Sunday Market Update: Will Indexes Go "Parabolic" from Here?

I hope you've had a great holiday weekend, celebrating and just plain enjoying life with family and friends!

I continually remind myself to do just that, despite the stresses (big and small) that come with life, and seek to treasure each day as it arrives.

So what about this stock market?

The biggest surprise for many in last week's omicron-dominated, holiday-shortened trading week was the S&P 500 finishing at a new all-time high. I brought up just such a scenario two Sundays ago in "Market Breakout Ahead?"

But is it THE breakout that propels all the other lagging markets - the DJIA, Nasdaq, Nasdaq 100 and Russell 2000 - to new highs as well, and continues on into 2022?

Reasons for Caution and Optimism

Ultimately, I'll let the individual stocks we have in the goodBUYs portfolio do the talking (+16% for the year since I started this publication in March - more on that for premium subscribers below).

But I'll give 50-50 odds for the market itself continuing higher.

One thing I do not like is that last week's rally saw the S&P make new daily highs - but on less and less trading volume:

There's no hard-and-fast rule that says "less trading volume = false breakout" - especially ahead of a major holiday. But rising levels of trading volume indicate lots of enthusiasm and big commitments, something that would be highly encouraging at this critical juncture.

The other thing I worry about - not so much for the coming week, but for January - is that I think a lot of traders are perhaps still too-eagerly bullish.

Let me put it this way - when too many of us are primed for playing the big breakout, Wall Street has a history of pulling the rug out from underneath us when we least expect.

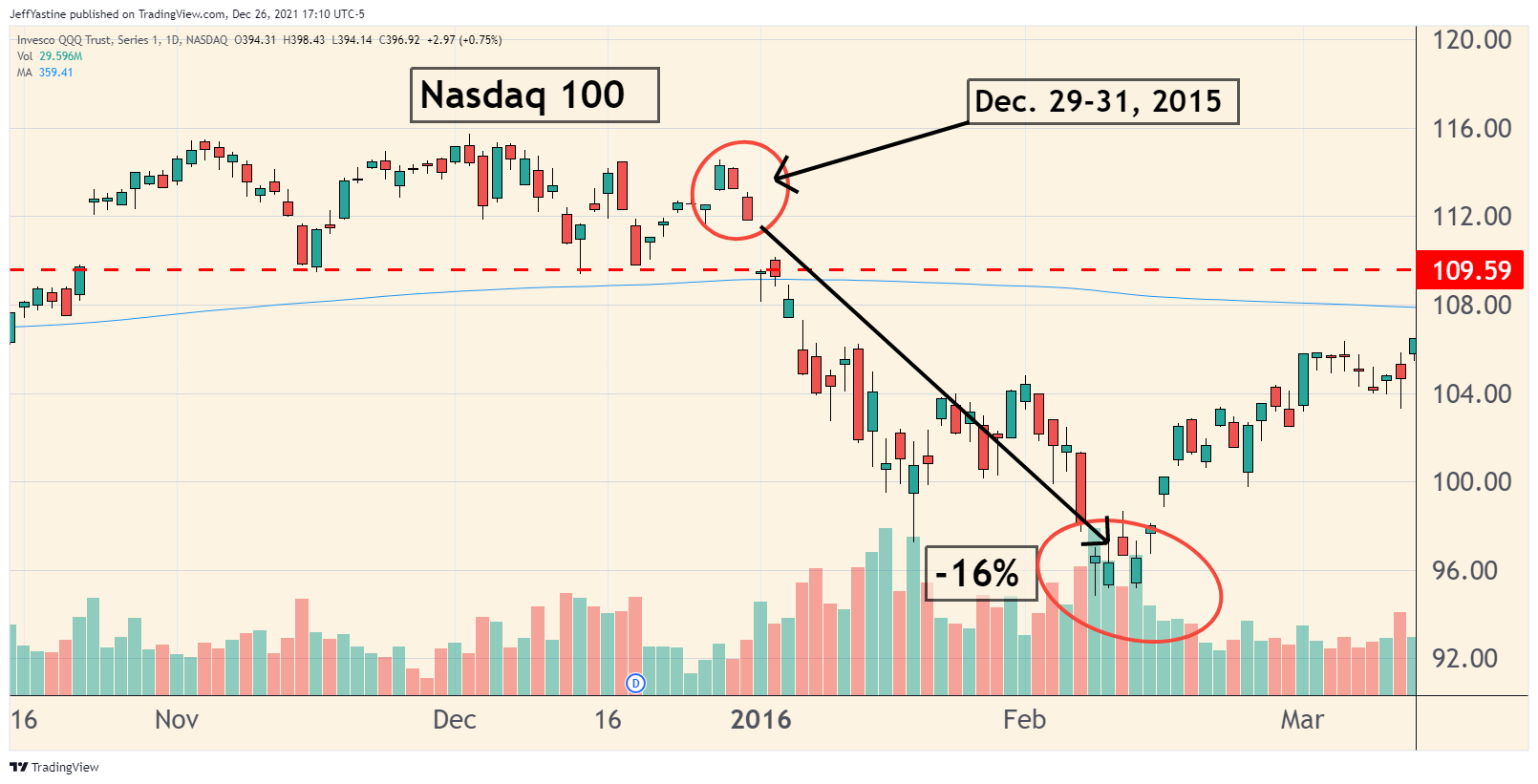

A good example is January 2016, where a key index like the Nasdaq 100 (the QQQ ETF) teased everyone with a series of slightly-higher all-time highs through year-end 2015 - and then promptly lost 16% in the first 6 weeks of 2016 as Wall Street engaged in a round of profit-taking on the prior-year's gains.

All I'm saying is...with the markets, we have to expect the unexpected. I've had my biggest losses when I expected one thing, and the stock market delivered the opposite.

But I also said I give the market rally 50-50 odds of continuing into 2022. So what's the positive half of all this?

As I noted 2 weeks ago in "Market Breakout Ahead?" we have to respect a market (or stock) that keeps making new all-time highs.

There's also a wall of money that's primed to enter the market when January 3rd (the first Monday of the new year) rolls around. There's a reason that November through April tends to be the strongest part of any trading year as people put year-end bonuses to work, and make new investment allocations for the coming year.

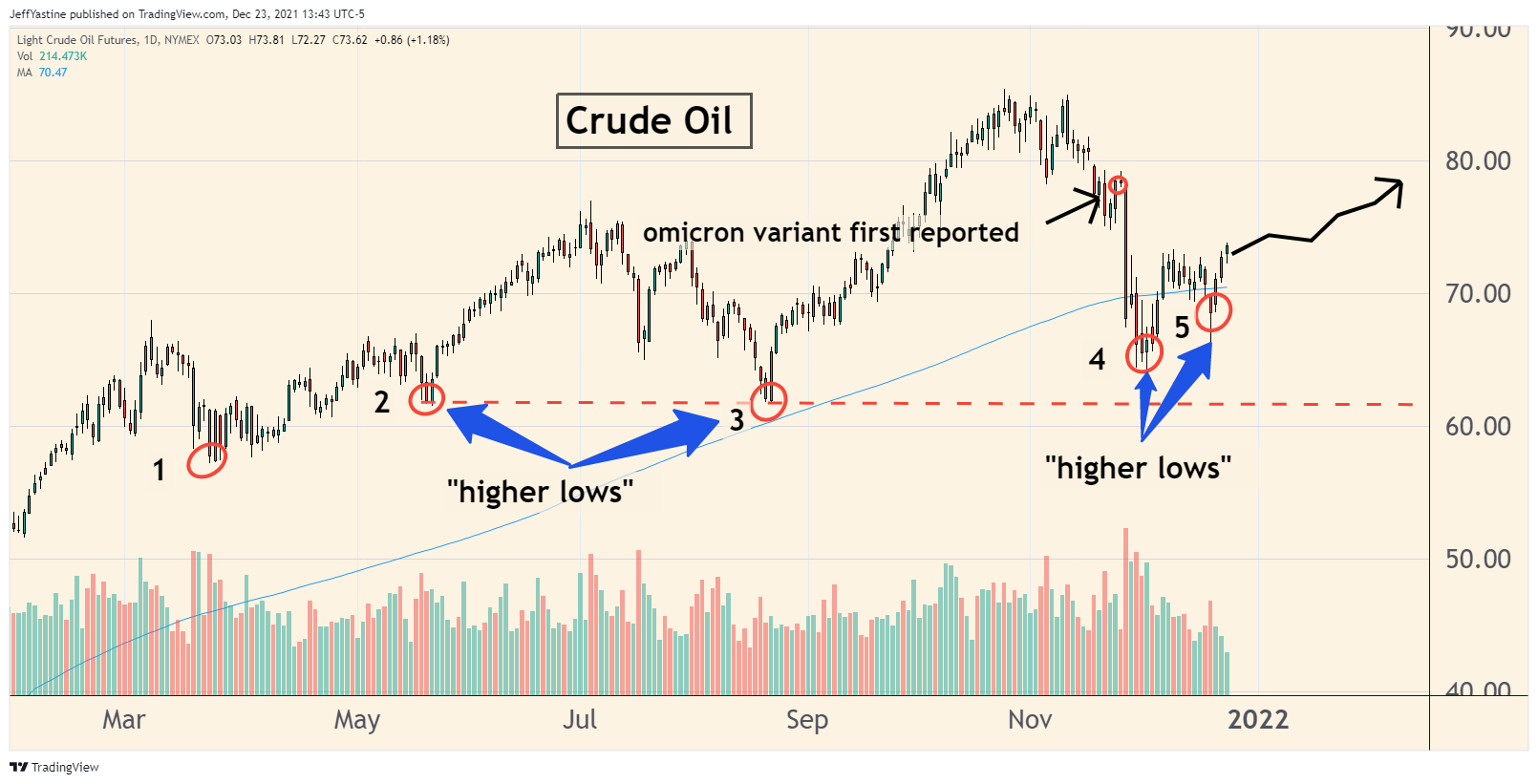

And perhaps most importantly, I think the price of oil - which has yet to make a new near-term low - is confirming a hunch of mine since the omicron variant became public in November: It's only a speed bump in the global economic recovery.

I noted all this in last week's "Chart of the Week: Omicron Optimism" message (which had email delivery problems for many subscribers - now resolved - so apologies from me if you did not receive it).

Cutting to the chase...the conditions are prime for the markets to make a huge parabolic move higher if traders lose their fear of an omicron-related economic slowdown.

It could ultimately prove to be unsustainable. After all, inflation is still a concern. If oil prices were to resume their march higher, so will the drumbeat of pressure for the Federal Reserve to keep its hawkish stance and raise interest rates in 2022.

But that peak could be far higher than we might believe at this point.

Portfolio Review

That's one reason why I think the goodBUYs portfolio could be primed for some outsized gains...

Arlo Technologies (ARLO), the #2 maker of connected-home security devices worldwide, continues to impress. As I've been saying for a while now, I think the stock - which is up more than 20% in the goodBUYs portfolio - is well on its way to tripling over the coming 12-18 months.

I think it's likely ARLO's rally could pause here - as you can see from the chart, it's running up against a resistance level from a previous spike up to this price level early this year. ARLO's next earnings report is due out in early February.

So let's give it time to work its way through this level - likely with some "backing and filling" above and below the current price - before it moves higher still.

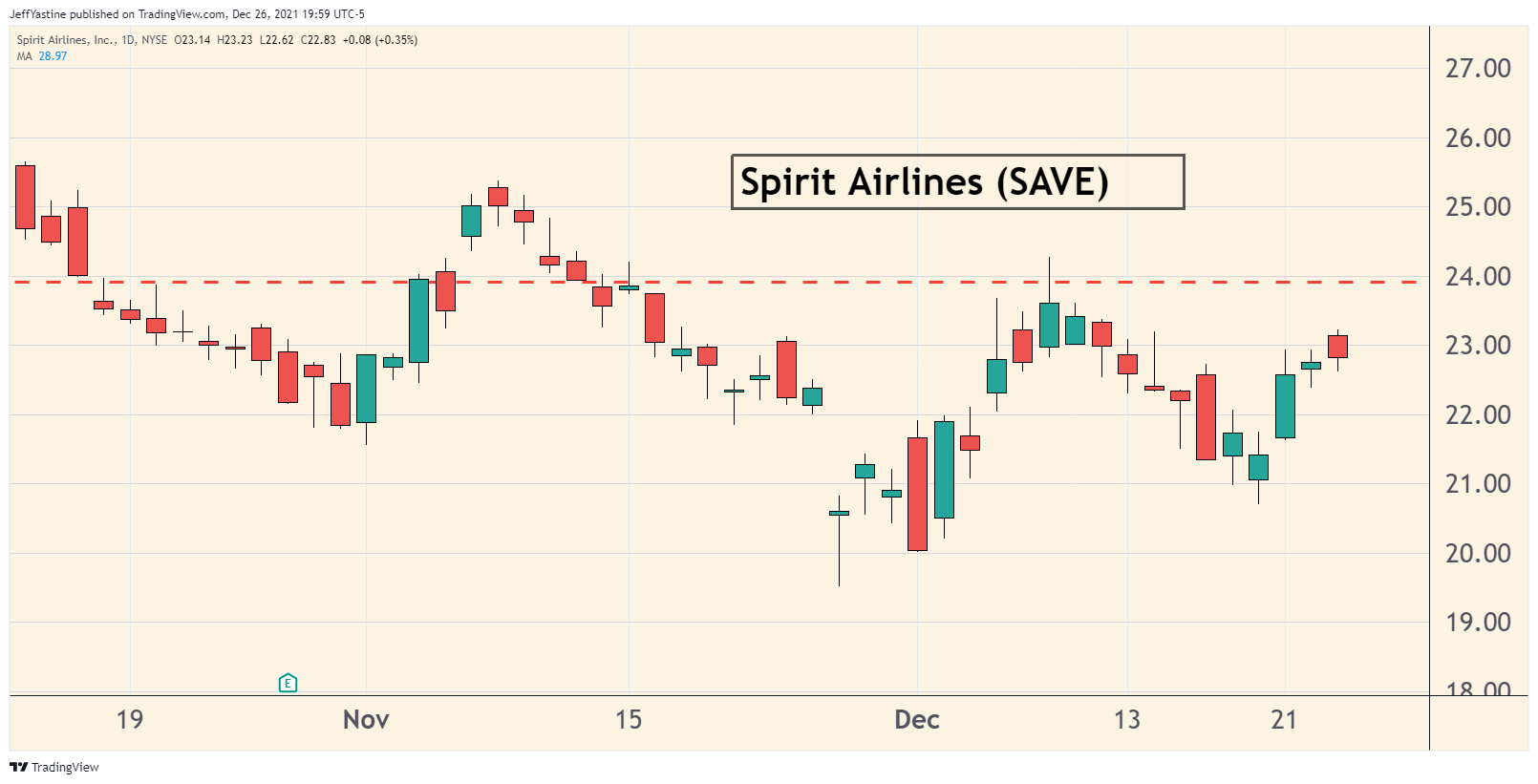

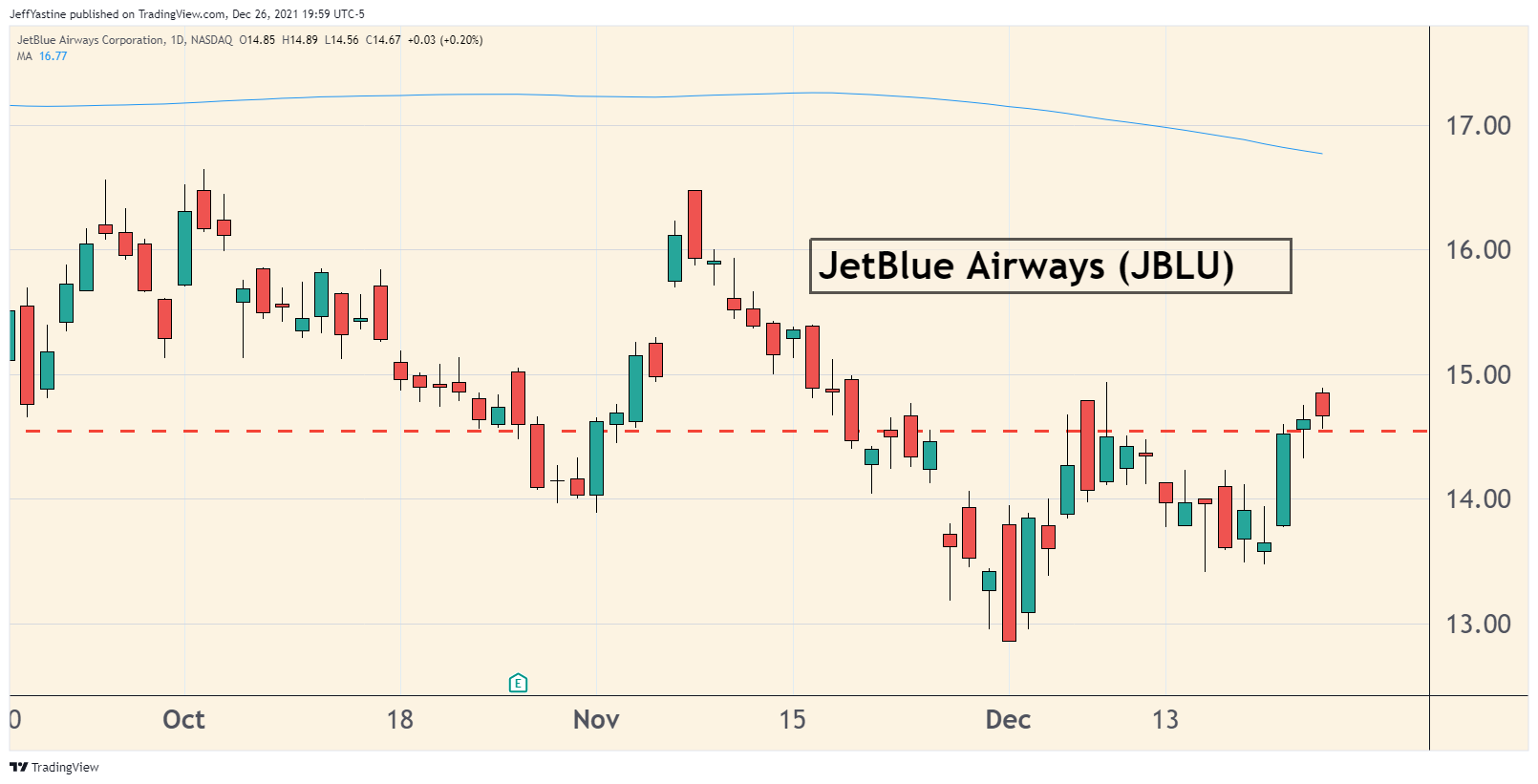

JetBlue (JBLU) and Spirit Airlines (SAVE) were also looking like they could start to move higher with the rest of the airline industry when the trading week came to a close on Thursday:

Now, it is possible we could see some selling in both of these names in the coming week. Most of the major airlines (including JetBlue) were forced to cancel many flights over the holiday weekend because of crew shortages, etc. But as long as both stocks remain above their late November/early December lows, I still view these kinds of headlines as buying opportunities if some selling emerges.

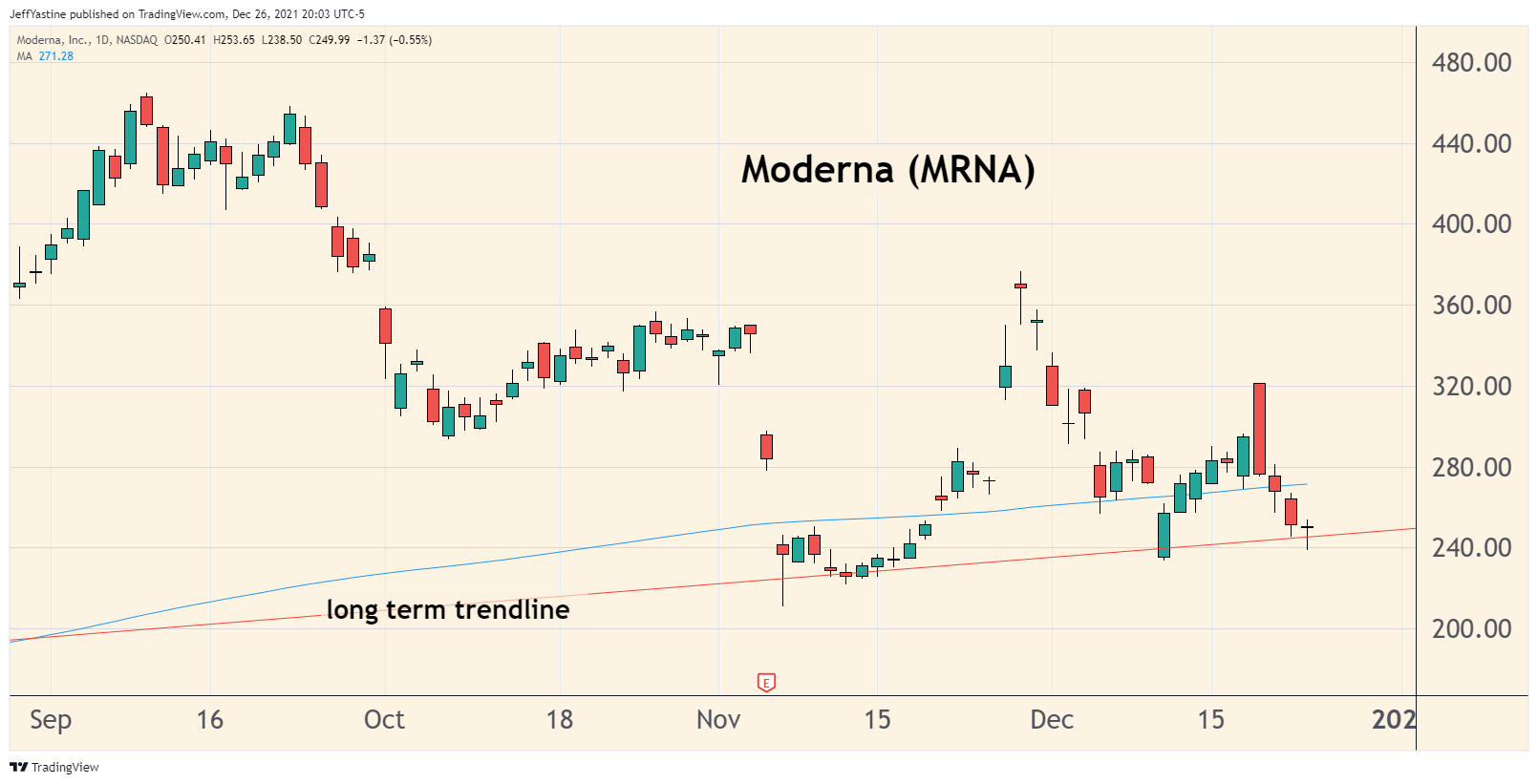

Moderna (MRNA) has taken a pounding in recent days. That's despite what has been generally good news for the company on the omicron front. I view much of what we've been seeing lately as typical "year-end portfolio adjustments" as traders try to game the various COVID headlines, and scalp profits here and there in the stock.

Overall, I still look at $350 as a near-term target for the stock. Moderna last week reported preliminary data showing that its mRNA-1273 booster shots increase omicron-fighting antibodies. And a follow-on booster shot in development, mRNA-1273.529, will enter clinical trials early in the coming year.

An analyst at Piper Sandler recently forecast Moderna's 2022 revenue rising to over $21 billion (from $17.5 billion for 2021), and also hung a price target of $348 on the stock.

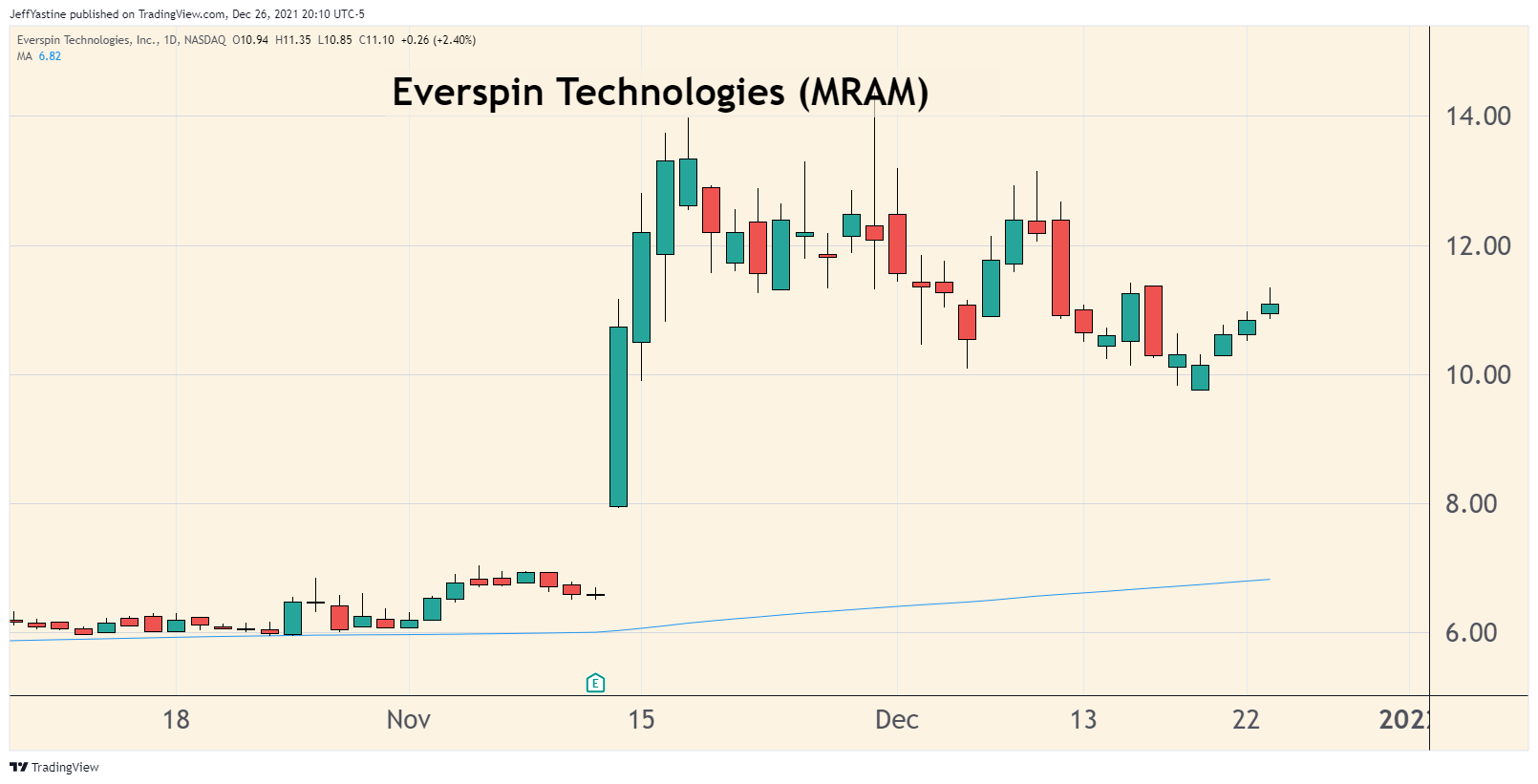

Everspin Technologies (MRAM) has given back some of its gains from early November, when the stock more than doubled in value in a matter of days after a surprisingly (to analysts) strong quarterly earnings report. The shares are now up "only" 79% from when I recommended it in June.

I would be looking to buy the stock on weakness here if I didn't own it already:

Analysts continue to undervalue Everspin's potential as a next-generation manufacturer of memory technology. I think the headlines about semiconductor shortages are also holding back interest in the stock.

But Everspin has beaten analysts' estimates in 7 of its last 8 earnings reports. If the company can continue to beat estimates (its next quarterly report is in March), I expect Everspin to emerge as a bright new alternative growth stock for the traders who follow the chip industry.

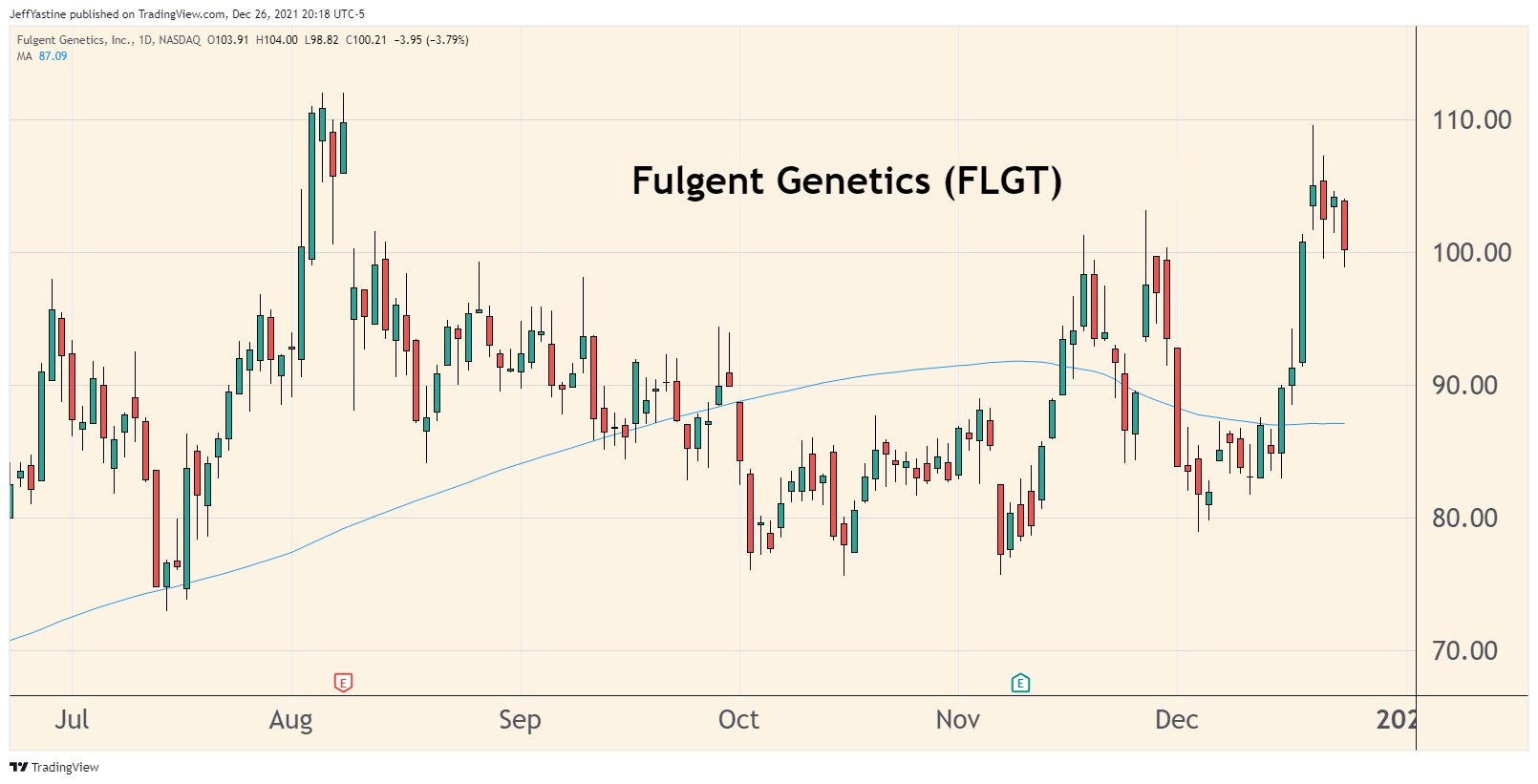

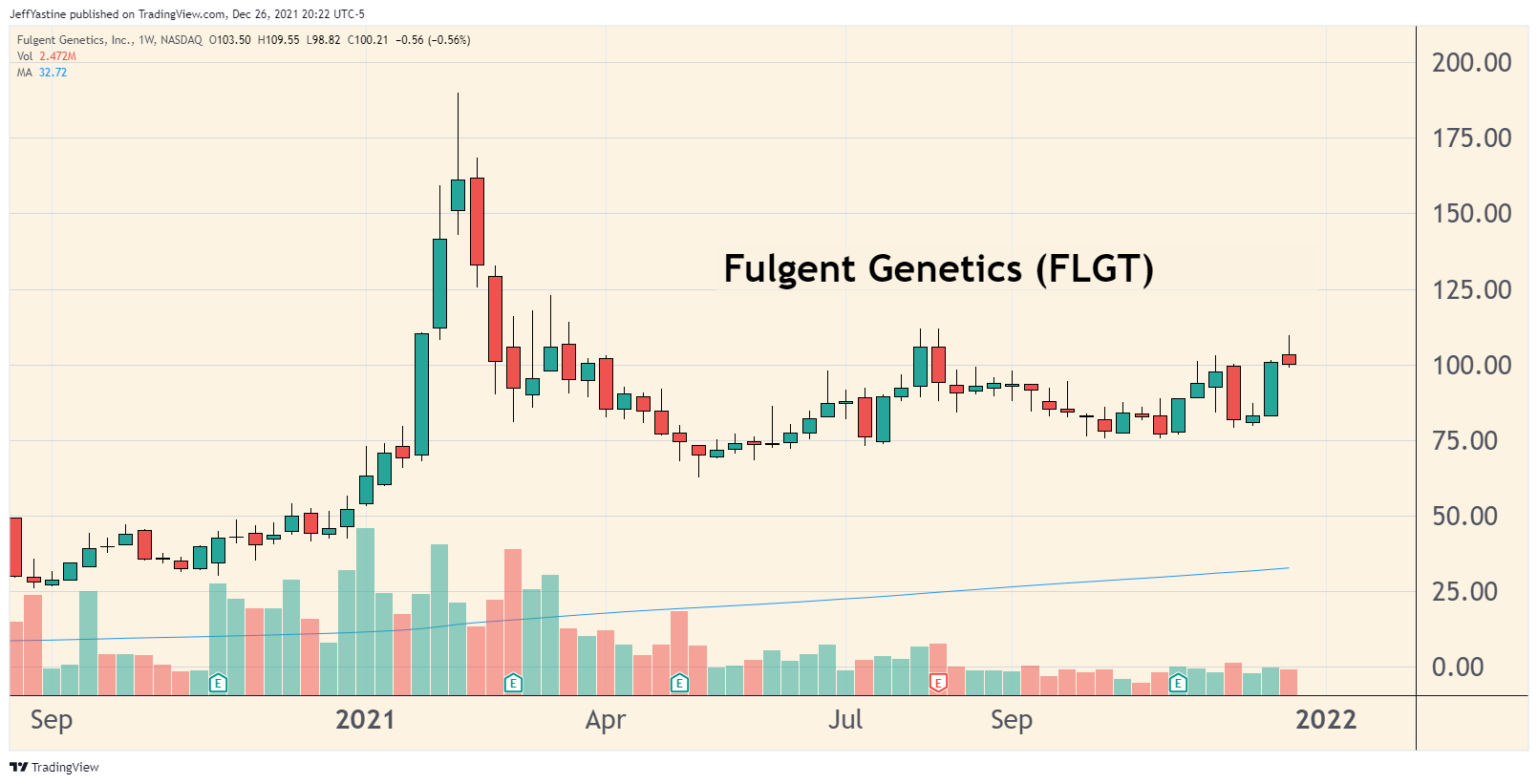

Fulgent Technologies (FLGT) has taken its own sweet time moving into positive territory in the goodBUYs portfolio. We have a 5% gain right now.

I think the key with this stock is just being patient, and now being too quick to sell in frustration as it sort of drifts along.

A weekly chart shows how the stock seems poised to slowly gain ground as investors understand that it's not "just" a COVID-19 testing stock, and that it has a wide array of cancer- and similar genetic tests that are contributing to its strong earnings performance.

Moving on to Stereotaxis (STXS)...

The stock continues to drift as we head into the final trading week of the year. I would be a buyer of weakness here. That's not because the stock is going to take off like a rocket anytime soon. The evidence for Stereotaxis' robotic surgery technology continues to grow with additional published studies, which should help support additional sales to hospital systems in the US, and worldwide in 2022:

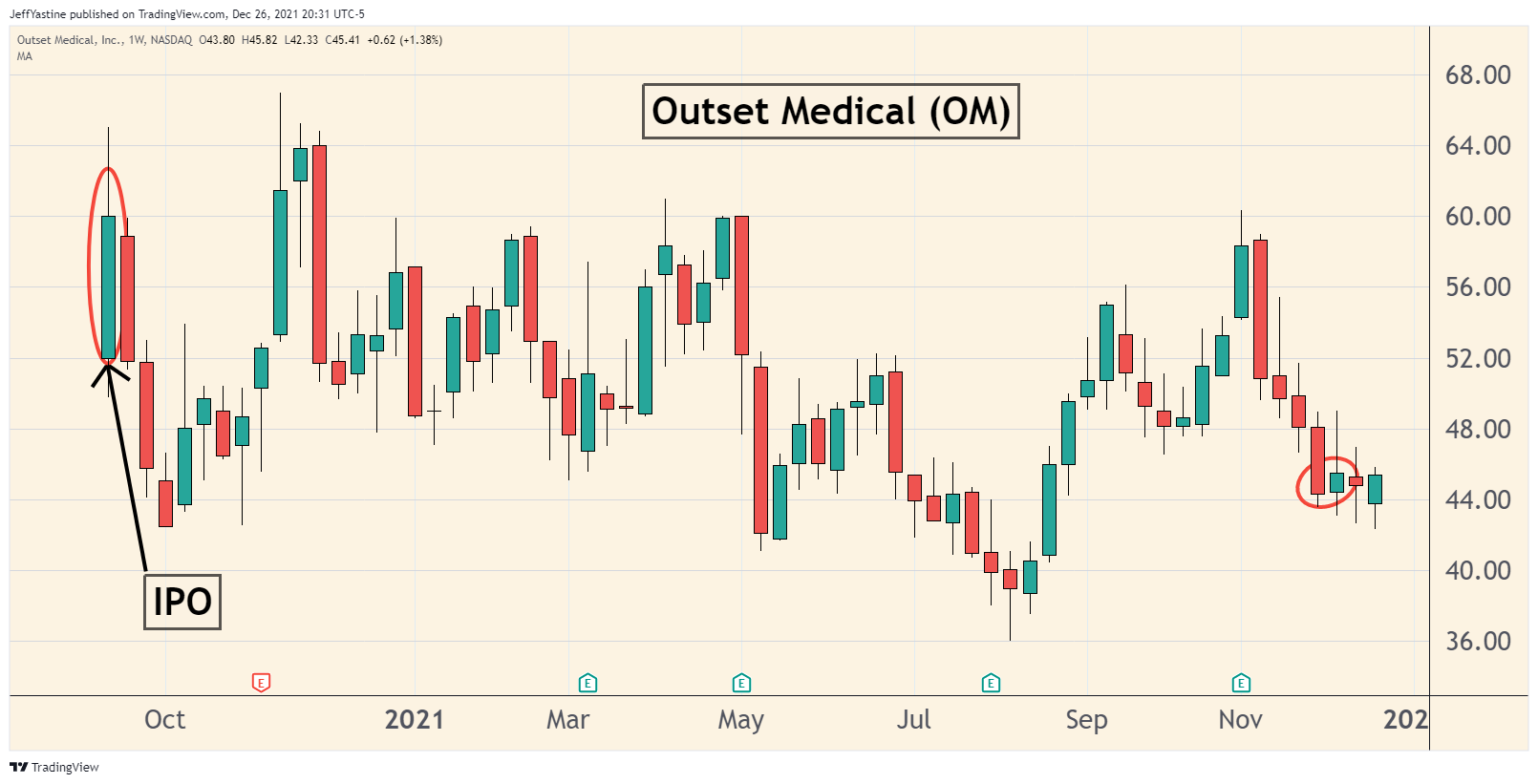

Outset Medical (OM) continues to be a stock that excites me for 2022, when I think about the market for kidney dialysis treatment and monitoring. We're owning the stock at what I think could be its final lows.

The entire trend in medical devices (and importantly, where Medicare is willing to pay and reimburse) is for technologies that enable advanced medical care and remote monitoring from the home (instead of expensive hospitals, clinics and outpatient treatment centers).

I think the weakness in the shares in the last few months will be looked at as a last great buying opportunity for this stock, with its strong quarterly revenue growth and a steady path towards profitability.

Walgreens Boots Alliance (WBA), I think, is one of those stocks that's going to be a slow-but-steady riser in the price of its shares from here:

I've been impressed that the stock gained ground, even on days when the Nasdaq and S&P 500 were very weak. WBA stayed strong, even amid the drumbeat of omicron-panic headlines in the past few weeks as well.

One thing with big stocks like this one (it's on the Dow Jones Industrial Average and the S&P 500), with its $43 billion market cap - they don't trade like a typical small cap or "pure play" tech stock. They drift up and down and appear to go nowhere.

Then one day they're up 4%, and up another 5% the day after, and suddenly a big move is already on hand. So this is one of those positions we need to own - provided the trend is generally steady to higher - and let the rest of the market discover what we already know about its undervalued and overlooked nature.

Best of goodBUYs,

Jeff Yastine

Member discussion