Chart of the Week: Sign of "Omicron Optimism"?

I was in NYC for most of the past week for a little pre-Christmas getaway with my family - and got an upclose look at the omicron panic sweeping the nation's financial capital.

But here's two bits of info for some market-related optimism...

One is the S&P 500 looks on track today to finish the week (markets are closed Friday and Monday) at a new all-time high (albeit on lower holiday-type trading volume).

But the rebound is gaining fuel from more studies which appear to confirm earlier reports from South African researchers (where the variant first appeared) that omicron is far less dangerous than delta.

In South Africa itself, the headlines are indicating that the variant has peaked and begun to subside already:

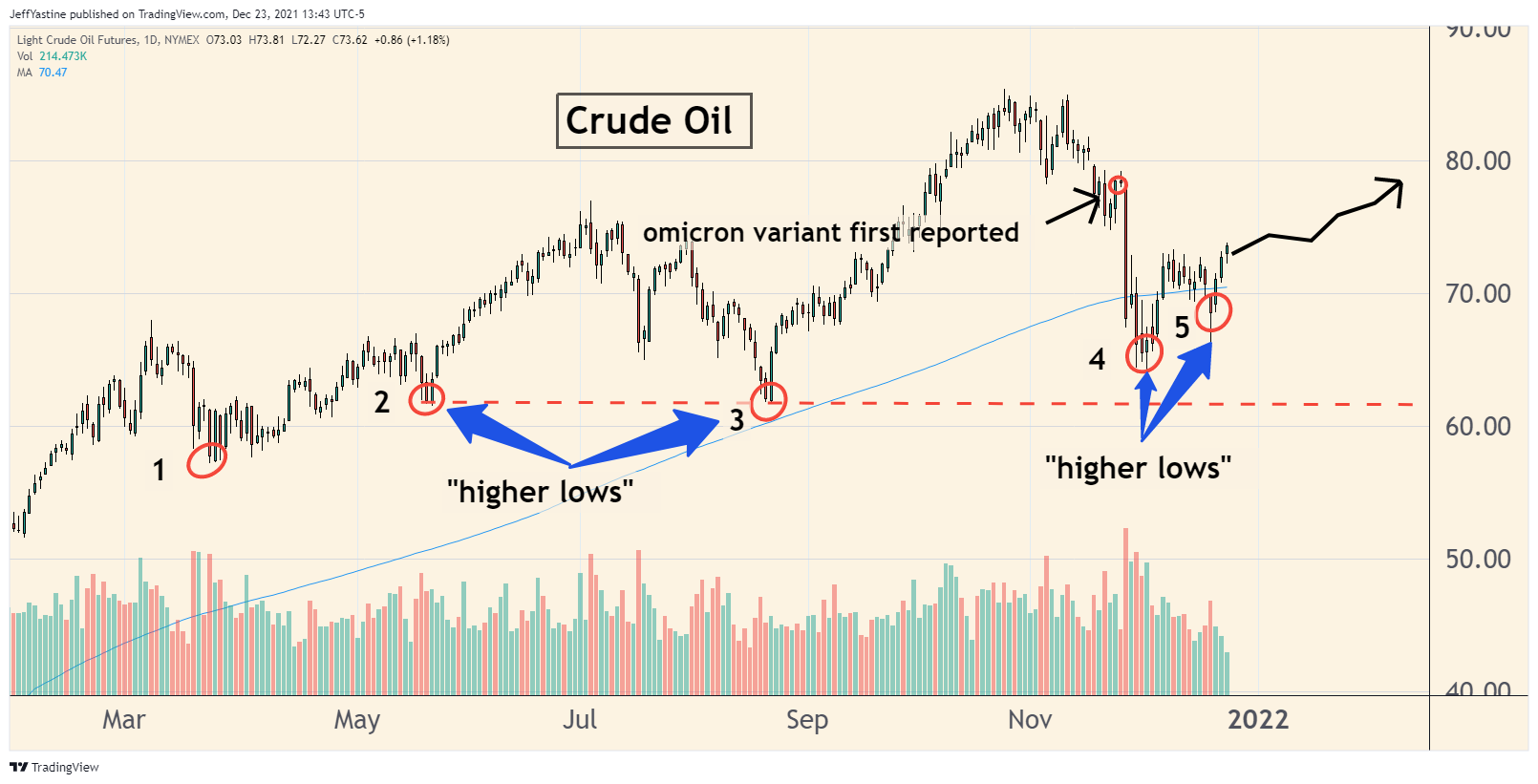

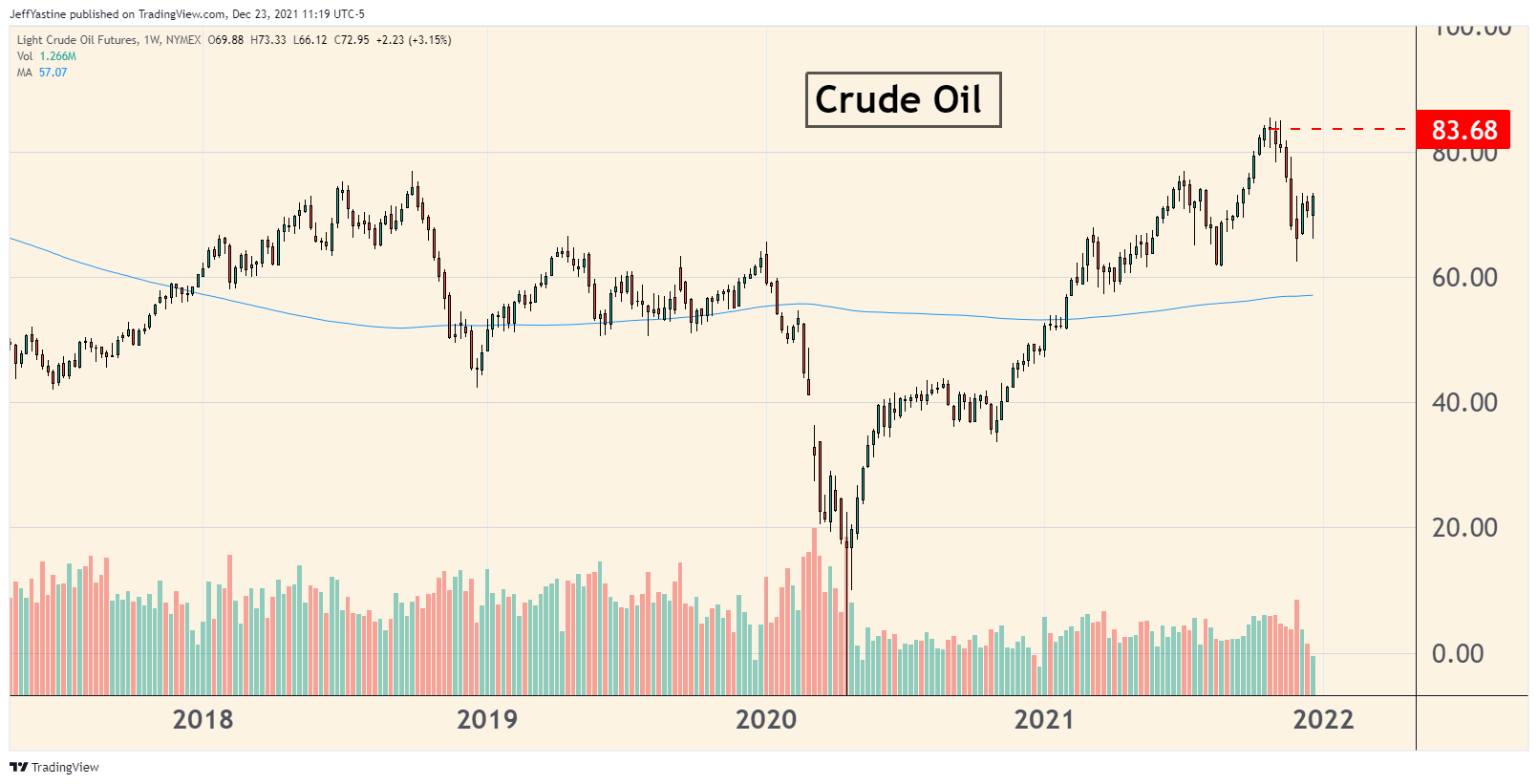

The second bit of info is this chart of oil prices...

A pattern of "higher lows" is always something important to watch for, in any stock, index or commodity.

In oil's case, it rallied into the new year and then sold off in the March/April period, marking a near-term low (#1, circled in red).

Oil's had numerous selloffs since then, including in May and August (#2 and #3, circled in red) - each time ending at a price slightly higher than the near-term low before it.

And even with the more recent omicron scare, oil prices (#4 and #5) have yet to penetrate the support levels of prior selloffs.

So you can see where this might be heading - another breakout in oil prices, perhaps in the first quarter of the coming year.

As far as what it all means to the broader US stock market, that part is still open for debate.

If oil continues to head higher, it would continue to underline economic growth and the threat of continued inflation pressures. That may not be good for the major indexes, and their so-far wonderful (and seemingly inexhaustible) ability to keep making new all-time highs.

But considering the pent-up demands of the US and global economies, that doesn't necessarily mean bad stuff, like a crash or huge correction.

Instead, it's possible that the current investing environment evolves into what Wall Street pros like to call a "stock picker's market."

In other words, the major indexes might cool off a bit. But well-chosen individual stocks could be propelled higher as investors search for other stock ideas that are either undervalued or have under-appreciated growth potential - like many of the stocks currently in our goodBUYs portfolio.

Best of goodBUYs,

Jeff Yastine

Member discussion