Market Update: Why I'm Getting Bullish Now

Last Wednesday I warned that "we have to be prepared for yet another selloff to finish out June" before we prepare for a very bullish July.

Looks like I'm getting my wish.

As I'm writing this morning, the pre-opening prices for the major indexes are down almost 3%...

- The Nasdaq futures are down 350 points to 11, 500.

- The S&P 500 futures are down about 90 points to 3,800.

You can hear, read, and feel the panic amid the sour-puss headlines about last Friday's "catastrophically bad" inflation report. The morning TV shows are echoing the same themes.

But let's set all that aside for a moment.

Because at times like now, it's easy to forget the phrase that's key to our existence (and ultimate success) as investors...

Stock prices move in anticipation of future events.

That's why the stock market has been moving lower and lower for the past 6 months through this morning's panicky selloff:

Why Think "Bullish"

Let's flip things around and ask...what is the market NOT anticipating?

How about the idea of "moderating inflation"?

It's basic economics. Prices zoom higher, so we consume less. High prices also attract more competition (in this case, more oil drilling and production). Lower prices eventually follow.

Maybe that's why oil prices have begun to show weakness the last few days?

As you know, I've been expecting a "double top" in oil prices around $120 to $130 a barrel.

It's a bit too early to say whether this is it, but if we want to anticipate a stock market rally in July and beyond, a top in oil prices is what we want to see.

Then there's this bit of overlooked bullish news on Friday

Why is record-low consumer sentiment of 50.2 (as measured by its record keepers at the University of Michigan) considered bullish?

Until now, there have only been 9 other instances when consumers were this negative.

In all 9 instances, the average return for the S&P 500 was nearly 20% higher over the next 12 months.

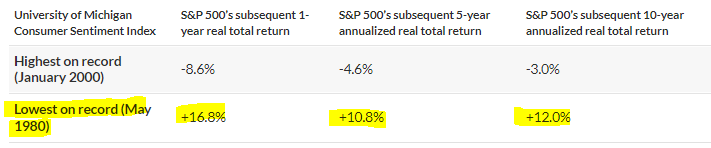

As Marketwatch's Mark Hulbert noted in a column a week ago, the subsequent 5-year and 10-year returns haven't been too shabby either

I can only speak for myself, but I'm having trouble containing my enthusiasm. If we want to buy when prices are low and values are high...we couldn't ask for a better setup.

For premium subscribers, get ready for more stock market buys this coming week as we increase our exposure to the stock market for the coming rebound in July and beyond.

Jeff Yastine

Member discussion