Was Last Week's Market Rally "Real"?

I thought last week's market activity was sort-of encouraging - but only up to a point.

As we get into late October, every day and every week that goes by without another big decline moves the probabilities toward the bullish side of things. From late October through the spring of next year is - from a historical, seasonal, market-timing perspective - the very best period to be in stocks.

In other words, when the market starts moving up, we have to pay attention. Plenty of rallies start doubtfully, and gradually build strength.

So on the face of it, last week's rally looks encouraging, right?

On the other hand, I've been encouraging people lately to watch the heavily-traded but less-liquid ARK Innovation (ARKK) etf for a better understanding of the true nature of the market (because institutions cannot pile in and out of it, like they can the S&P 500's SPY etf or the Nasdaq's QQQ etf).

From that perspective, last week's rally is more like a shoulder-shrugging "meh":

Last week was also an options-expiration week.

And if I've learned anything as an investor and trader over the years, it's to automatically distrust such periods as not-necessarily "real."

From that perspective - millions of investors and traders, pro and amateur alike, bought up a record $2 trillion worth of options in recent months as protection against a severe market plunge in October. After all, that's when crashes are most likely to happen, right?

But, as with most things on Wall Street, the bigger the crowd betting on a certain outcome (in this case, a deeper selloff or crash) ...the more likely we get the opposite result - as the Bloomberg headline below noted on Thursday:

Adding to the red flags last week...is a popular new options strategy called "weaponized gamma" that may have played a big role in juicing up last week's rally...

"Weaponized Gamma"

For a bit of background on it, do you remember in 2021 how millions of amateur traders ganged up on professional short-sellers?

Working under the mantra of "YOLO" - you only live once - and coordinative via social media, they bought up huge amounts of stock in cruddy, heavily-shorted stocks like Gamestop (GME) and the movie theater chain AMC Entertainment (AMC).

As a result, the stocks went on huge, but unsustainable, short-squeeze rallies. As a result, hedge funds that focus on short-selling lost billions of dollars.

According to a Dow Jones article late last week, aggressive option trading firms are now using a similar technique called "weaponized gamma" - against Wall Street market-makers.

Without going into the technical details, it involves buying massive quantities of heavily-traded options (such as those for the S&P 500's SPY etf or the Nasdaq's QQQ etf) that are due to expire within a day or two.

Typically, almost no ordinary trader buys options just a day or two before they expire, for obvious reasons.

But if everyone did it in a massive, coordinated way - it highjacks the typical method that market makers use to hedge their own risk as they fill customers' options orders.

As the Dow Jones article notes, "weaponized gamma" has become an extremely popular strategy with pro options traders. It has important implications for whether the market is really improving, or perhaps not:

"Investors piled into these near-expiry options ahead of last Friday's expiration, which likely contributed to the huge intraday reversal that occurred one week ago on Oct. 13, when the S&P 500 logged its biggest intraday turnaround on a percentage-point basis since 2008, according to Dow Jones Market Data."

"Large trading shops have been buying - "YOLO-ing" - these near-expiry options as part of a broader trading strategy that allows them to profit by anticipating the hedging activity of large options dealers."

"In that respect, these professionals are behaving like "full-tilt" day traders, using the certainty of Dealer hedging flows that their orders create, to then amplify and 'juice' the intended directional market move, [Nomura derivatives strategist Charlie] McElligott said."

So it begs the simple question...

If a scheme like "weaponized gamma" played a major role in propelling the market sharply higher through an "expiration week" - what happens this week now that options-related volatility is no longer a factor?

Portfolio Review

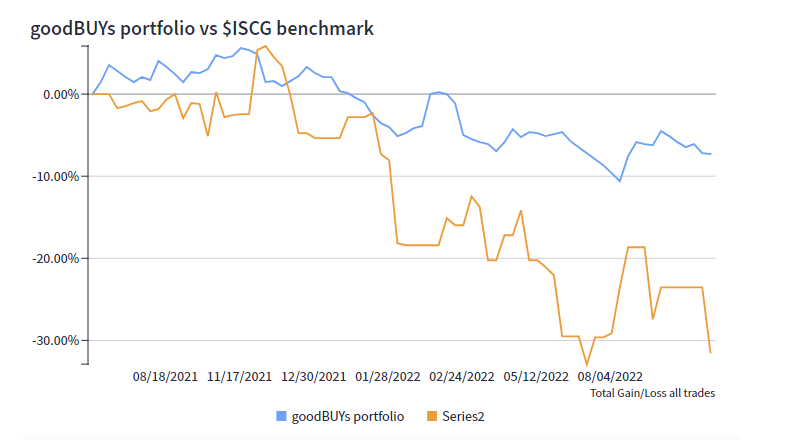

I'm pondering a few more ideas to add to the goodBUYs portfolio. But as I noted somewhat doubtfully at midweek - the broad stock market rally did little for our 4 portfolio stocks with a large position of cash.

So I'd like to see a little more upside improvement before committing additional capital to our positions.

If you put the 4 existing positions - Outset Medical (OM), Palantir Technologies (PLTR), Desktop Metal (DM) and Clear Secure (YOU) - into their own little index, here's what their chart would look like:

In other words, there's a little improvement - maybe, kinda, sort-of. But basically, they're spinning their wheels.

Like many stocks last week, (those that are not key elements within the Nasdaq or S&P 500) they haven't even made a new high for the past week, the past month, or 2 months for that matter.

My opinion of things would change very quickly if we actually saw our positions begin to gain ground. Perhaps we'll see that in the coming week.

Palantir (PLTR) is up 2.5% for us, as of Friday. It has the best-looking chart of the bunch, but that's not saying much at this stage of the game:

The company announced a partnership with Hertz to bring Palantir's AI-based data insights to better manage the rental agency's auto fleet.

But Morgan Stanley cut its price target on Palantir from $11 to $10 a share as it cut estimates for the software industry sector.

The key thing to think about with these downgrades is whether the downgrade is already priced into the stock. I'd say yes - but as always, the stock market has the final say.

Outset Medical (OM) is down nearly 10% in the goodBUYs portfolio, but remains a company that I continue to be impressed with. The company's story is a good one - it's on track to post $108 million in revenue this year (up 5% from a year ago), $157 million in 2023 and $239 million in 2024.

The company is in what I consider the sweet spot for growth in medical care - care that can be provided in the home - with its FDA-approved and Medicare-approved mobile Tablo Hemodialysis system.

Desktop Metal (DM) is down 6% in the portfolio and continues to drift in this bear market.

When we see a stock trading at $2.50, we always have to be careful. Most stocks that trade at $2.50 will not become $20 or $50 stocks.

But in the midst of a bear market, growth stock bargains do come along. DM is a company with real sales. On a trailing 12 month basis, the company has sales of $183 million.

And DM is on track to see its forecast sales rise 124% this year (to $252 million), another 31% next year (to $332 million), and 65% in 2024 (to $525 million).

If things go off as planned. DM could see its annual losses shrink from -$0.99 a share this year to breakeven by 2024.

Clear Secure (YOU) is also down 6%, and likewise offers much promise...promise that is not being rewarded by the bear market, obviously.

The company has posted upside sales surprises in each of the last 5 quarters since YOU went public more than a year ago. Likewise, Clear Secure has posted 4 straight quarterly earnings surprises, most recently posting its first-ever period of breakeven results.

Jeff

Member discussion