Market Update: Watching a "Developing Bottom"

Hope you had a great weekend! Last week was capped off by a very interesting Friday session.

A lot of the small cap stocks I track started the day strongly, for the first time in weeks, and never sold off.

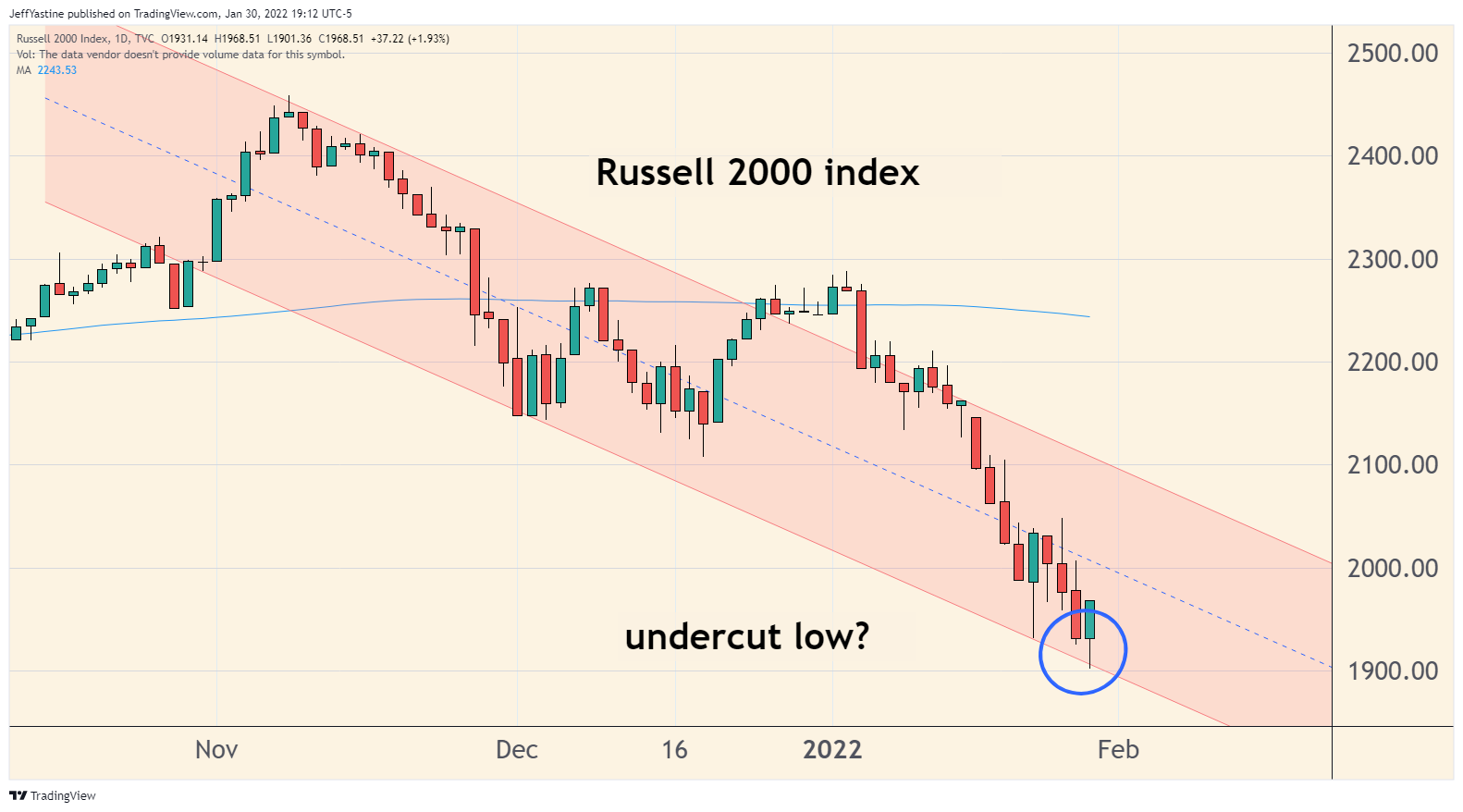

Then around midday, I noticed that the Russell 2000 - small cap stocks have been the weakest of all classes of stocks lately - had carved out an almost exact "undercut low" of the type I laid out earlier in the week for the S&P 500.

By the time I finished writing something to you and pushed the "send" button, suddenly the whole market started moving higher. The Russell 2000 rose nearly 2% by the time they rang the closing bell on Friday.

As I noted Friday, my gut instinct is that we've bottomed.

If we have, than it was a routine deal. The S&P 500, from its all-time closing high to lowest closing low, fell almost exactly 10% - a textbook correction.

So here's what to look for - and what not to look for - in the coming week...

- Don't expect a "v-shaped" bottom where stocks explode higher.

I'm actually hoping for the opposite.

The biggest, longest-lasting market rallies tend to have an initial burst of buying then move sideways for awhile.

The action helps keep folks from getting too bullish too quickly. It also allows bearish investors to keep heading for the exits while smart institutional traders slowly accumulate positions in their favorite stocks for the coming rebound.

Let's also keep in mind that there are ongoing developments - such as the Russia/Ukraine situation - that could easily lead to knee-jerk selloffs, giving fence-sitting investors yet another reason to avoid the stock market.

2. If the markets open the session sharply lower in coming days, give it time.

If I'm right about a "developing bottom", we'll see buyers quietly take advantage of temporary price weakness and bid the market indexes back to breakeven levels by the end of the day.

Portfolio Update

On Friday, I added Stereotaxis (STXS), Wrap Technologies (WRAP), PLx Pharma (PLXP) and ReNew Energy (RNW) back into the goodBUYs portfolio. Moderna (MRNA) was added on Wednesday.

Those stocks join Arlo Technologies (ARLO), which is at breakeven levels in the portfolio - and posted a monster 9% rally in Friday's session.

Notice how ARLO's stock, even after the big declines in the indexes and so many other stocks - still trades above its 200 day moving average? That's a great sign to see, and evidence of a healthy pullback before another move higher, in my book.

I'm going to add a second position in ARLO on Monday with the idea that we've just seen a nice pullback in the stock before it powers higher again.

Alibaba (BABA) looked like it was going to plunge off the cliff again as last week's market weakness played out before Friday's big rebound.

The company reports its latest quarterly earnings in the coming week. I'm betting that whatever bad news is out there on the stock is already "baked in" at the current price of the stock - its lowest since 2017.

The other thing to consider with Alibaba is that, as a Chinese stock, it represents an opportunity to benefit from a weakening dollar if global investors decide at some point to begin rotating out of an overweighted position in US equities and other dollar-based assets.

Walgreens Boots Alliance (WBA) continues to look like a value stock that's beginning to gain some investment fans. I like that the stock continues to use its 200 day moving average as a support level, despite a weak S&P 500.

Proto Labs (PRLB) finished Friday on the positive side. But it was hardly a convincing rebound. If my bottom call is correct, we should start to see buyers reverse its slow-motion descent soon:

Proto Labs reports its latest quarterly numbers in the middle of February. Considering that 2 senior officers bought large chunks of the stock recently at the current price, it could bode well for a sustained move higher in coming quarters.

Spirit Airlines (SAVE) was caught up in the market's overall panic selling over the past 10 days. On Friday, it rebounded strongly after a deep selloff - which is what we want to see in preparation for a more sustained recovery in coming days:

I still believe that airline and travel stocks are going to do very well as investors realize that the worst of the pandemic is likely behind us. If oil prices have a correction, SAVE and stocks like it should be strong beneficiaries.

Best of goodBUYs,

Jeff

Member discussion