Sell Alert: Waving Bye-Bye to BABA, MRNA

The stock market certainly feels (to me) like we're near a bottom (more on that below).

But sticking to our "small losses" plan, let's move Alibaba (BABA) out of the goodBUYs portfolio for a 17% loss, and Moderna (MRNA) for a similar sized loss.

Part of me would like to stay with both of these. If the market begins to do better in coming days, then so will these companies - at least in theory.

Both are major value plays, no doubt about it. BABA will earn more than $8 a share this, giving it a P/E ratio of around 13. MRNA will earn $28 a share this year, giving it a P/E ratio of 4.

If you look around the internet, you'll see that the likes of Charlie Munger (Warren Buffett's investing sidekick and Berkshire Hathaway vice-chairman) is buying BABA hand over fist - but the stock has yet to respond with a higher price, so far.

On the other hand, both Moderna and Alibaba are due to report quarterly results on Wednesday. And both continue to slide down the bottom of their channels.

So we're exiting with an abundance of caution.

I'd rather leave the money from a potentially sharp rebound (in quarterly earnings come in much better than expected) on the table, and sidestep the equal chance of a deeper loss.

Market Update

Just going by instinct, the stock market certainly feels like it's bottoming here. Stocks are still going down - but only grudgingly. Selling exhaustion, fear and frustration are in the air.

Corporate insiders are apparently buying shares in their own companies in a significant way at these price levels - which should be bullish as well beyond the current geopolitically-focused market environment of the moment.

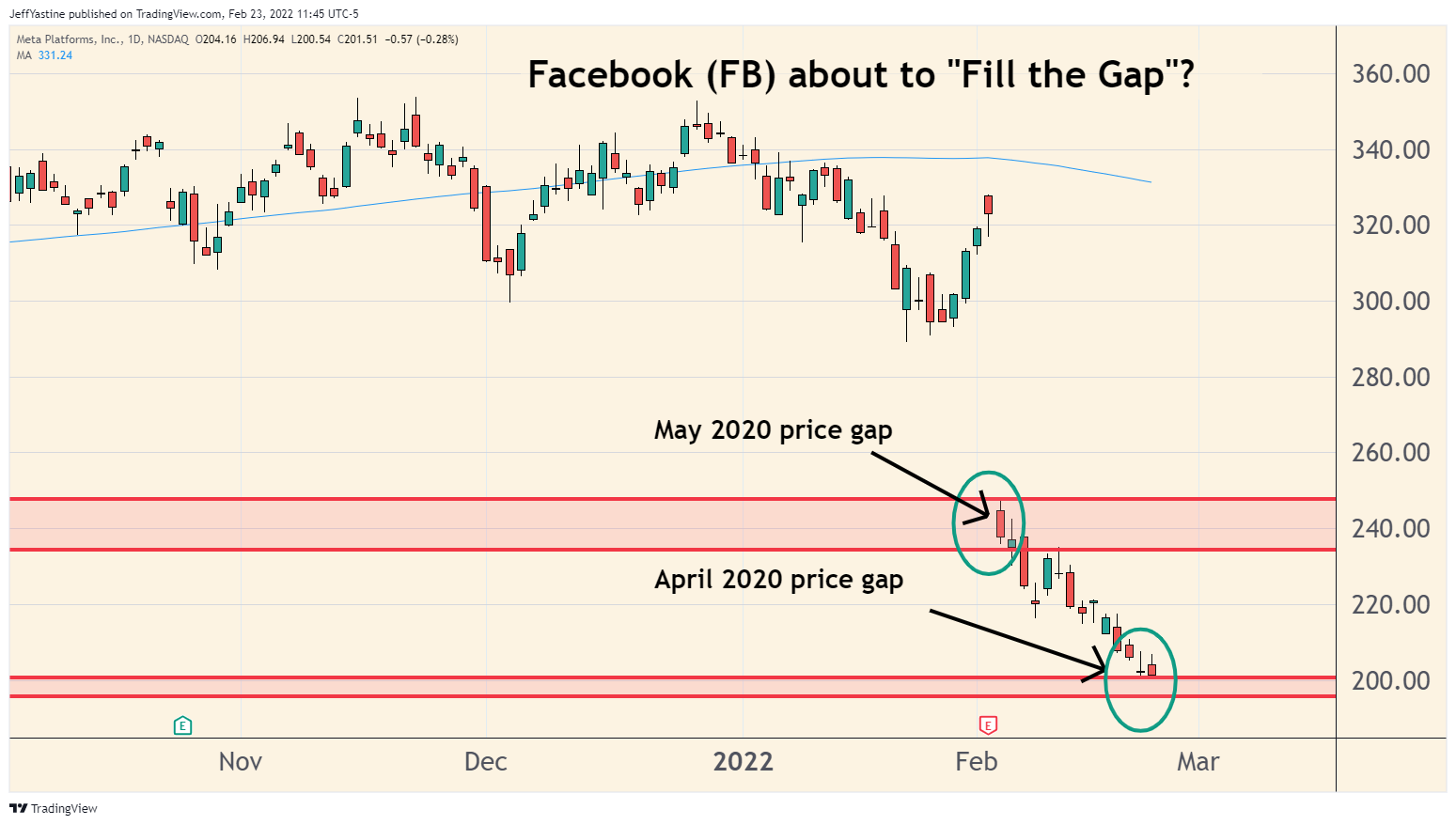

Remember yesterday's note about Facebook - needing to "fill the gap" on its chart from 2020?

The stock continues to hover just above that April 2020 gap, just above $200 - which is probably the point below which lots of folks would throw in the towel, and make for an excellent entry in the shares.

Jeff

Member discussion