves to the worst, sell all our stocks and "go to cash" - the stock market stops rewarding that kind of behavior and starts creeping upward.

As the great trader Sir John Templeton was fond of saying, there's always a point of maximum pessimism.

Our job as traders and investors is look for those potential points and - while recognizing that we'll never be 100% certain - we don't have to be right that many times to make a career's worth of successful trading and investing.

Portfolio Review

Overall, I couldn't be happier about the performance of the portfolio.

Yes, we're losing some ground as the market erodes. But because we had some big winners last year, and made sure to cut our losses quickly when things headed south recently - we're at breakeven levels (or -.013% to be exact) since inception (March 4, 2021), while my benchmark - small-cap growth stocks - is down 16% over the same time period.

I won't bother going into the whole portfolio this week. As we've seen in prior weeks, at this point much of the movement of our positions depends on whether the market decides to rise or fall in general.

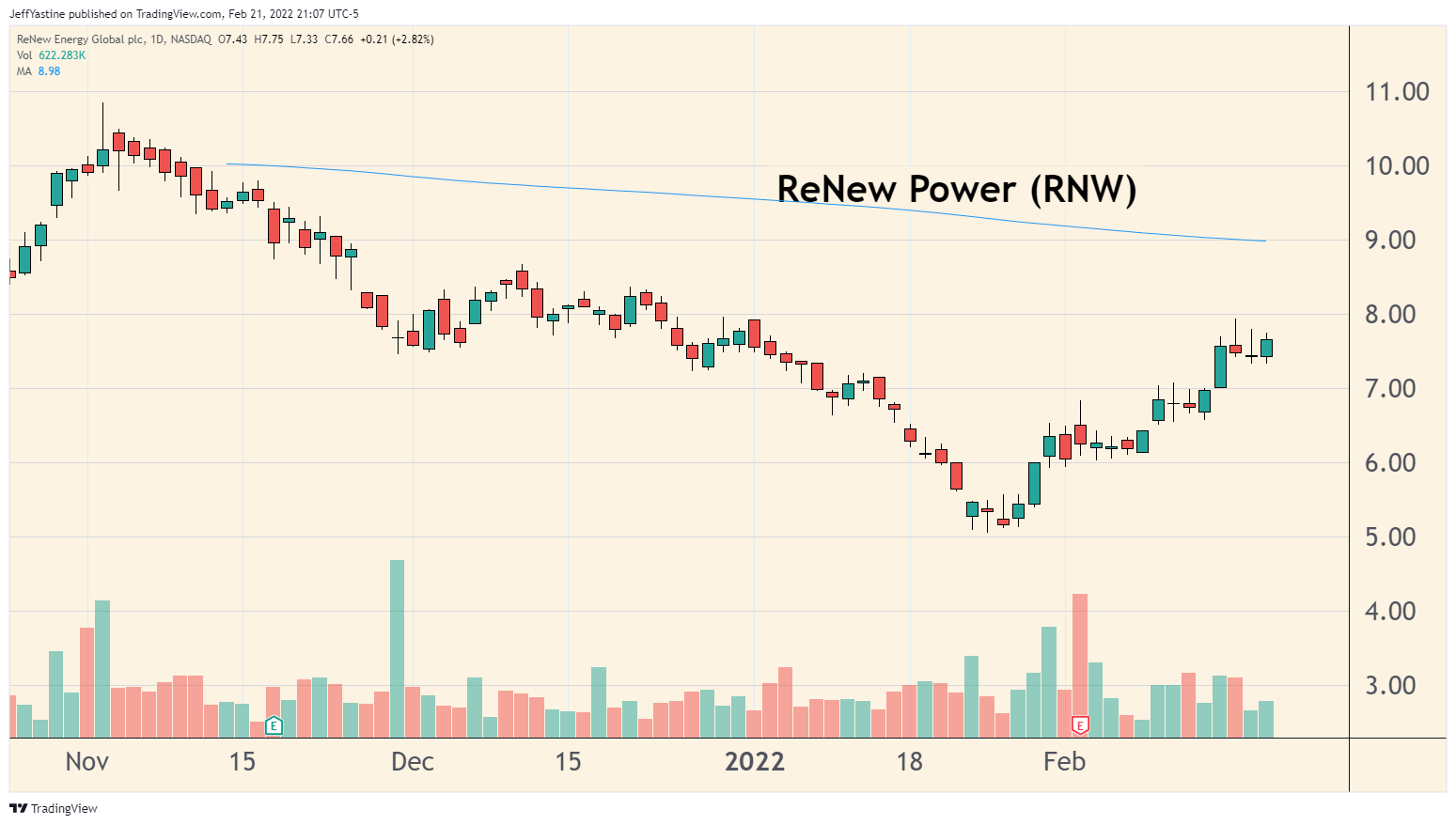

But suffice to say I'm most impressed by our India solar power provider ReNew Power (RNW).

The company made a point weeks ago that it would be using some of its excess cash to buy back RNW's stock at opportune times. I think that support we're seeing is a good sign for the future of this promising company.

Best of goodBUYs,

Jeff Yastine

Member discussion