Market Update

On days like today, I feel like I need to stuff beeswax in my ears - like the Greeks of ancient mythology - to avoid hearing the "siren call" of buying the markets.

With the major indexes all up roughly a percentage point in steady trading (so far) today, the urge is strong.

And maybe this is the real deal? This is one of those situations where we're all just guessing.

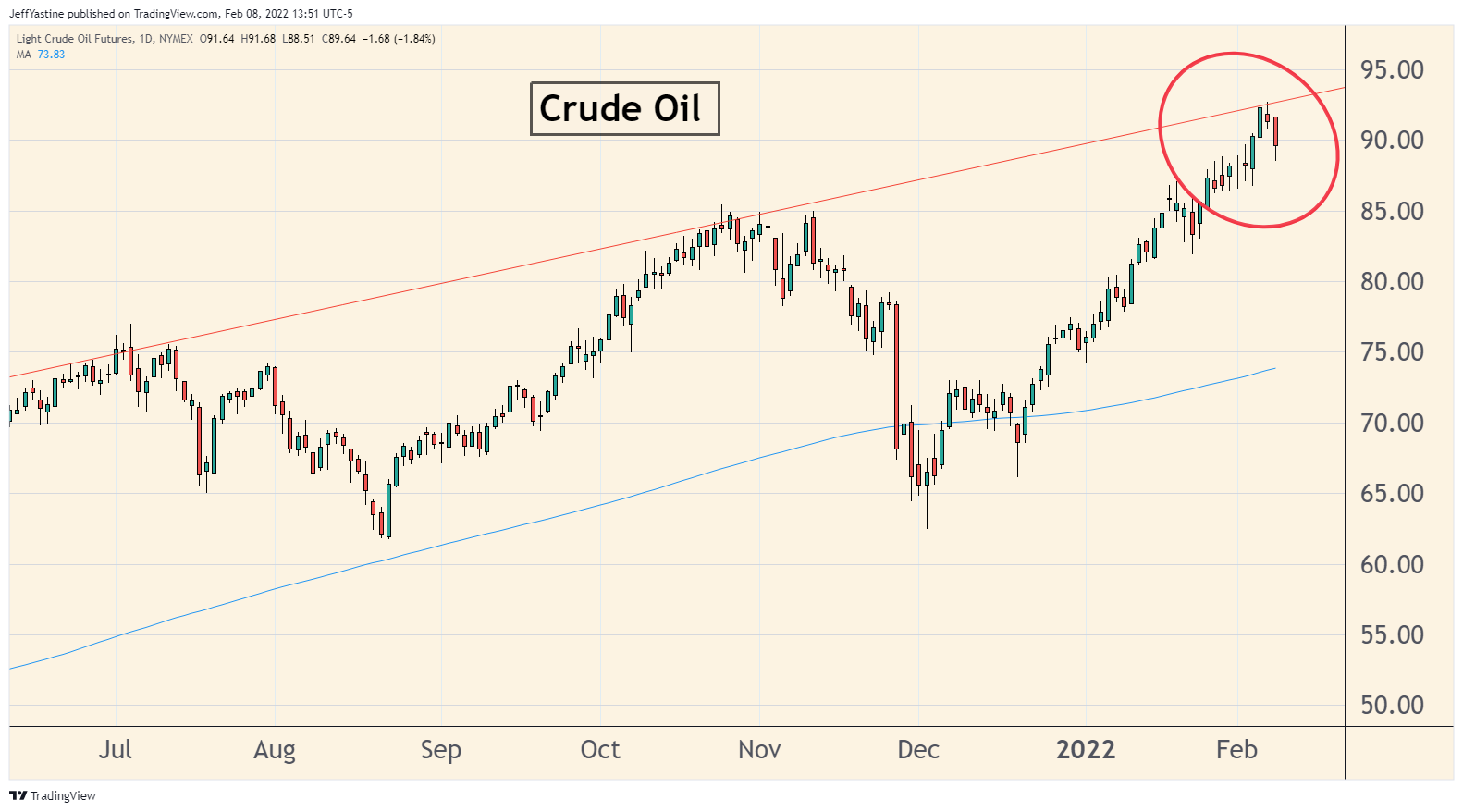

On the one hand, it's nice to see oil prices sell off a bit the last 2 days after finishing Friday at 7 year highs:

If oil prices suddenly began to collapse in coming days, it could take a little pressure off the Federal Reserve to raise interest rates - and potentially light a fire under a lot of stocks.

On the other hand, what did I say in Sunday's (subscribers-only) update?

I said to watch for the major indexes to meet (and hopefully exceed) their most recent near-term highs (circled in red in the charts below) before we could get a little more enthusiastic about the overall market again.

From that perspective, today's rally remains under-whelming. The S&P 500 and Nasdaq 100 (representing the largest tech stocks) aren't anywhere close.

In fact, if you take a closer look at the Nasdaq 100 chart below, I've added 4 arrows to point out that even the intra-day rally highs of the last 4 days - are each just a little lower than the day before.

That's no guarantee of further weakness - maybe the markets come roaring back in a giant short-squeeze rally tomorrow. We never know.

But from an instinctive standpoint, it's the confidence-building equivalent of a limp handshake.

Think of it this way - it's like we're playing a game of poker against Wall Street pro traders who have billions of dollars at their disposal.

The cards they shown us - a few days of mildly bullish action - look good on paper. And maybe things will get even better from here.

But they might be bluffing, hoping the rest of us will toss in a little more money to the center of the table before they fold their hand and withdraw from the game.

In other words, we rush in to buy the big tech stocks that have sold off so much lately. But in reality, we're just helping Wall Street institutions to exit their huge positions in these stocks - before they engage in another round of selling.

That's why I say, let's wait - and see if the indexes can at least equal or exceed their most recent near-term highs in coming sessions. Anything less than that could be the trading equivalent of a head fake.

Best of goodBUYs,

Jeff Yastine

Member discussion