Market Update: Oversold...What Happens Next?

Last week I asked in a brief "Chart of the Week" post..."Will our 'analog' keep playing out?

At that point, the chart comparisons between our current market - and that of 2007's sharp (and final) 10% rally to new highs, just before the financial crisis meltdown began - looked really good.

As it turns out...it was too good to be true.

Instead of a sharp rally to "the final highs," the market tanked and never recovered after Wednesday. That's when the Federal Reserve announced it was keeping interest rates unchanged, but would likely raise rates one more time before the end of the year:

The Importance of Last Week's Selloff:

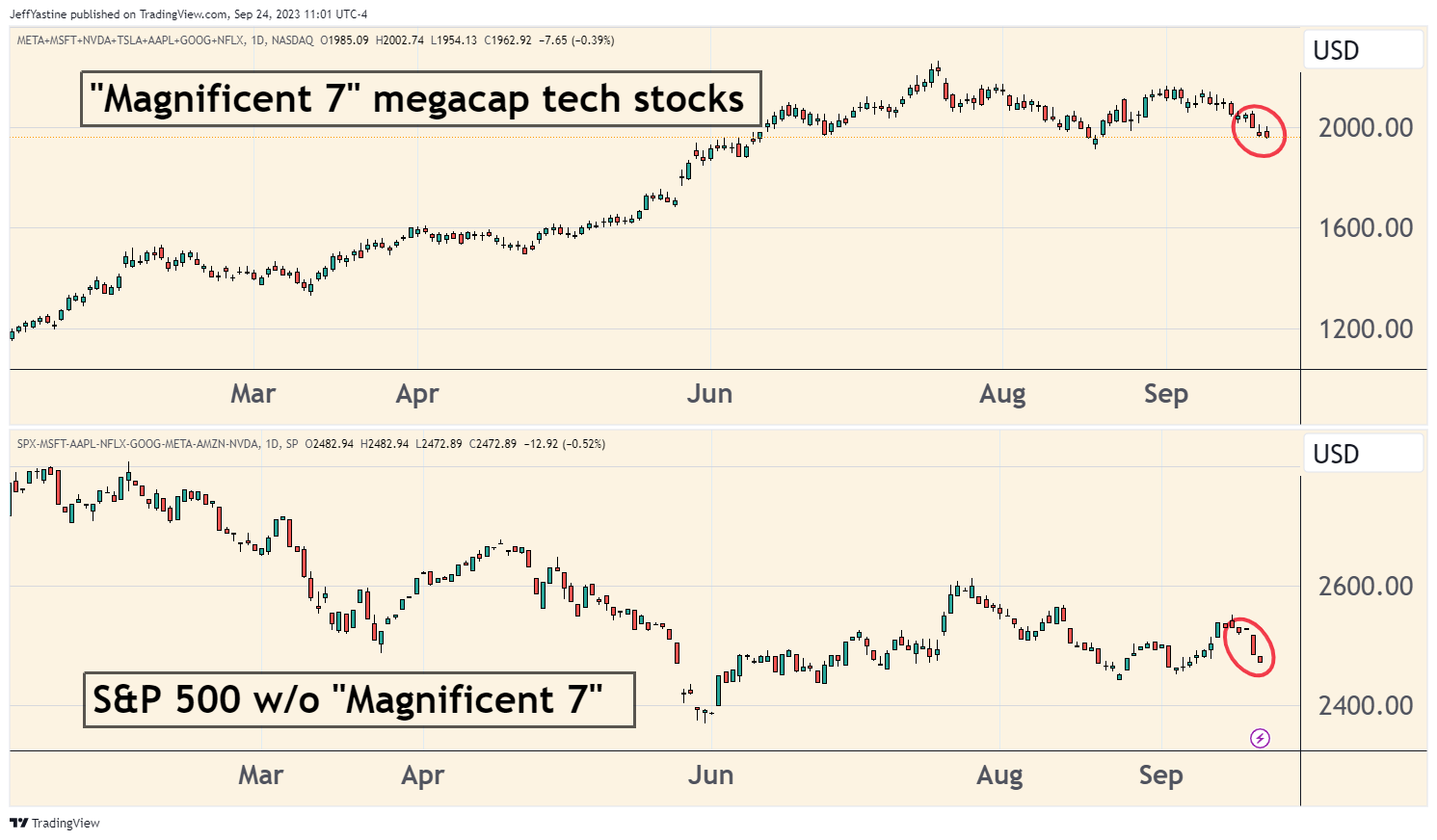

What makes last week's selloff particularly notable and worrisome is that the "Magnificent 7" (or "8" if we want to include Tesla) megacap tech stocks - previously the market's island of strength in an ocean of weakness - are also succumbing to bearish selling pressure:

Rebound or... Put on Crash Helmets?

At the risk of sounding alarmist... last week's selloff, and finishing at the lows of the day on Friday - are not good signs.

The next few weeks will be very, very important to the ongoing health of the market, in my opinion. A rebound...a good, solid one...would resolve what is currently a very oversold condition (oversold meaning a market or stock that's fallen quite a bit and is due for a sharp rebound).

What happens if we don't get a rebound?

Or only see a weak, tepid rebound (which I would say is a gain of no more than 3-4% from Friday's closing prices)?

It could mean a very sharp correction - or (gulp) a crash are right ahead of us.

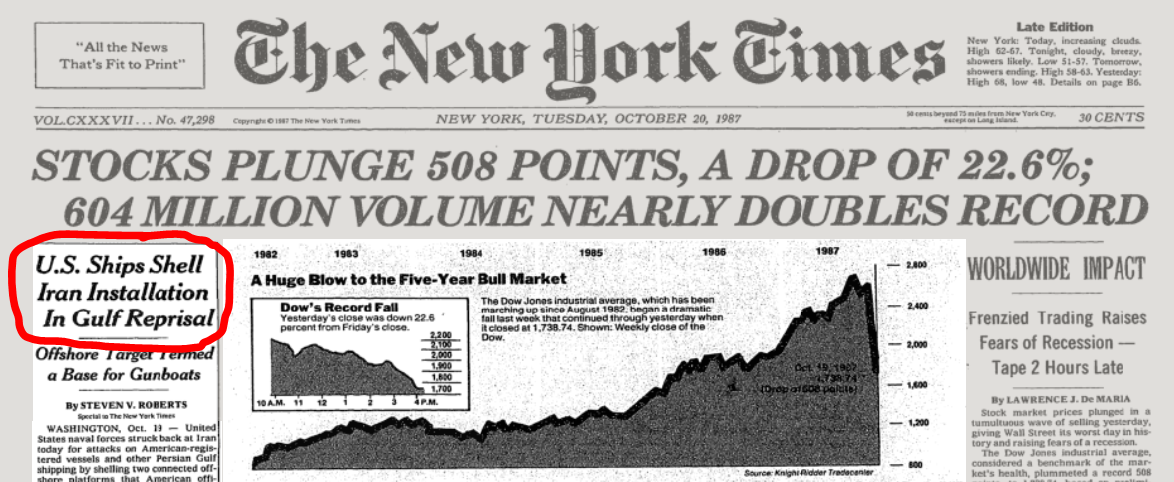

These rare events typically occur during periods of...

- Oversold market conditions

- Rising interest rates

- Stubbornly bullish sentiment

- "Exogeneous" events

In the October 20, 1987 crash, for example, the exogenous event was the US Navy attacking an Iranian oil platform, and the worry that a tit-for-tat conflict in the Persian Gulf was about to turn hot:

We have no small number of potential exogenous events. For example, the looming government shutdown will probably get resolved before its September 30th funding deadline. But if it does not...well, there you go.

Probabilities

The truth is that 99.99999% of the time, this will never happen.

What happens instead is that "news" intervenes to buoy the market. Typically, someone at the Federal Reserve - like a Jay Powell or a Fed bank presidents - makes a speech or says something of a bullish nature "on background" to a reporter at Bloomberg or the WSJ.

That info goes out to the investor community, sparks a rebound rally. It won't forestall a bear market, but such machinations have in the past reduced the market's vulnerability to an outright panic or crash during vulnerable periods.

My hope and guess is that perhaps we'll see something like that occur next week.

But I'd rather sound alarmist and have you un-subscribe from this newsletter than dismiss a more extreme, negative possibility outright, or worse - have you be completely surprised in the rare chance that it happens.

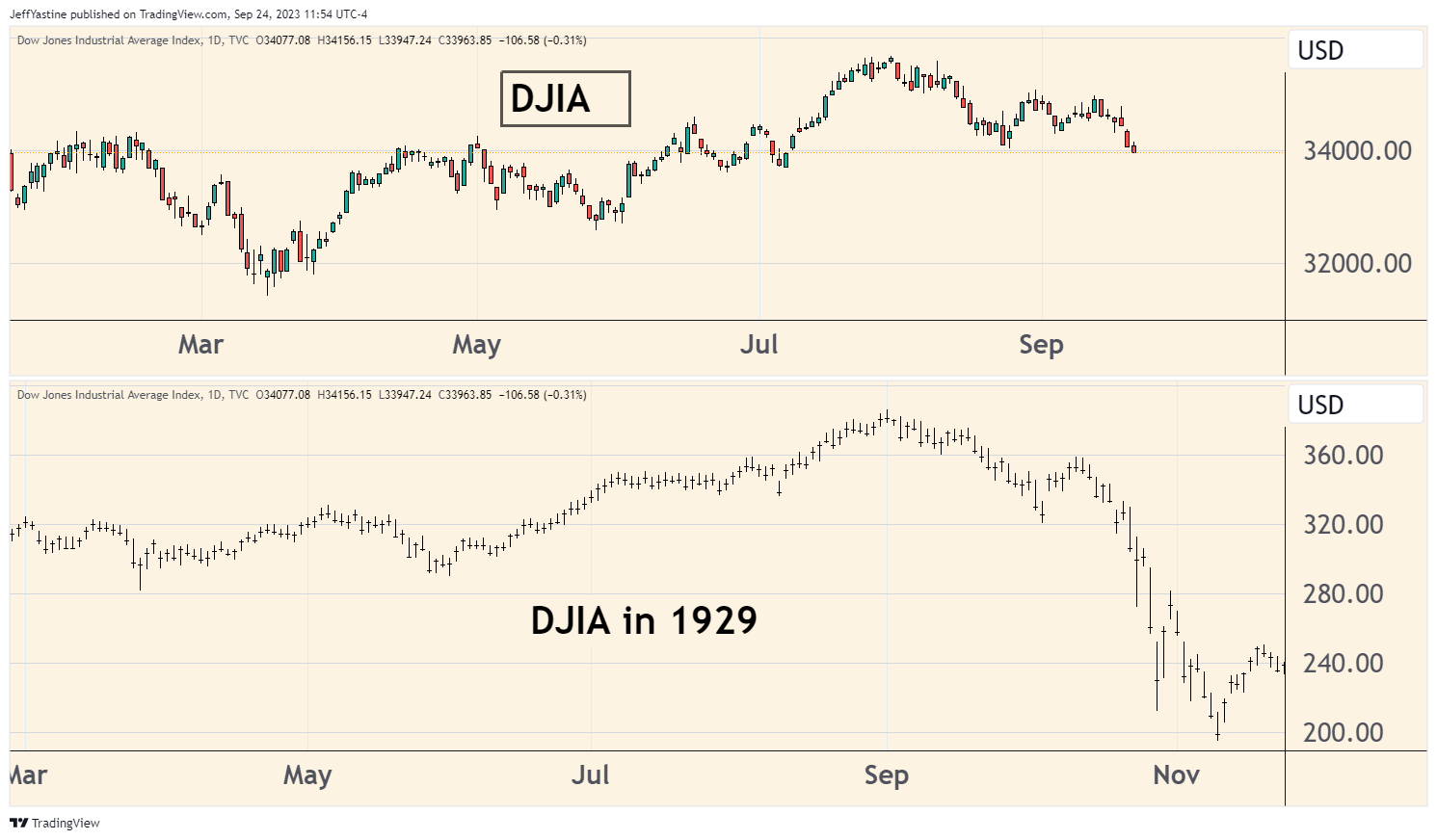

For the heck of it, here's what 1987 looked like, and below that, the 1929 crash event:

I love to buy stocks. So I'm hoping I'm wrong about this in a big way.

But I also don't like losing lots of money, or seeing the same thing happen to others.

Lastly, I used to hate it in my days as a financial reporter (such as in 2007), when some Wall Street strategist would tell me "Everything is good" when we all knew that it was not.

Best of goodBUYs,

Jeff Yastine

Member discussion