"What Does a Market Bottom Look Like?" and a New Buy Alert

PAID SUBSCRIBERS: Skip to the middle of this article - I'm adding a new stock to the goodBUYs portfolio, effective at tomorrow's opening price. It's a leading retailer - consistently profitable - yet overlooked by investors and massively undervalued by Wall Street. Read below for more exciting details!

It's a question folks have been asking me about lately via email - what exactly does a market bottom look like?

I guess the best answer is "I'll know it when I see it." But I've seen quite a few corrections and bear markets in the last 30 years, so I have a little expertise.

Given how the market has continued to weaken - we're obviously not quite there yet.

On a practical basis, my hunch is that we need to get past the upcoming Federal Reserve meeting March 15-16, because until the Fed makes its move, it represents a major "uncertainty"(something the stock market hates).

So best guess is perhaps the market winds up looking something like this...

From experience, I can tell you that - unlike the huge "bounce" that we saw Thursday a week ago (where the Nasdaq rocketed 9% in 2 days) - at real bottoms, good stocks and the market itself are just sort of lying there.

There's no "bounce." No big rebound.

It's sort of like in the movies where 2 characters, contemplating the start of a risky activity, say to one other "You go first." And the other says "No, you go first."

Investors' confidence is so shattered and uncertain that, if you parachuted in without prior knowledge of the market's troubles, you'd think "My gosh, why doesn't anyone want to buy this stock?"

A good example from the past is Apple (AAPL) in late 2018.

Wall Street was worried about rising interest rates at the time. The stock market was down almost 20% by then, and Apple's stock was down nearly 40% in 3 months. Relative to the profits it was earning, the shares had fallen to "value stock" status - yet no one seemed interested in stepping in to recommend the stock.

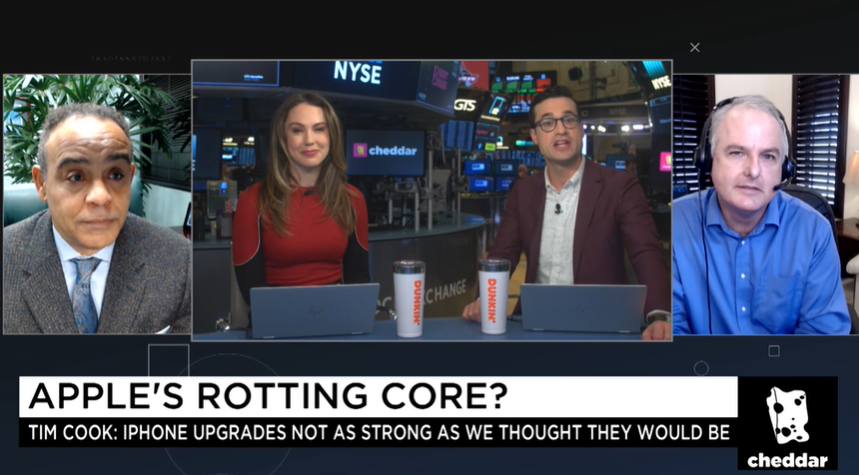

On January 3, 2018, I was invited to talk about Apple on a financial TV program and noted how the stock was so cheap it was practically at "throwaway" status with Wall Street. Yes, the headlines were bad (note the program's "Apple's Rotting Core" screen graphic!); I bought it for myself and did very well:

How puny that 38% decline seems compared to what happened afterwards - AAPL rose 100% in the next 9 months, and 400% in the next 3 years:

I'm making it look easy. Of course, you and I both know it's not.

The hard part is 1. - getting the timing right - and 2. - identifying stocks that haven't fallen from just "overvalued" to "fairly valued" status, but to "deeply undervalued" levels.

Now, I know what you're thinking at this moment...

"Jeff, what about the war in Ukraine? What about $115/barrel oil prices? What about inflation, the Federal Reserve and interest rates?"

The simple answer is that these are all concerns known by everyone. At some point, all that FUD - fear, uncertainty, doubt - gets baked into stock prices.

The question is when.

Like I said, I think we're close, but there could be a few more weeks of pain ahead until we get past the March 15-16 meeting of the Federal Reserve. That's as far into the future as my dollar-store crystal ball allows me to see.

New Stock Buy!

There's nothing "nice" about a correction or bear market. After experiencing a bunch of them in my decades as an investor, the current one is as hard as all the rest.

But the silver lining is that lots of good stocks get knocked down to amazingly cheap levels. We don't always know if they won't get even cheaper, of course. That's part of the risk we take on as investors.

But eventually the odds turn in our favor and we reap the rewards.

New Buy!

So that's what I like most about a new stock I'm adding to the goodBUYs portfolio tomorrow morning...