Why Bitcoin's Chart Matters...Even if You Just Own Stocks

I don't own any Bitcoin. But as a stock investor, I think it's important to follow the ups and downs of crypto prices.

They offer us important clues about what I'll loosely call "speculative flows."

Think of it like the ocean tides. When the tide is coming in - interest rates are low, and there's lots of money pumping through the economy - folks feel good and we like to take risks.

So we buy assets like crypto currencies and tech stocks. They offer us the biggest bang for every buck's worth of "risk." If I want to quickly turn $1,000 into $2,000, and $2,000 into $4,000...that's where I'm paid the most for taking that risk.

Likewise, when the monetary tide is going out - as it may be doing now as the Federal Reserve prepares to raise interest rates later this year - "risk" assets sometimes fall out of favor, leading to lower prices.

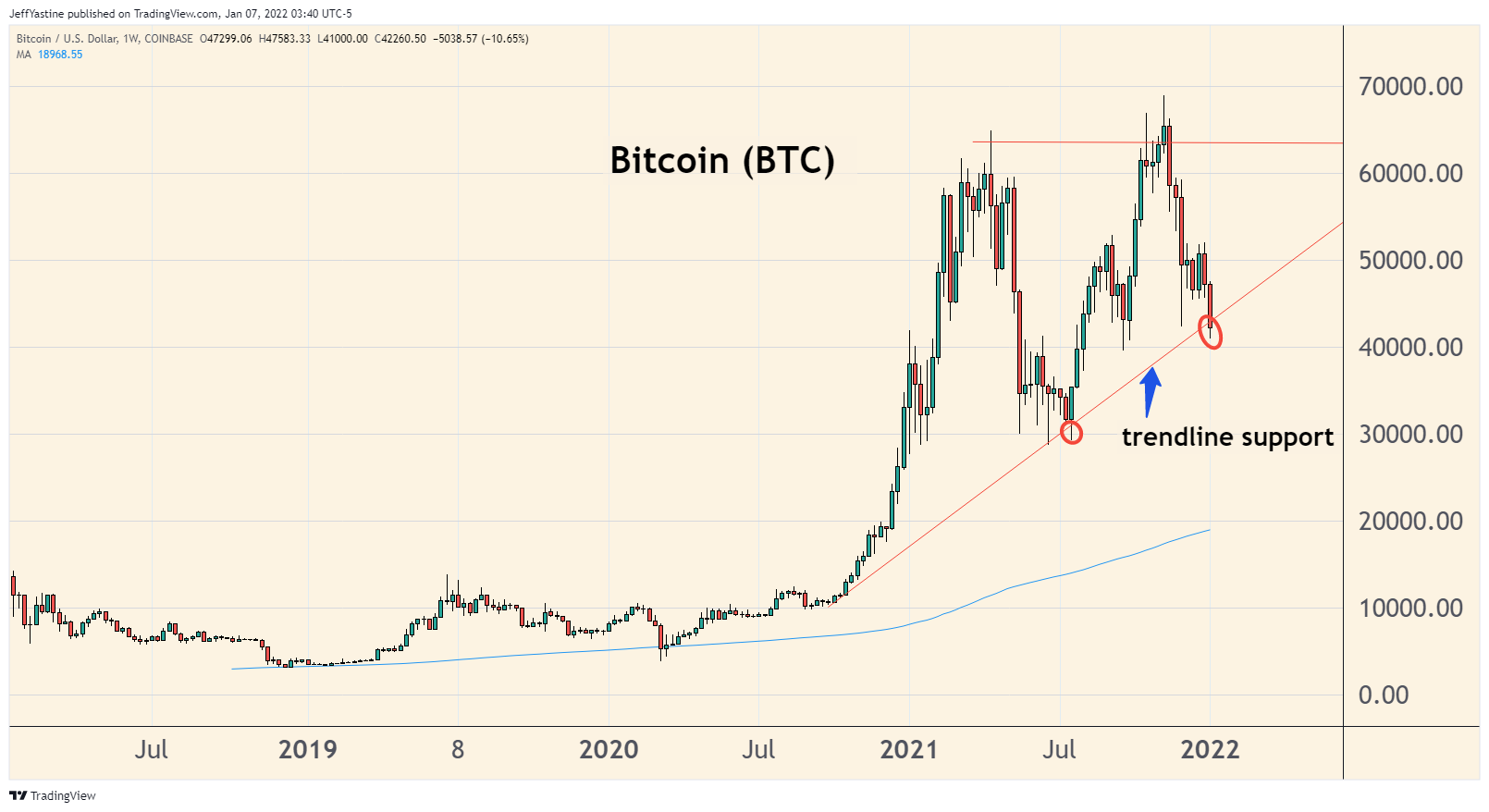

So it's worth noting that Bitcoin - having fallen from nearly 70,000 to 42,000 is at a very important point on its chart right now...

Here's a bigger picture going back to 2018 for perspective...

Does it mean that Bitcoin prices, riding the edge of the "support trendline" precipice at the moment, are going to crash soon?

No one knows. It's possible that bargain hunters could step in and bid prices back up again.

But the chart is telling us, as stock investors, to be careful. The tide of "speculative flows" is still headed in the wrong direction.

Member discussion