Moderna: Perfect Time for Adding a Position

I've been waiting for this moment for a while now...but sometimes it's painful when we get what we wish for...

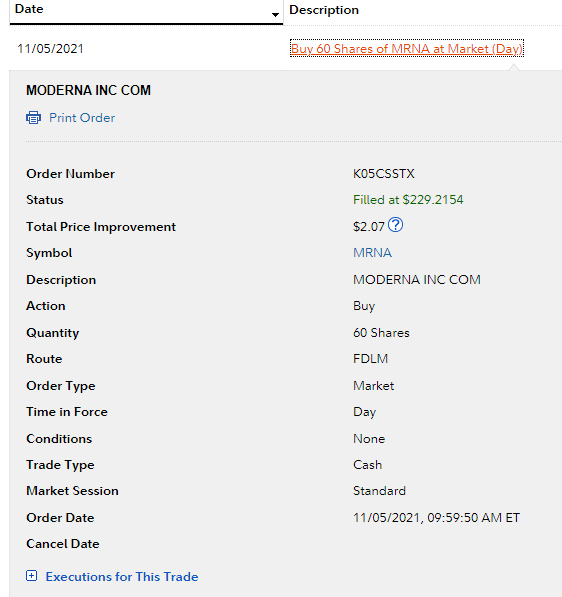

With shares of Moderna (MRNA) down another 20% this morning (the reasons discussed below), I bought a chunk of stock - nearly $14,000. Here's my fill order from Fidelity this morning at $229 and change...

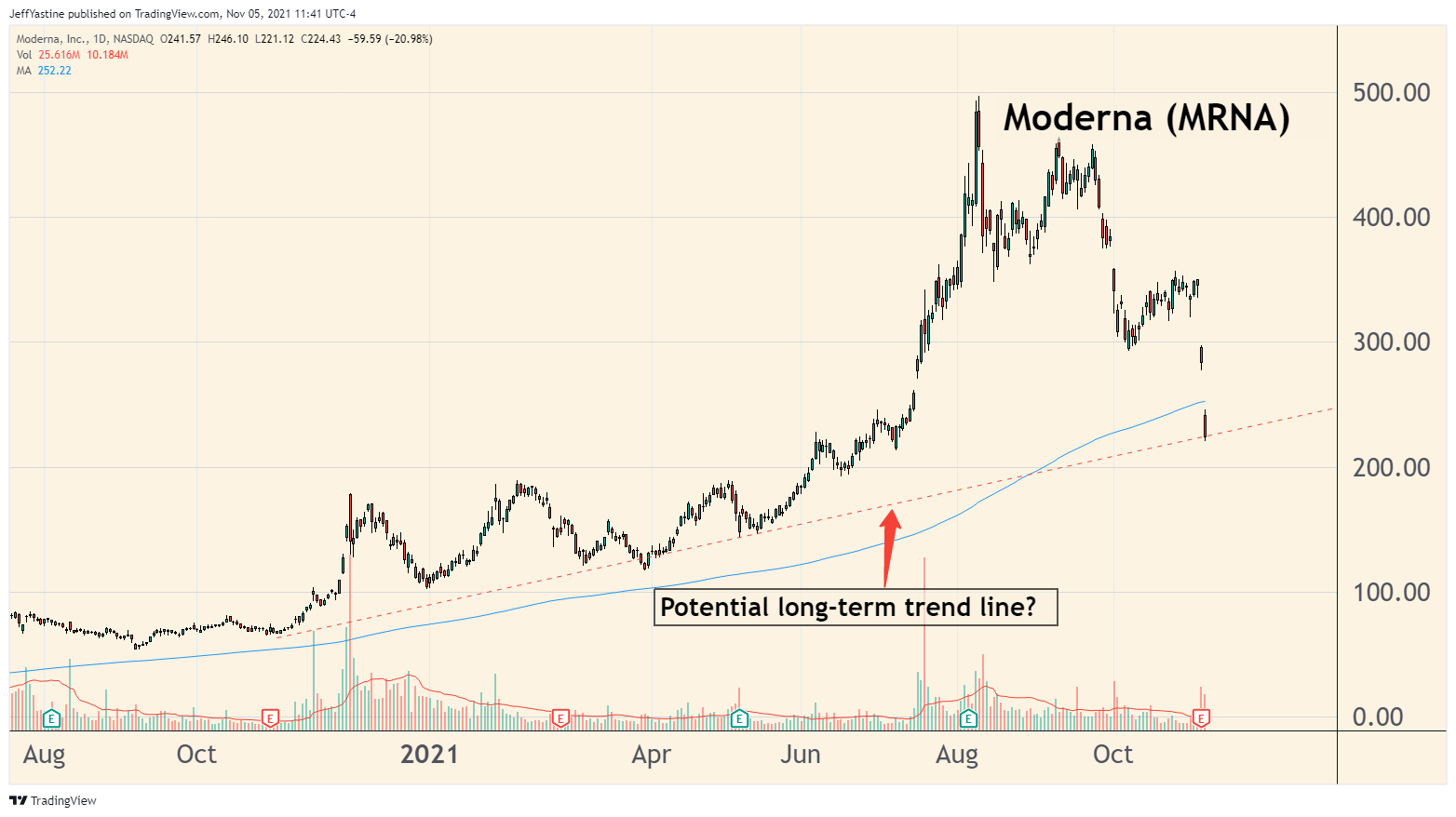

My plan is to buy the shares here. Yes, I'm attempting to "catch the falling knife" - but I'm being smart about it.

If MRNA's shares keep falling to say, $160, in coming days or weeks, it would mean a 1% loss to this particular portfolio of mine. I can live with that level of risk.

I still have a very nice profit (although not as nice as a few months ago), so there's an important distinction here...I'm adding to a winner in my portfolio - not averaging down on a stock with a loss in portfolio's "P&L" column.

I'm also going to do the same for the goodBUYs portfolio, adding 1.5 shares at current prices (yes, you can own fractional shares these days on platforms like Robinhood, which is great for small accounts).

With Moderna's shares down 50% in just a handful of months...I think the balance is now tilted towards the "reward" side of the risk-reward equation.

So what happened to Moderna today?

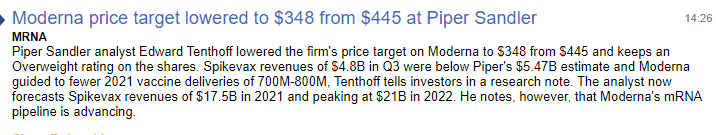

The headline reason is that - after Moderna's disappointing "miss" on its Q3 profits and revenue yesterday - a bunch of analysts all lowered the price targets on the stock.

The most bullish of the bunch, at Piper Sandler, lowered his target price to $348 from $445. Barclays' analyst dropped his from $463 to $404.

I call it the "headline reason" not to dismiss Moderna's third quarter results as inconsequential, but to point out that this is typical of momentum/growth stocks.

They get super-hot. And then...

They get ice-cold as traders move on to other ideas.

So analysts are forced to do the same, or look out of step with the crowd.

Why am I confident enough to buy Moderna's stock now, with the shares down this much?

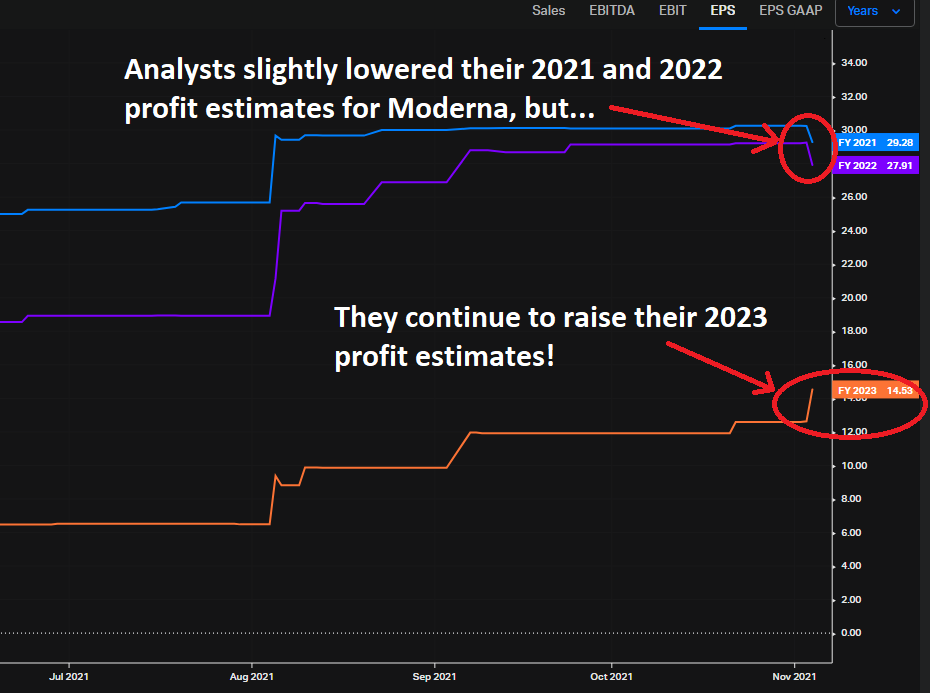

The "spaghetti" chart below - a timeline of analysts' profit estimates for MRNA stock as the months go by - speaks volumes...

Keep in mind, the data above presumes that we'll see a spike in COVID vaccine sales sometime in 2022 or early 2023 (hence a drop in Moderna's profits from one year to the next).

But I'd be more worried about the stock if those 2023 earnings estimates were also being downgraded. As you can see from the chart...they're not.

Yes, those COVID vaccine sales will likely hit their peak sometime in the next 2 years (if we're lucky). But that's a long way from now.

That's 2 more years for...

- Moderna to launch its in-development COVID+flu vaccine...

- A next-gen vaccine formulated specifically for the Delta variant...

- A host of other vaccine projects for various forms of cancer and other ailments in its development pipeline.

The only thing that really changed was Moderna noting that it had to push some orders - that it hoped to fill this year (and therefore book as revenue and profit) - into early 2022.

That's it.

Even the analysts, writing about their downgrades, had to admit the same. As the analyst at Jefferies noted (lowering his target to $325 from $375) the revenue "miss" of $5 billion gets shifted to next year and hence "would seem to net each other out."

And to round things out, we're hitting the cold months in the northern hemisphere. People are beginning to travel in vast numbers again, while mask mandates are being lifted.

So get ready for news of COVID hot spot outbreaks - news of which will likely boost Moderna's shares once again (and spur the same analysts who are downgrading the stock now to upgrade it later, no doubt!)

Best of goodBUYs,

Jeff

Member discussion